Fidelity Retirement is one of the most trusted platforms for individuals planning for their post-work life. As the cost of living continues to rise and financial security becomes a top priority, understanding how Fidelity Retirement works is crucial for long-term stability. Whether you're just starting your career or nearing the end of it, this guide will help you navigate the complexities of retirement planning.

Retirement planning is not just about saving money; it's about creating a sustainable financial future that aligns with your lifestyle and goals. Fidelity Retirement offers a wide range of tools, resources, and investment options to help you achieve financial independence. With its robust platform and expert guidance, Fidelity is a go-to choice for millions of Americans.

This article will explore everything you need to know about Fidelity Retirement, from understanding the basics to maximizing your savings. By the end of this guide, you'll have a clear understanding of how Fidelity can help you secure your financial future.

Read also:Brandon Lee Net Worth Exploring The Legacy And Wealth Of A Hollywood Icon

Table of Contents

- Introduction to Fidelity Retirement

- Key Benefits of Fidelity Retirement

- Getting Started with Fidelity Retirement

- Exploring Investment Options

- Tools and Resources Available

- Effective Retirement Planning Strategies

- Frequently Asked Questions About Fidelity Retirement

- Comparing Fidelity with Other Retirement Platforms

- Tips for Maximizing Your Fidelity Retirement Account

- Conclusion

Introduction to Fidelity Retirement

Fidelity Retirement is part of Fidelity Investments, one of the largest financial services companies in the world. Founded in 1946, Fidelity has grown into a trusted name in the financial industry, managing over $13 trillion in global assets. The company offers a wide range of retirement accounts, including IRAs, 401(k)s, and Roth IRAs, designed to help individuals save for their golden years.

One of the standout features of Fidelity Retirement is its commitment to customer service and education. The platform provides extensive resources to help users make informed decisions about their retirement savings. From investment options to tax considerations, Fidelity ensures that its clients have access to the tools they need to succeed financially.

Why Choose Fidelity for Retirement?

Fidelity stands out in the crowded retirement planning space due to its:

- Comprehensive Investment Options: With a wide range of mutual funds, ETFs, and stocks, Fidelity allows users to tailor their portfolios to their specific needs.

- Low Fees: Fidelity offers competitive fees, making it an attractive option for both novice and experienced investors.

- Customer Support: Dedicated advisors are available to assist with account setup, investment strategies, and financial planning.

Key Benefits of Fidelity Retirement

Fidelity Retirement offers numerous advantages that make it a popular choice among individuals planning for their future. These benefits include:

1. Wide Range of Investment Choices

Fidelity provides access to thousands of investment options, including mutual funds, ETFs, and individual stocks. This flexibility allows users to create a diversified portfolio that aligns with their risk tolerance and financial goals.

2. Robust Retirement Planning Tools

The platform offers a variety of tools to help users plan for retirement effectively. These include retirement income planners, savings calculators, and tax-efficient withdrawal strategies.

Read also:Lucy Devito A Rising Star In The Entertainment Industry

3. Competitive Fees

Fidelity is known for its low fees, which can significantly impact long-term savings. With no account maintenance fees and low expense ratios on many of its funds, Fidelity makes it affordable for individuals to save for retirement.

Getting Started with Fidelity Retirement

Setting up a Fidelity Retirement account is a straightforward process. Here's a step-by-step guide to help you get started:

- Create an Account: Visit the Fidelity website and sign up for a new account.

- Choose Your Account Type: Decide whether you want a Traditional IRA, Roth IRA, or another type of retirement account.

- Fund Your Account: Transfer funds from your bank account or roll over existing retirement savings into your new Fidelity account.

- Select Investments: Choose from Fidelity's extensive list of investment options to build your portfolio.

Exploring Investment Options

Fidelity offers a variety of investment options to suit different risk levels and financial goals. Some of the most popular choices include:

1. Mutual Funds

With over 10,000 mutual funds available, Fidelity provides a diverse selection of actively and passively managed funds. These funds are ideal for investors who prefer a hands-off approach to managing their portfolios.

2. Exchange-Traded Funds (ETFs)

Fidelity's selection of ETFs offers low-cost, tax-efficient investment opportunities. These funds track specific indexes and provide exposure to a wide range of asset classes.

3. Individual Stocks

For those who prefer a more active role in their investments, Fidelity allows users to buy and sell individual stocks. This option provides greater control over portfolio composition and potential returns.

Tools and Resources Available

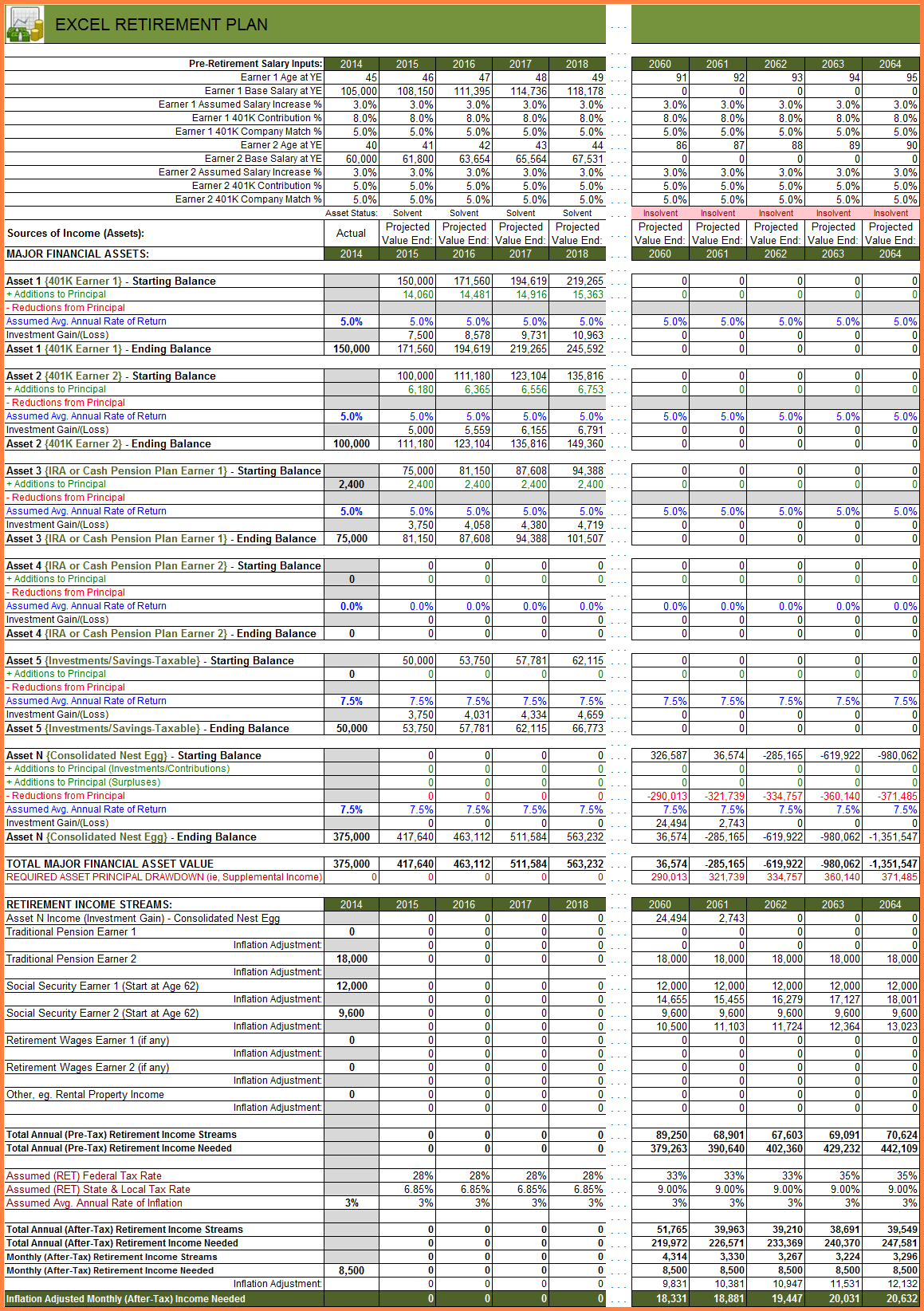

Fidelity Retirement offers a wealth of tools and resources to help users make informed decisions about their savings. These include:

1. Retirement Income Planner

This tool helps users estimate how much income they will need in retirement and how their current savings will meet those needs.

2. Savings Calculator

The savings calculator allows users to project their future savings based on current contributions and expected returns.

3. Tax-Efficient Withdrawal Strategies

Fidelity provides guidance on how to withdraw funds from retirement accounts in a tax-efficient manner, minimizing the impact on overall savings.

Effective Retirement Planning Strategies

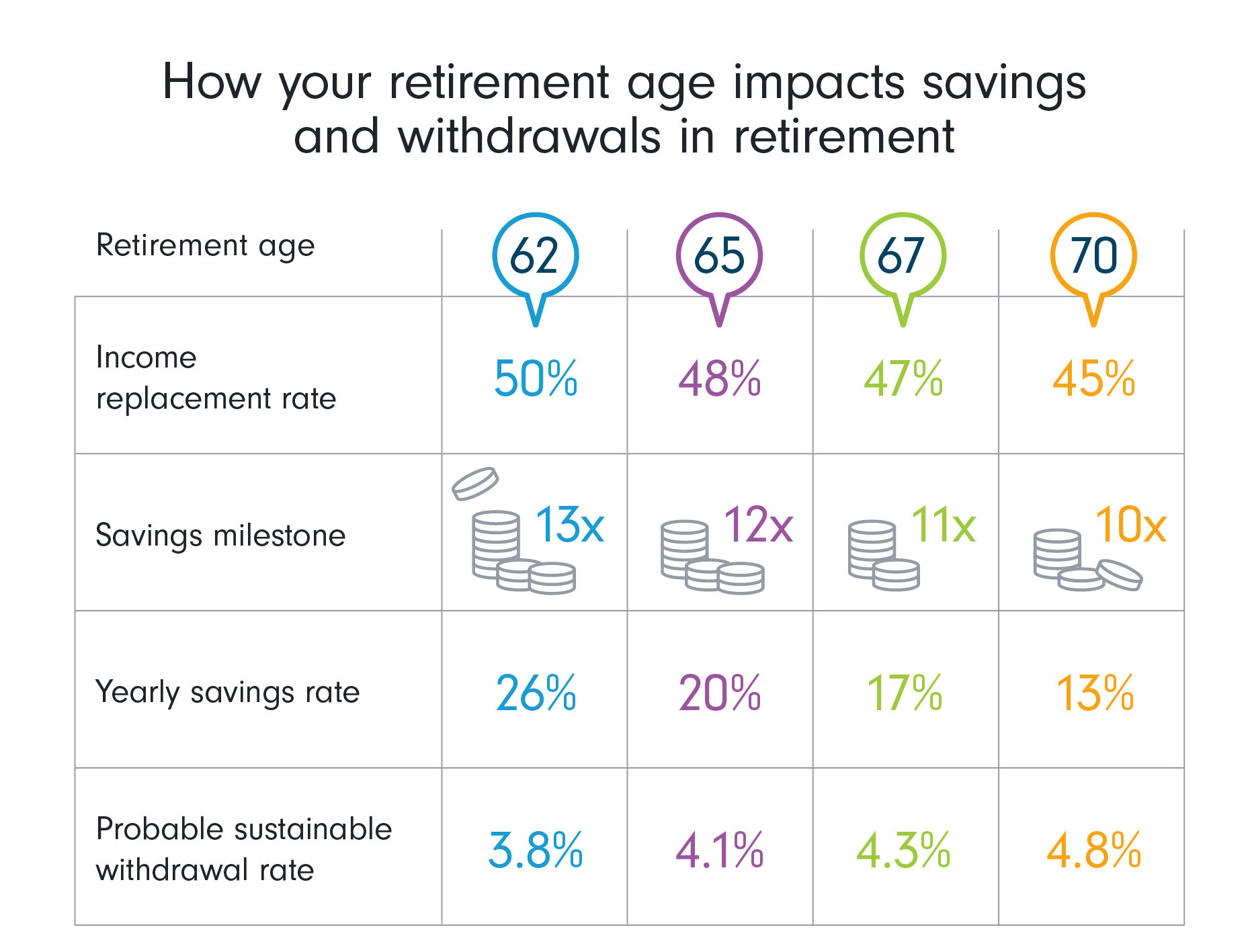

Planning for retirement requires careful consideration of various factors, including income needs, investment strategies, and tax implications. Here are some effective strategies to consider:

1. Start Early

The earlier you start saving, the more time your investments have to grow. Compound interest can significantly increase your savings over time.

2. Diversify Your Portfolio

Diversification reduces risk by spreading investments across various asset classes. This strategy helps protect your savings from market volatility.

3. Regularly Review Your Plan

Life circumstances and financial goals can change over time. Regularly reviewing and adjusting your retirement plan ensures that it remains aligned with your needs.

Frequently Asked Questions About Fidelity Retirement

Here are some common questions about Fidelity Retirement:

1. What is the minimum deposit required to open a Fidelity Retirement account?

There is no minimum deposit required to open most Fidelity Retirement accounts. However, some investment options may have minimum purchase requirements.

2. Can I roll over my existing 401(k) into a Fidelity IRA?

Yes, Fidelity allows users to roll over existing 401(k) accounts into an IRA. This process is straightforward and can be completed online.

3. Are there any fees associated with Fidelity Retirement accounts?

Fidelity offers competitive fees, with no account maintenance fees and low expense ratios on many of its funds. However, some investment options may incur transaction fees.

Comparing Fidelity with Other Retirement Platforms

When evaluating retirement platforms, it's important to consider factors such as fees, investment options, and customer service. Here's how Fidelity compares to other popular platforms:

1. Fidelity vs. Vanguard

Both Fidelity and Vanguard offer low-cost investment options and robust retirement planning tools. However, Fidelity stands out for its wider selection of mutual funds and ETFs.

2. Fidelity vs. Schwab

While Schwab is known for its commission-free trading, Fidelity offers a more comprehensive suite of retirement planning tools and resources.

Tips for Maximizing Your Fidelity Retirement Account

To get the most out of your Fidelity Retirement account, consider the following tips:

- Maximize Contributions: Aim to contribute the maximum allowable amount to your retirement account each year.

- Take Advantage of Employer Matches: If your employer offers a 401(k) match, be sure to contribute enough to receive the full match.

- Stay Informed: Regularly review market trends and adjust your portfolio as needed to stay on track with your goals.

Conclusion

Fidelity Retirement offers a comprehensive platform for individuals looking to secure their financial future. With its wide range of investment options, low fees, and robust planning tools, Fidelity is a trusted choice for millions of Americans. By following the strategies outlined in this guide, you can maximize your savings and achieve financial independence in retirement.

We encourage you to share this article with friends and family who may benefit from Fidelity's retirement planning resources. For more insights on personal finance and investment strategies, explore our other articles and resources. Remember, the key to a successful retirement is starting early and staying informed!