Are you considering disconnecting Experian Boost? You're not alone. Many people have questions about this service and whether it's worth maintaining. Experian Boost is a powerful tool designed to help individuals improve their credit scores by factoring in utility and subscription payments. However, there may be situations where disconnecting it makes sense. Let's explore everything you need to know.

Understanding how Experian Boost works and its impact on your credit score is crucial before making any decisions. This guide will delve into the functionality of Experian Boost, its benefits, and the steps you can take if you decide to disconnect it. Whether you're looking to simplify your financial management or reassess your credit-building strategy, this article has all the answers.

By the end of this article, you'll have a clear understanding of what Experian Boost is, how it affects your credit score, and the steps you need to take if you choose to disconnect it. Let's dive in!

Read also:Who Did Sza Date For 11 Years A Deep Dive Into Her Longterm Relationship

Table of Contents

- What is Experian Boost?

- How Does Experian Boost Work?

- Benefits of Using Experian Boost

- Why Consider Disconnecting Experian Boost?

- How to Disconnect Experian Boost

- Impact of Disconnecting Experian Boost

- Alternatives to Experian Boost

- Tips for Managing Credit

- Frequently Asked Questions

- Conclusion

What is Experian Boost?

Experian Boost is a free service offered by Experian, one of the three major credit reporting agencies in the United States. It allows users to include their on-time utility and subscription payments in their credit file, which can positively impact their credit score. Unlike traditional credit scoring models that only consider loans and credit card payments, Experian Boost takes into account everyday expenses like phone bills, internet services, and streaming subscriptions.

This service is particularly beneficial for individuals with limited credit histories or those looking to improve their credit scores. By incorporating these additional payment streams, Experian Boost provides a more comprehensive view of a person's financial responsibility.

How Experian Boost Differs from Traditional Credit Reporting

Traditional credit reporting focuses primarily on credit accounts, such as credit cards and loans. Experian Boost expands this scope by including non-traditional payment streams. This approach helps individuals who may not have extensive credit histories to demonstrate their financial reliability.

How Does Experian Boost Work?

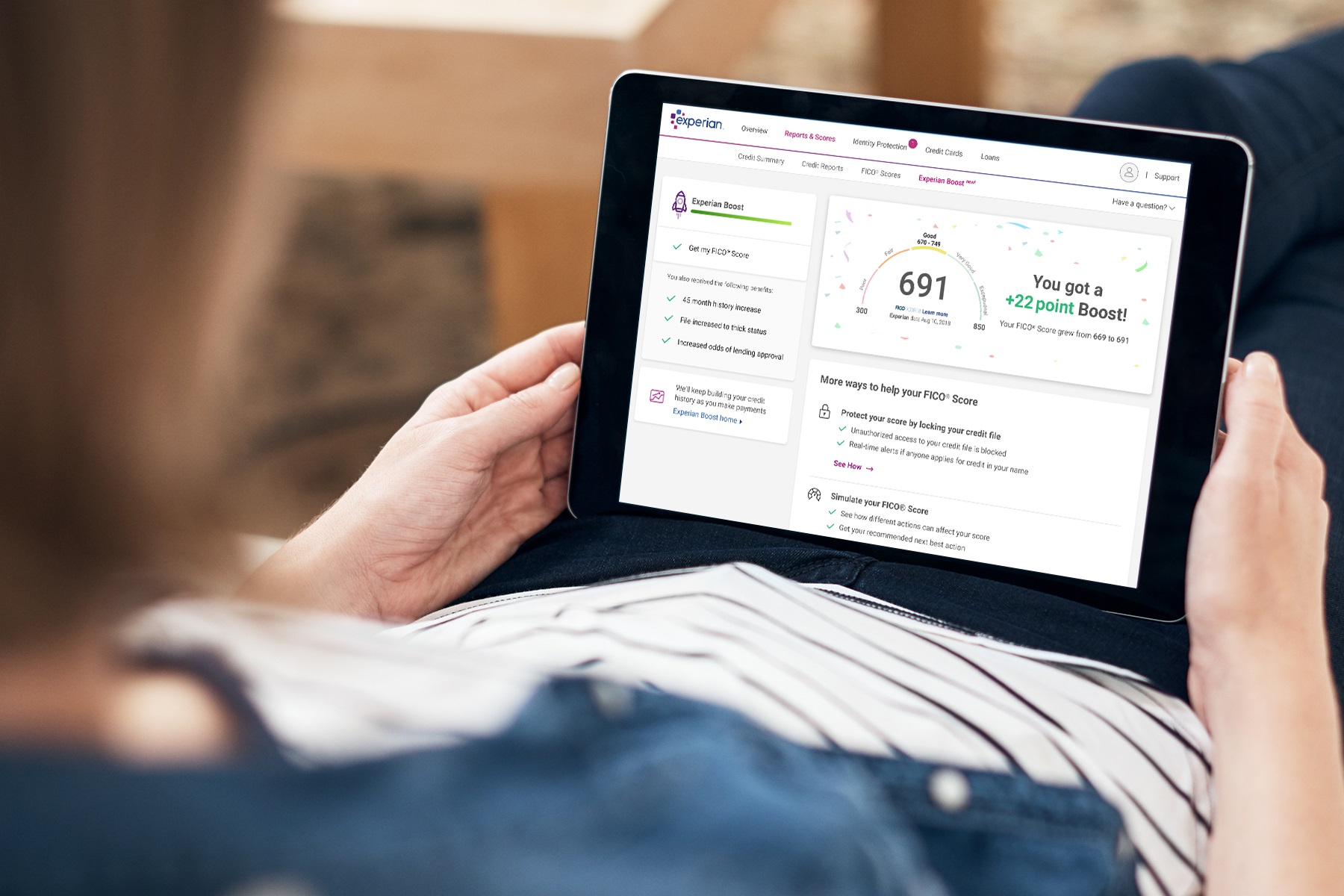

Experian Boost works by connecting to your bank accounts to identify eligible utility and subscription payments. Once connected, the service analyzes your transaction history and identifies payments that qualify for inclusion in your credit file. Users then have the option to select which payments they want to include. After this selection, Experian recalculates your FICO® Score based on the updated information.

Key Steps in Using Experian Boost:

- Sign up for Experian Boost through their official website.

- Connect your bank account to allow Experian to analyze your transaction history.

- Select the payments you want to include in your credit file.

- Review and confirm the updated credit score.

Eligibility for Experian Boost

To use Experian Boost, you must be a U.S. resident with a valid Social Security number and have at least one active bank account. Additionally, your bank must support Experian Boost's secure connection technology. Once these criteria are met, you can proceed with the setup process.

Read also:Alex Karp Partner Exploring The Visionary Force Behind Palantir Technologies

Benefits of Using Experian Boost

Experian Boost offers several advantages for users looking to enhance their credit profiles. Here are some of the key benefits:

- Improved Credit Scores: By including on-time utility and subscription payments, many users see an increase in their credit scores.

- Free Service: Experian Boost is completely free to use, making it an accessible option for anyone looking to build or improve their credit.

- Comprehensive Credit Picture: It provides a more complete view of your financial responsibility by incorporating everyday expenses.

- Quick Results: Users often see changes in their credit scores within minutes of selecting payments to include.

Who Can Benefit Most from Experian Boost?

Individuals with thin credit files or those recovering from financial setbacks can benefit significantly from Experian Boost. It offers a way to demonstrate financial responsibility without the need for traditional credit products.

Why Consider Disconnecting Experian Boost?

While Experian Boost offers many benefits, there may be reasons why you'd want to disconnect it. Some users may find the service no longer aligns with their financial goals, or they may prefer to manage their credit through other means. Below are common reasons for considering disconnection:

- Change in Financial Strategy: If your financial priorities have shifted, you might decide that Experian Boost no longer fits into your credit-building plan.

- Privacy Concerns: Some individuals may feel uncomfortable with Experian accessing their bank account information, even though the service uses secure encryption.

- Alternative Options: You may discover other credit-building tools that better suit your needs.

Evaluating Your Financial Goals

Before disconnecting Experian Boost, it's essential to evaluate your financial goals and determine whether the service still aligns with them. Consider consulting with a financial advisor if you're unsure about the best course of action.

How to Disconnect Experian Boost

If you've decided to disconnect Experian Boost, the process is straightforward. Follow these steps:

- Log in to your Experian Boost account through the official website.

- Access the settings or account management section.

- Select the option to disconnect your bank account.

- Confirm your decision to ensure that your data is no longer shared with Experian.

Important Note: Disconnecting Experian Boost will stop the service from analyzing your transaction history, but it will not remove previously included payments from your credit file. These payments will remain part of your credit history unless you request their removal.

Removing Payments from Your Credit File

If you wish to remove payments previously included through Experian Boost, you'll need to contact Experian directly. They can guide you through the process of updating your credit file to reflect your preferences.

Impact of Disconnecting Experian Boost

Disconnecting Experian Boost will stop the service from identifying and including new payments in your credit file. However, previously included payments will remain part of your credit history. This means that your credit score may not change immediately after disconnection unless you take additional steps to remove those payments.

It's important to note that the impact of disconnecting Experian Boost can vary depending on your overall credit profile. If Experian Boost was a significant factor in improving your credit score, you may notice a slight decrease once it's no longer active.

Monitoring Your Credit After Disconnection

After disconnecting Experian Boost, it's crucial to continue monitoring your credit report and score. Regular checks will help you stay informed about any changes and ensure that your credit remains in good standing.

Alternatives to Experian Boost

If you're looking for alternative ways to build or improve your credit, several options are available:

- Secured Credit Cards: These cards require a security deposit and can help establish a positive credit history.

- Credit Builder Loans: These loans are designed specifically to help individuals build credit by making regular payments.

- Rental Payment Reporting: Services like Rental Kharma allow you to report your on-time rent payments to credit bureaus.

Comparing Experian Boost with Other Credit-Building Tools

Each credit-building tool has its own strengths and weaknesses. It's important to evaluate your financial situation and choose the option that best aligns with your goals. For example, if you prefer not to use a service that accesses your bank account, a secured credit card might be a better fit.

Tips for Managing Credit

Regardless of whether you use Experian Boost or another credit-building tool, managing your credit effectively is key to achieving financial stability. Here are some tips to help you maintain a healthy credit profile:

- Pay Bills on Time: Consistently paying your bills on time is one of the most significant factors in maintaining a good credit score.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit to avoid negatively impacting your score.

- Monitor Your Credit Regularly: Regularly checking your credit report can help you identify errors and address them promptly.

- Limit New Credit Applications: Applying for too much new credit in a short period can lower your score.

Building Long-Term Credit Health

Building and maintaining good credit takes time and consistent effort. By following these tips and staying informed about your credit status, you can achieve long-term financial success.

Frequently Asked Questions

Can I Reconnect Experian Boost After Disconnecting?

Yes, you can reconnect Experian Boost at any time. Simply log in to your account and follow the prompts to reconnect your bank account.

Will Disconnecting Experian Boost Harm My Credit Score?

Disconnecting Experian Boost will not harm your credit score unless you also remove previously included payments. Even then, the impact is likely to be minimal.

Is Experian Boost Safe to Use?

Experian Boost uses advanced encryption and security measures to protect your data. However, it's always a good idea to review the terms and conditions before sharing any financial information.

Conclusion

Experian Boost is a valuable tool for improving credit scores by incorporating utility and subscription payments into credit files. However, if you decide to disconnect it, the process is simple and can be done through your account settings. Remember that previously included payments will remain part of your credit history unless you request their removal.

To ensure long-term credit health, focus on paying bills on time, keeping credit utilization low, and monitoring your credit regularly. Whether you choose to continue using Experian Boost or explore other credit-building options, staying informed and proactive is key to achieving financial success.

We encourage you to share your thoughts and experiences with Experian Boost in the comments below. Additionally, feel free to explore other articles on our site for more tips and insights into managing your finances effectively.

![[CBC] Experian Boost Credit Bureau Connection](https://www.creditbureauconnection.com/images/nav/ex_boost_start_now.jpeg)