Home improvement projects can be an exciting way to enhance the value and comfort of your home. However, financing these projects can sometimes feel overwhelming. Fortunately, Home Depot offers interest-free financing options that allow you to upgrade your space without the added stress of high-interest payments. Whether you're renovating your kitchen, updating your bathroom, or installing a new HVAC system, understanding how Home Depot's interest-free financing works can help you make smarter financial decisions.

In today’s fast-paced world, many homeowners are looking for convenient and cost-effective ways to fund their home improvement projects. With Home Depot's interest-free financing, you can spread out your payments over a specified period without worrying about accumulating interest charges. This flexibility makes it easier to manage your budget while still achieving your dream home upgrades.

This comprehensive guide will delve into everything you need to know about Home Depot's interest-free financing options. From eligibility requirements to tips for maximizing this benefit, we’ll cover all the essential aspects to ensure you’re well-informed before making any financial commitments.

Read also:Serp Trends Unveiling The Future Of Search Engine Optimization

Table of Contents

- What is Home Depot Interest-Free Financing?

- Eligibility Requirements

- Types of Projects Covered

- How It Works

- Advantages of Using Interest-Free Financing

- Common Mistakes to Avoid

- Comparison with Other Financing Options

- Tips for Maximizing Benefits

- Customer Reviews and Testimonials

- Frequently Asked Questions

What is Home Depot Interest-Free Financing?

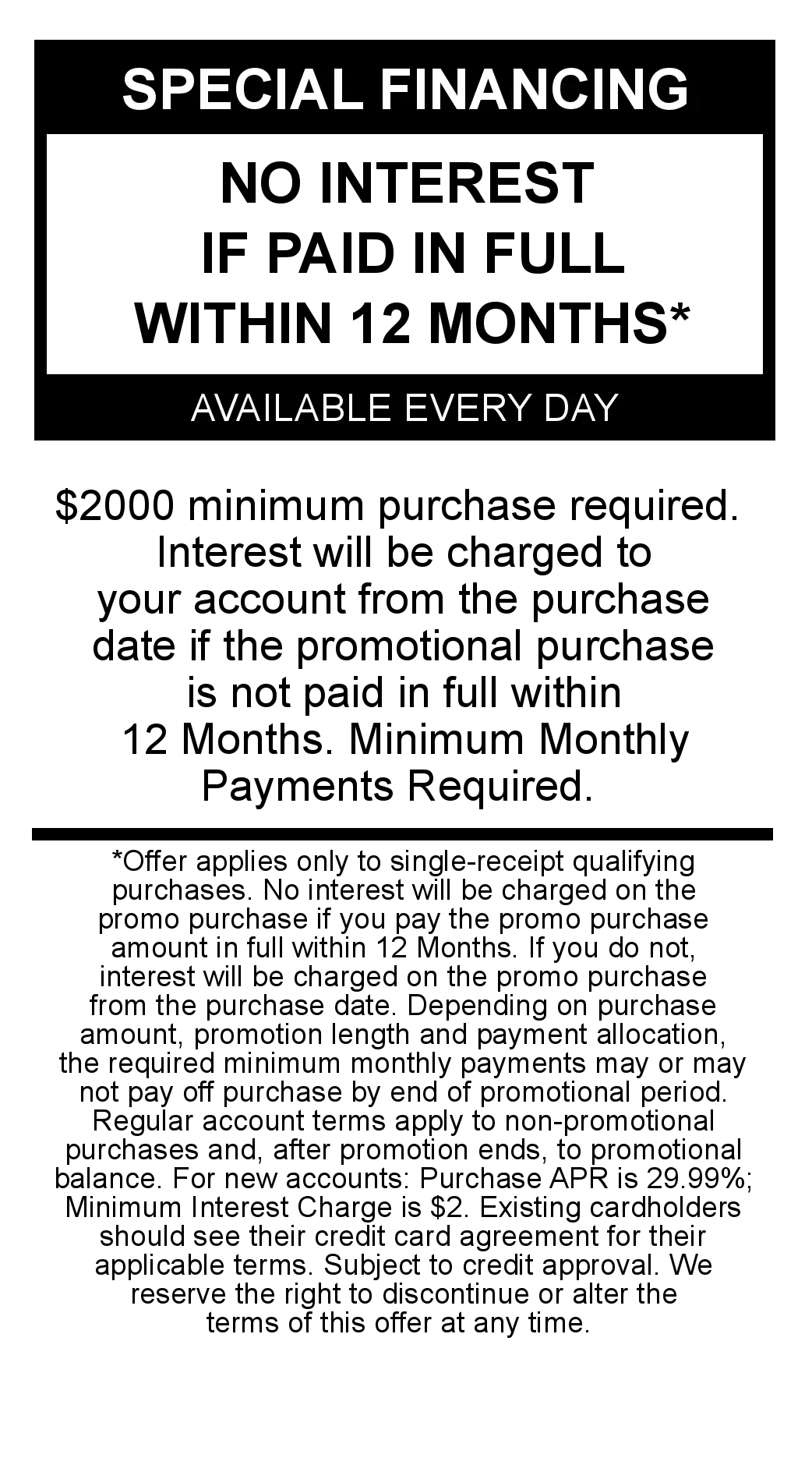

Home Depot interest-free financing is a financial program designed to help customers fund their home improvement projects without incurring interest charges during a promotional period. This program is typically available through special offers, allowing customers to finance purchases over a specific timeframe, often ranging from six months to two years, depending on the promotion.

During this promotional period, you can make payments on your purchases without worrying about interest accumulating. However, it's important to note that if the balance isn't paid in full by the end of the promotional period, interest will retroactively apply to the original purchase amount.

Key Features of Home Depot Interest-Free Financing

- No interest charges during the promotional period.

- Flexible payment options tailored to your budget.

- Suitable for large purchases like appliances, HVAC systems, and major renovations.

- Available through Home Depot's credit card or other partnered financial institutions.

Eligibility Requirements

Before taking advantage of Home Depot’s interest-free financing, it’s crucial to understand the eligibility criteria. Not all customers may qualify for this program, and certain conditions must be met to secure the benefits.

Firstly, you must have a Home Depot credit card or apply for one during the checkout process. Your credit score and financial history will play a significant role in determining your eligibility. Generally, individuals with good to excellent credit scores are more likely to qualify for these offers.

Factors That Affect Eligibility

- Credit score – Higher scores increase your chances of approval.

- Income level – Demonstrating sufficient income can strengthen your application.

- Debt-to-income ratio – Lower ratios improve your likelihood of qualifying.

- Employment history – A stable employment record is beneficial.

Types of Projects Covered

Home Depot interest-free financing covers a wide range of home improvement projects. From small updates to large-scale renovations, this program provides the flexibility needed to tackle various tasks around your home. Below are some examples of projects that typically qualify for interest-free financing:

Common Projects Eligible for Financing

- Kitchen remodels, including cabinets, countertops, and appliances.

- Bathroom renovations, such as installing new fixtures, tiles, and vanities.

- Heating, ventilation, and air conditioning (HVAC) system installations.

- Roofing replacements and repairs.

- Flooring upgrades, including hardwood, tile, and carpet installations.

How It Works

The process of utilizing Home Depot interest-free financing is straightforward. Here’s a step-by-step guide to help you navigate the program:

Read also:Jenicka Lopez Net Worth Exploring The Rise Of A Prominent Figure

- Visit your local Home Depot store or shop online at homedepot.com.

- Select the items or services you wish to purchase.

- During checkout, choose the interest-free financing option if available.

- Apply for a Home Depot credit card if you don’t already have one.

- Once approved, complete your purchase and adhere to the payment schedule outlined in the terms of the financing agreement.

Remember, timely payments are critical to avoiding interest charges after the promotional period ends.

Advantages of Using Interest-Free Financing

There are numerous benefits to choosing Home Depot interest-free financing for your home improvement projects. Here are some of the most significant advantages:

Key Benefits

- Cost savings: Avoid paying interest during the promotional period, which can result in significant savings.

- Flexibility: Spread out payments over time, making it easier to manage your budget.

- Convenience: Streamlined application process and easy access to financing options.

- Wide range of eligible purchases: Cover a variety of home improvement needs under one financing plan.

Common Mistakes to Avoid

While Home Depot interest-free financing offers many benefits, there are pitfalls to watch out for. Here are some common mistakes to avoid:

Potential Pitfalls

- Missing payments: Failing to make timely payments can lead to interest charges being applied retroactively.

- Not understanding the terms: Always read the fine print and ensure you fully comprehend the conditions of the financing agreement.

- Overextending your budget: Be cautious not to take on more debt than you can comfortably repay within the promotional period.

Comparison with Other Financing Options

Home Depot interest-free financing stands out among other financing options for home improvement projects. Below is a comparison with some alternative methods:

Comparison Table

| Financing Option | Interest Rate | Flexibility | Eligibility |

|---|---|---|---|

| Home Depot Interest-Free Financing | 0% during promotional period | High | Credit-dependent |

| Personal Loans | Varies by lender | Moderate | Varies |

| Credit Cards | High APR after introductory period | Flexible | Credit-dependent |

Tips for Maximizing Benefits

Here are some practical tips to help you get the most out of Home Depot interest-free financing:

Maximizing Your Financing

- Plan your project carefully to ensure you stay within budget.

- Pay off the balance before the promotional period ends to avoid interest charges.

- Take advantage of additional perks, such as cashback or rewards points, offered by the Home Depot credit card.

Customer Reviews and Testimonials

Many Home Depot customers have had positive experiences with their interest-free financing program. Here are a few testimonials:

“I recently used Home Depot’s interest-free financing to fund my kitchen remodel. The process was smooth, and I saved a lot of money by avoiding interest charges.” – Sarah M.

“Having the flexibility to pay over time without worrying about interest was a game-changer for my HVAC installation. Highly recommend!” – John D.

Frequently Asked Questions

Q: How long does the promotional period last?

A: The promotional period typically ranges from six months to two years, depending on the specific offer.

Q: What happens if I don’t pay off the balance by the end of the promotional period?

A: If the balance isn’t paid in full, interest will be applied retroactively to the original purchase amount.

Q: Can I use Home Depot interest-free financing for any purchase?

A: While most large home improvement purchases qualify, certain items or services may have restrictions. Always check the terms of the financing offer.

Conclusion

Home Depot interest-free financing provides a valuable opportunity for homeowners to upgrade their living spaces without the added burden of high-interest payments. By understanding the eligibility requirements, maximizing the benefits, and avoiding common pitfalls, you can make the most of this program.

We encourage you to explore Home Depot’s financing options and take the first step toward transforming your home. Share your thoughts in the comments below or check out our other articles for more home improvement tips and tricks. Together, let’s build a better future for your home!