Getting your first credit card can be an exciting milestone, but understanding what constitutes a good credit limit is crucial for financial responsibility. Whether you're a young adult stepping into the world of credit or someone new to the financial system, your credit limit plays a significant role in shaping your credit journey. A credit limit is more than just a number; it reflects your ability to manage finances responsibly and can impact your credit score over time.

Your first credit card serves as a foundation for building credit history, and the credit limit offered can vary depending on several factors such as income, credit history, and the lender's policies. While a higher credit limit might seem appealing, it's essential to start with a limit that aligns with your financial capabilities to ensure responsible usage.

Understanding what a good credit limit is for a first credit card involves evaluating your financial situation, budgeting habits, and long-term credit goals. This article will delve into the nuances of credit limits, offering insights and guidance to help you make informed decisions about your first credit card.

Read also:Darth Talon R34 A Comprehensive Guide To The Iconic Sith Warrior

Table of Contents

- Understanding Credit Limit

- Factors Affecting Credit Limit

- Average Credit Limit for First Cards

- Benefits of a Low Credit Limit

- Risks of a High Credit Limit

- Managing Your Credit Card Responsibly

- Building Credit with Your First Card

- Choosing the Right Credit Card

- Improving Your Credit Limit Over Time

- Conclusion

Understanding Credit Limit

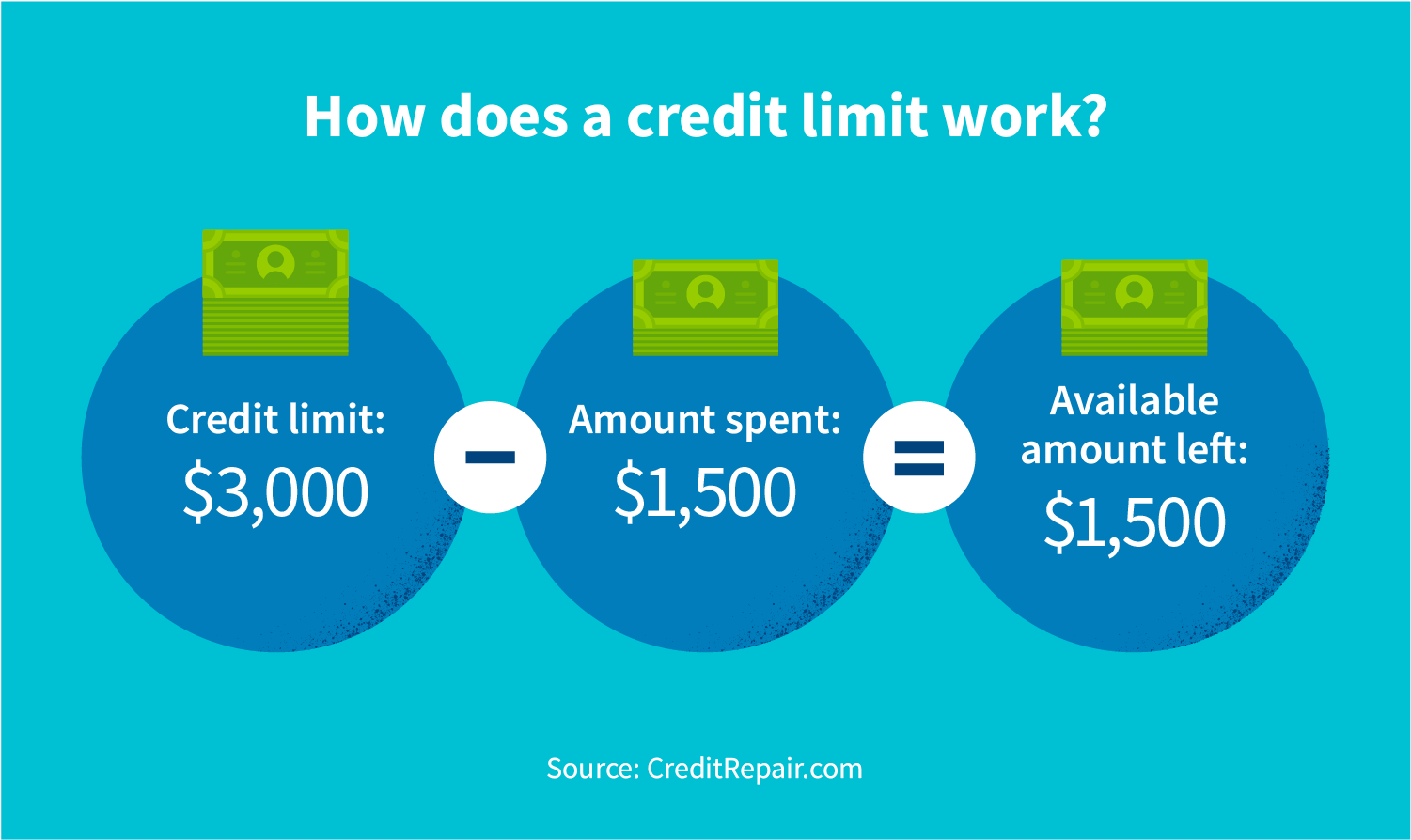

A credit limit is the maximum amount of credit that a lender allows you to borrow on your credit card. This limit is determined based on various factors, including your credit score, income, and financial history. For first-time credit card users, understanding the credit limit is essential as it dictates how much you can spend without incurring penalties or additional fees.

When you apply for a credit card, the lender evaluates your financial profile to determine an appropriate credit limit. While some cards may offer a high credit limit, it's important to choose a limit that aligns with your spending habits and repayment capabilities. Starting with a manageable credit limit helps in building a strong credit history.

Impact of Credit Limit on Credit Score

Your credit limit directly affects your credit utilization ratio, which is a key factor in determining your credit score. Credit utilization refers to the percentage of your available credit that you're using. Experts recommend keeping your credit utilization below 30% to maintain a healthy credit score. For instance, if your credit limit is $1,000, you should aim to keep your balance under $300.

Factors Affecting Credit Limit

Several factors influence the credit limit you receive for your first credit card. Lenders assess these factors to determine the risk associated with extending credit to new users. Below are some key considerations:

- Income: Your income level plays a significant role in determining your credit limit. Lenders want to ensure that you have the means to repay your credit card balance.

- Credit History: Although first-time users may not have an extensive credit history, any existing credit accounts or payment history can impact the credit limit offered.

- Employment Status: Stable employment increases your chances of securing a higher credit limit as it indicates financial stability.

- Card Type: Different types of credit cards come with varying credit limits. Student cards or secured cards typically have lower limits compared to standard unsecured cards.

The Role of Income in Credit Limit Determination

Your income is one of the primary factors lenders consider when setting your credit limit. A higher income generally allows for a higher credit limit, as it indicates a greater ability to repay debts. However, lenders also evaluate your debt-to-income ratio to ensure that extending credit won't overburden your financial situation.

Average Credit Limit for First Cards

For first-time credit card users, the average credit limit tends to be on the lower side. According to a report by Experian, the average credit limit for new credit card users is around $3,000. However, this figure can vary significantly based on individual circumstances and the type of card applied for.

Read also:Big Red Angry Bird The Iconic Character Explored

Secured credit cards, which require a security deposit, often come with lower credit limits, usually ranging from $200 to $500. These cards are designed for individuals with limited or no credit history, providing a safe entry point into the world of credit.

Secured vs. Unsecured Credit Cards

Choosing between a secured and unsecured credit card depends on your financial situation and credit-building goals. Secured cards are ideal for those with little or no credit history, as they offer a lower risk to lenders. Unsecured cards, on the other hand, provide higher credit limits but require a stronger credit profile.

Benefits of a Low Credit Limit

Starting with a low credit limit has its advantages, especially for first-time credit card users. Here are some benefits:

- Encourages Responsible Spending: A low credit limit forces you to budget carefully and avoid unnecessary expenses.

- Reduces Financial Risk: With a lower limit, the risk of accumulating excessive debt is minimized.

- Promotes Discipline: Managing a low credit limit helps develop good financial habits, setting a strong foundation for future credit use.

Risks of a High Credit Limit

While a high credit limit might seem advantageous, it comes with certain risks, especially for inexperienced credit card users. Below are some potential pitfalls:

- Increased Temptation to Spend: A higher limit can encourage overspending, leading to debt accumulation.

- Higher Minimum Payments: Larger balances result in higher minimum payments, which can strain your budget.

- Impact on Credit Score: If not managed properly, a high credit limit can negatively affect your credit score through high utilization rates.

Managing Your Credit Card Responsibly

Successfully managing your first credit card involves adopting responsible financial practices. Here are some tips to help you maintain a healthy credit profile:

- Pay on Time: Always make your payments by the due date to avoid late fees and negative impacts on your credit score.

- Monitor Your Balance: Regularly check your credit card balance to ensure you're staying within your credit limit.

- Use Credit Wisely: Only use your credit card for essential purchases and avoid impulse buying.

Budgeting Tips for Credit Card Users

Creating a budget is crucial for managing your credit card effectively. Allocate a specific portion of your income towards credit card payments and stick to this plan. Consider using budgeting apps or spreadsheets to track your expenses and ensure you're not exceeding your credit limit.

Building Credit with Your First Card

Your first credit card is a powerful tool for building credit. By using it responsibly, you can establish a positive credit history, which will benefit you in the long run. Regular, timely payments and low credit utilization are key to improving your credit score.

Additionally, consider keeping your first credit card open for an extended period. The length of your credit history is another factor that influences your credit score, and maintaining older accounts can have a positive impact.

Strategies for Building Credit

Implementing effective credit-building strategies can accelerate your progress. Some strategies include becoming an authorized user on someone else's credit card, using credit-builder loans, and consistently making small purchases that you can pay off in full each month.

Choosing the Right Credit Card

Selecting the right credit card for your needs is crucial. Consider factors such as interest rates, fees, rewards programs, and customer service when making your decision. For first-time users, cards with low or no annual fees and introductory offers can be particularly appealing.

Research different credit card options and read reviews from current users to gain insights into the card's features and benefits. This due diligence will help you choose a card that aligns with your financial goals.

Comparing Credit Card Options

When comparing credit cards, focus on key features such as interest rates, rewards, and benefits. Use comparison tools available online to evaluate different cards side by side. This will help you identify the best option for your specific needs and financial situation.

Improving Your Credit Limit Over Time

As you demonstrate responsible credit behavior, you can request a credit limit increase from your lender. Improving your credit limit involves maintaining a good payment history, reducing debt, and increasing your income. Lenders periodically review your account, and a positive track record can lead to automatic credit limit increases.

Alternatively, you can contact your lender directly to request a credit limit increase. Be prepared to provide updated financial information, such as proof of income or recent pay stubs, to support your request.

Conclusion

In summary, understanding what constitutes a good credit limit for your first credit card is vital for establishing a solid financial foundation. Starting with a manageable limit helps in building credit responsibly and avoiding unnecessary debt. By adopting responsible financial practices, such as timely payments and budgeting, you can improve your credit score and eventually qualify for higher credit limits.

We encourage you to share your thoughts and experiences in the comments below. If you found this article helpful, please consider sharing it with others who might benefit from the information. Additionally, explore other articles on our site to further enhance your financial knowledge.

Sources:

- Experian - www.experian.com

- Consumer Financial Protection Bureau - www.consumerfinance.gov

:max_bytes(150000):strip_icc()/howtoincreaseyourlimitonyourfirstcreditcard-07d537491b0648cdbc51438989360ca8.png)