GEICO Insurance Company quote has become one of the most sought-after services in the insurance industry. Many drivers are turning to GEICO for its competitive rates, exceptional customer service, and comprehensive coverage options. Whether you're a new driver or an experienced one, understanding how GEICO quotes work can help you make an informed decision about your insurance needs.

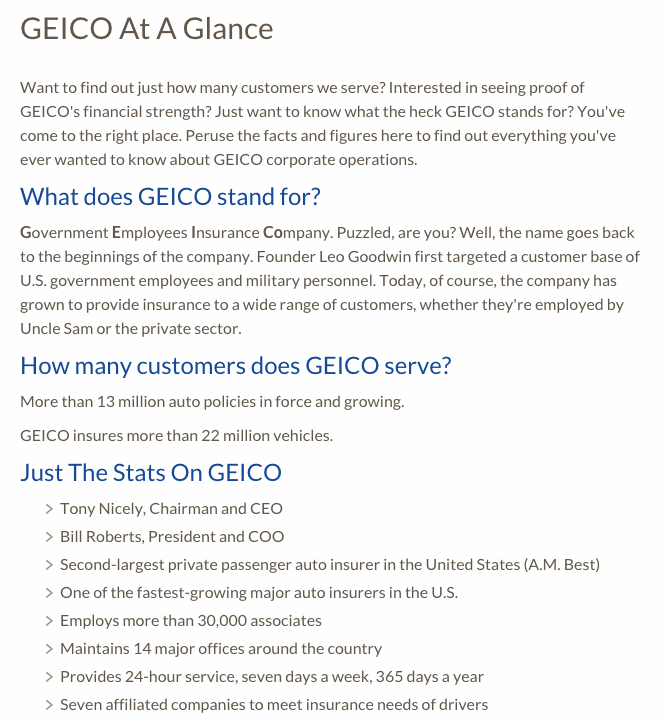

Insurance is not just a legal requirement; it is a crucial financial safety net that protects you and your assets. GEICO, short for Government Employees Insurance Company, has been providing affordable and reliable insurance solutions since 1936. Its reputation as a trusted provider has earned it millions of satisfied customers across the United States.

In this article, we will explore everything you need to know about GEICO insurance company quotes, including how to get one, factors that influence your premium, and tips to save money. By the end of this guide, you'll be well-equipped to secure the best possible coverage for your needs.

Read also:How Old Was Eminem When He Had Hailie Exploring The Story Behind Eminems Family Life

Table of Contents

- History of GEICO Insurance Company

- How to Get a GEICO Insurance Quote

- Factors Influencing GEICO Insurance Quotes

- Types of Coverage Offered by GEICO

- Tips to Save on GEICO Insurance

- Customer Service at GEICO

- Comparing GEICO with Other Insurers

- Available Discounts and Programs

- GEICO Claims Process

- Why Trust GEICO for Your Insurance Needs?

History of GEICO Insurance Company

Founded in 1936 by Leo Goodwin, GEICO started as a small company catering exclusively to federal employees. The idea was to offer insurance at lower rates by directly selling policies to customers and eliminating intermediaries like agents. Over the decades, GEICO expanded its customer base to include a broader audience while maintaining its commitment to affordability and quality service.

Today, GEICO is one of the largest auto insurers in the United States, serving millions of policyholders. Its growth can be attributed to innovative marketing strategies, cutting-edge technology, and a relentless focus on customer satisfaction.

Key Milestones in GEICO's Journey

- 1936 - GEICO is founded in Washington, D.C.

- 1948 - GEICO goes public and expands its customer base beyond government employees.

- 1995 - Berkshire Hathaway acquires GEICO, ensuring financial stability and growth.

- 2023 - GEICO continues to lead the industry with advanced digital tools and personalized services.

How to Get a GEICO Insurance Quote

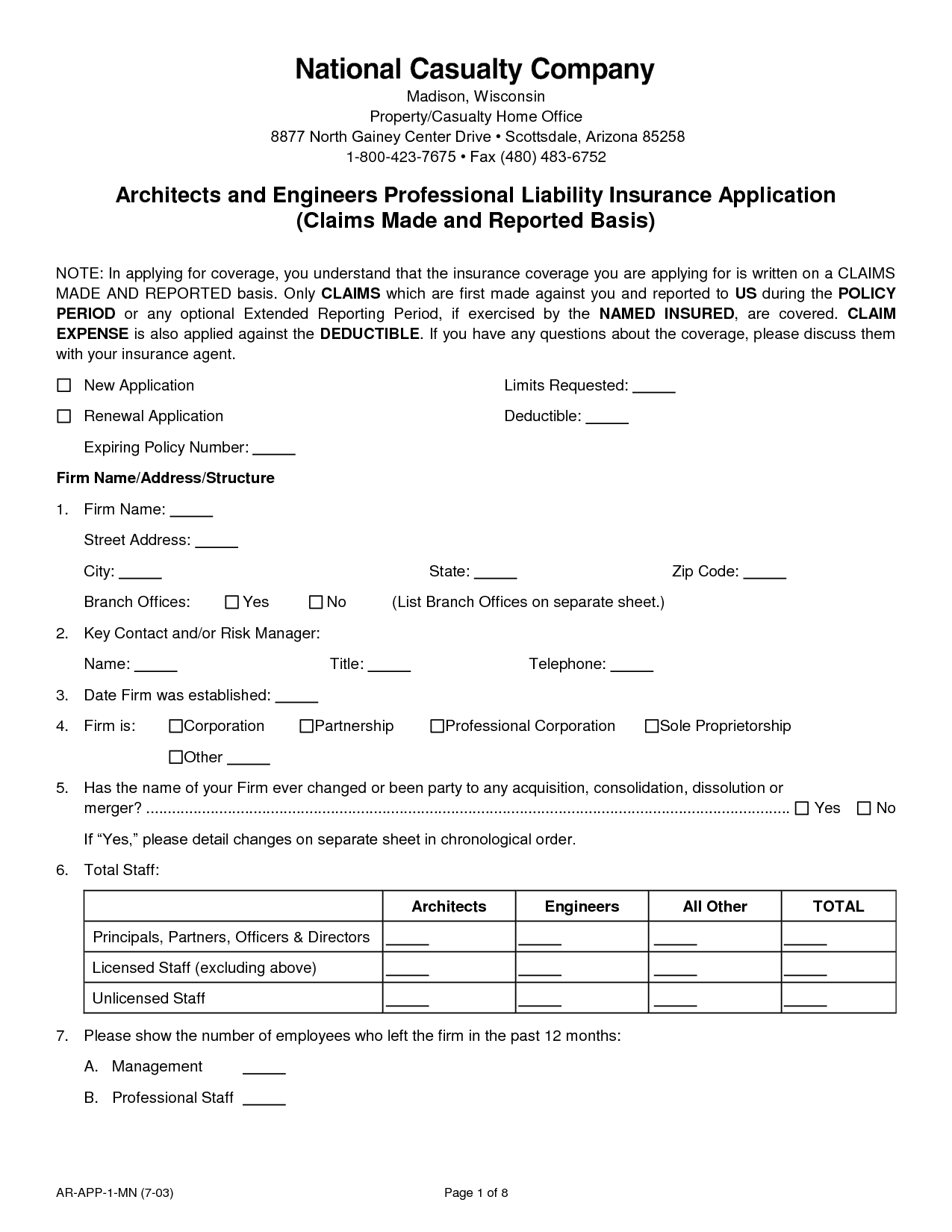

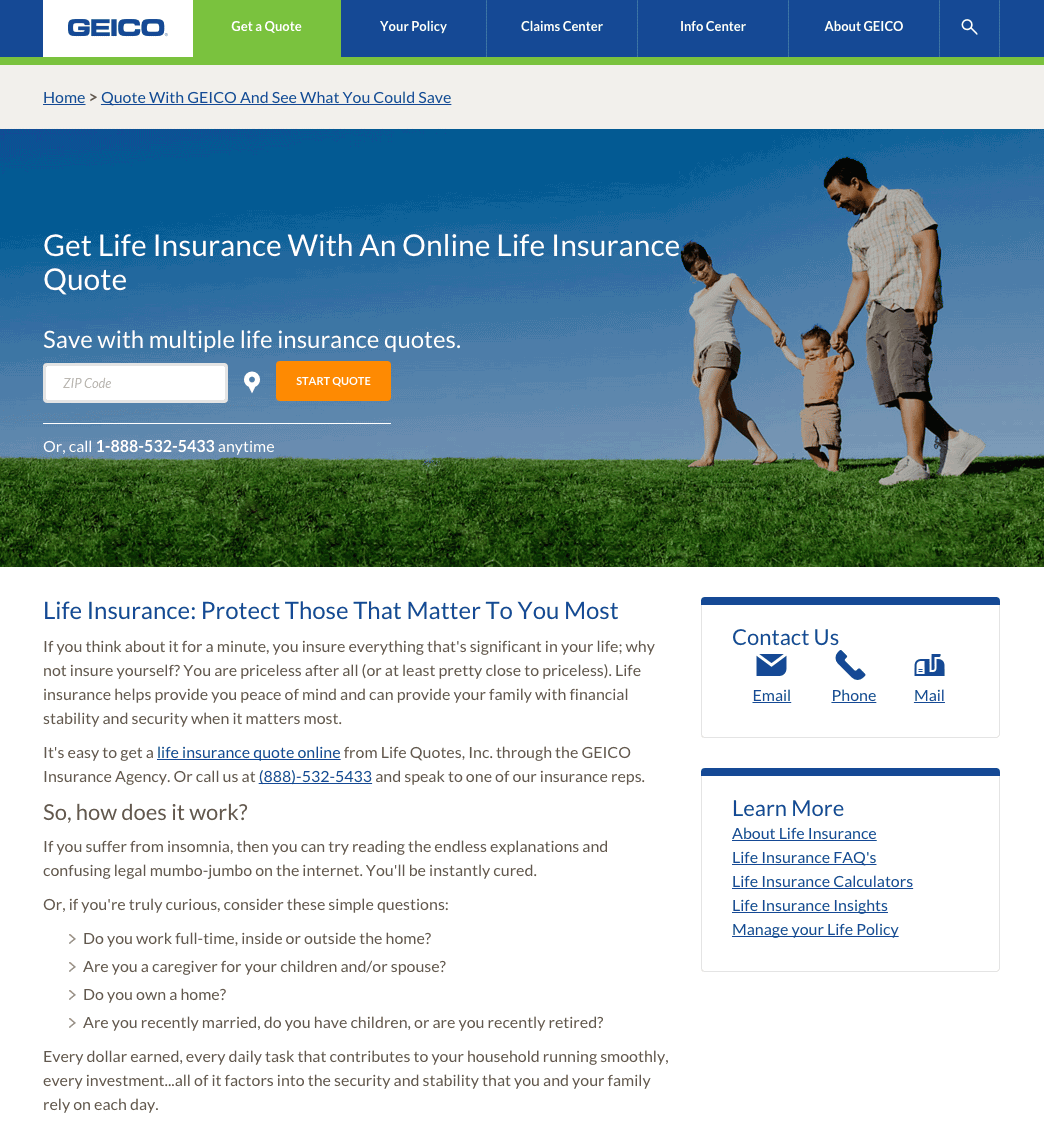

Obtaining a GEICO insurance company quote is a straightforward process that can be done online, over the phone, or in person at a local agency. The company provides multiple channels to ensure convenience for its customers.

Steps to Get an Online Quote

- Visit the official GEICO website and navigate to the "Get a Quote" section.

- Enter your ZIP code and select the type of vehicle you want to insure.

- Provide details about your driving history, vehicle information, and coverage preferences.

- Review your personalized quote and proceed to purchase if satisfied.

Factors Influencing GEICO Insurance Quotes

Several factors determine the cost of your GEICO insurance company quote. Understanding these elements can help you anticipate your premium and make adjustments to reduce costs.

Primary Factors

- Driving Record: A clean driving record typically results in lower premiums.

- Vehicle Type: The make, model, and age of your car influence the cost of coverage.

- Location: Where you live affects the likelihood of accidents and theft, impacting your rates.

- Coverage Options: Adding comprehensive or collision coverage can increase your premium.

Types of Coverage Offered by GEICO

GEICO offers a wide range of coverage options to meet the diverse needs of its customers. Below are some of the most common types of coverage available:

Popular Coverage Options

- Liability Coverage: Protects against damages or injuries caused to others in an accident.

- Collision Coverage: Covers damage to your vehicle resulting from a collision.

- Comprehensive Coverage: Provides protection against non-collision incidents like theft or natural disasters.

- Roadside Assistance: Offers help for unexpected breakdowns or emergencies.

Tips to Save on GEICO Insurance

While GEICO is known for its competitive rates, there are additional steps you can take to save even more on your insurance company quote.

Read also:Noodles Magazine The Ultimate Guide To Exploring Global Noodle Culture

Effective Saving Strategies

- Bundle multiple policies (auto, home, etc.) to receive discounts.

- Maintain a good credit score, as it often correlates with lower premiums.

- Take advantage of safe driver programs and defensive driving courses.

- Choose a higher deductible if you're comfortable with out-of-pocket expenses.

Customer Service at GEICO

GEICO prides itself on delivering exceptional customer service. Whether you need assistance with a quote, policy changes, or claims, their team is available 24/7 to assist you. Customer satisfaction is a top priority, and GEICO consistently ranks high in customer service surveys.

Ways to Contact GEICO

- Call the toll-free customer service number for immediate assistance.

- Use the GEICO mobile app for quick access to account information and tools.

- Visit a local GEICO office for face-to-face support.

Comparing GEICO with Other Insurers

While GEICO is a leading player in the insurance industry, it's essential to compare it with other providers to ensure you're getting the best deal. Factors such as pricing, coverage options, and customer service should be considered.

Key Competitors

- State Farm: Known for its extensive network of agents and comprehensive coverage.

- Allstate: Offers innovative technology and a wide range of insurance products.

- Progressive: Provides customizable plans and competitive rates.

Available Discounts and Programs

GEICO offers various discounts and programs designed to reward loyal customers and encourage safe driving habits. These incentives can significantly reduce your insurance company quote.

Popular Discounts

- Safe Driver Discount: For individuals with a clean driving record.

- Military Discount: Available to active-duty military personnel and veterans.

- Multi-Car Discount: For insuring multiple vehicles under one policy.

- Student Discount: For students with good academic performance.

GEICO Claims Process

Handling claims efficiently is a critical aspect of any insurance provider. GEICO has streamlined its claims process to ensure quick resolution and minimal hassle for its customers.

Steps to File a Claim

- Contact GEICO immediately after an incident to report the claim.

- Provide all necessary documentation, including police reports and photos.

- Work with a claims adjuster to assess damages and determine compensation.

- Receive payment or repairs as per the agreed settlement.

Why Trust GEICO for Your Insurance Needs?

Trust is the foundation of any successful relationship, and GEICO has earned the trust of millions of customers through its commitment to quality and integrity. With a strong financial backing from Berkshire Hathaway, GEICO ensures stability and reliability for its policyholders.

Reasons to Choose GEICO

- Over 85 years of experience in the insurance industry.

- Competitive rates and flexible payment options.

- Exceptional customer service and support.

- Advanced technology and user-friendly platforms.

Conclusion

In conclusion, GEICO Insurance Company quote provides an excellent opportunity for drivers to secure affordable and comprehensive coverage. By understanding the factors that influence your premium and taking advantage of available discounts, you can maximize your savings while ensuring adequate protection.

We encourage you to explore GEICO's offerings and compare them with other providers to find the best fit for your needs. Don't hesitate to reach out to their customer service team for further assistance or clarification. Your feedback and experiences are invaluable, so please share your thoughts in the comments section below.

For more informative articles and guides, explore our website and stay updated on the latest trends and tips in the insurance industry.