TIAA Bank 1 Year CD Rates have become an increasingly popular choice for individuals looking to grow their savings with minimal risk. Certificates of Deposit (CDs) offer a secure way to earn interest on your money, and TIAA Bank's offerings are no exception. In this article, we will delve into the specifics of TIAA Bank's 1-year CD rates, helping you make informed decisions about your financial future.

TIAA Bank, a well-established financial institution, provides competitive CD rates that cater to a wide range of investors. Whether you're a first-time saver or an experienced investor, understanding the intricacies of these rates can significantly impact your financial strategy.

This guide will explore everything you need to know about TIAA Bank's 1-year CD offerings, including the benefits, risks, and how to maximize your returns. Let's dive in and uncover the secrets behind TIAA Bank's CD rates.

Read also:Gary Sinise Net Worth Exploring The Wealth And Achievements Of A Hollywood Icon

Table of Contents

- Introduction to TIAA Bank 1 Year CD Rates

- Overview of TIAA Bank

- Understanding CDs and Their Importance

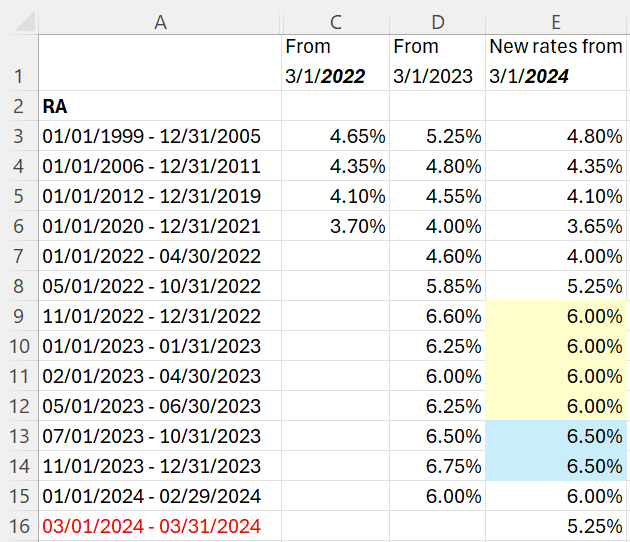

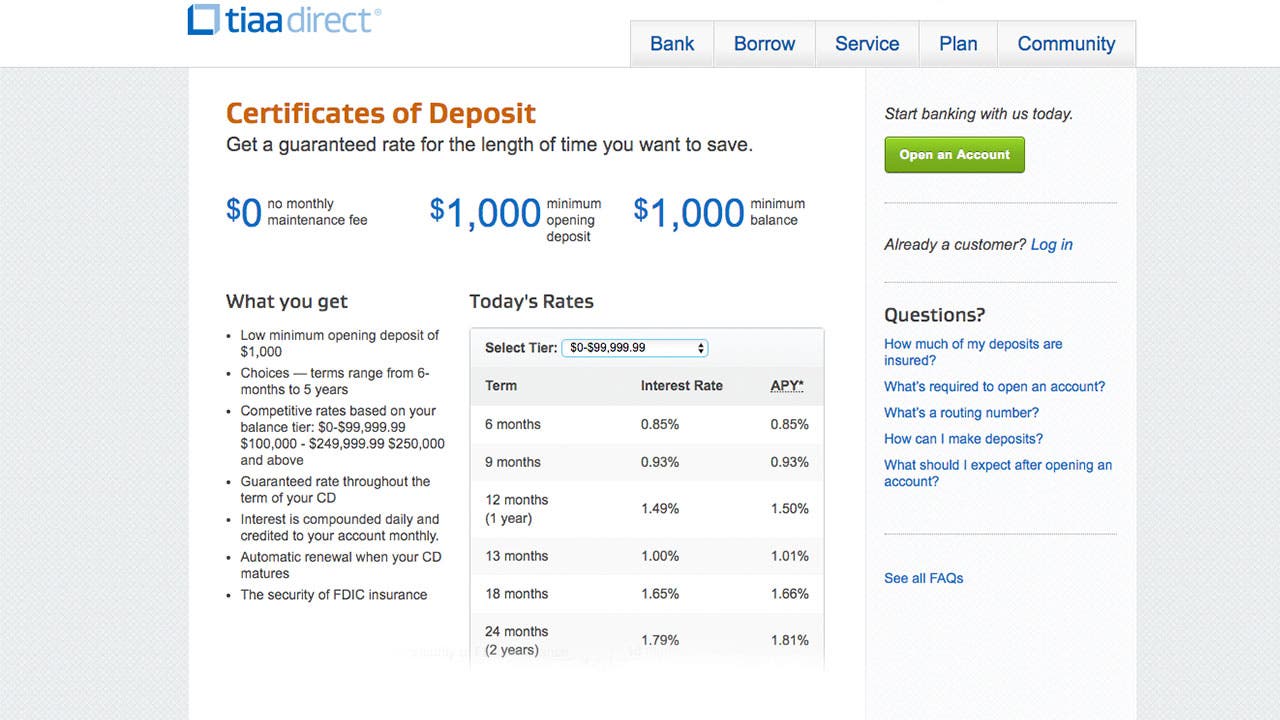

- Current TIAA Bank 1 Year CD Rates

- Benefits of Choosing TIAA Bank CDs

- Potential Risks to Consider

- Comparing TIAA Bank Rates with Other Banks

- Eligibility and Requirements

- How to Open a TIAA Bank CD Account

- Tips for Maximizing Your Returns

- Frequently Asked Questions

- Conclusion

Introduction to TIAA Bank 1 Year CD Rates

TIAA Bank's 1-year CD rates are designed to provide savers with a reliable and predictable way to grow their wealth. Unlike traditional savings accounts, CDs typically offer higher interest rates, making them an attractive option for those looking to secure their financial future.

Why Choose a 1-Year CD?

A 1-year CD is an ideal choice for individuals who want to lock in a competitive interest rate without committing to a long-term investment. This short-term option allows you to take advantage of current market conditions while maintaining flexibility.

Overview of TIAA Bank

TIAA Bank, part of the TIAA organization, has a long history of providing financial solutions to individuals and businesses. With a focus on customer satisfaction and innovation, TIAA Bank continues to be a trusted name in the financial industry.

Key Features of TIAA Bank

- Competitive interest rates

- Wide range of financial products

- Exceptional customer service

Understanding CDs and Their Importance

Certificates of Deposit (CDs) are time-bound savings accounts that offer fixed interest rates. They are a popular choice for those seeking a low-risk investment option that provides higher returns than traditional savings accounts.

How CDs Work

When you open a CD, you agree to deposit a specific amount of money for a predetermined period. In return, the bank pays you interest at a fixed rate. At the end of the term, you can withdraw your money or reinvest it in another CD.

Current TIAA Bank 1 Year CD Rates

As of the latest update, TIAA Bank offers competitive 1-year CD rates. These rates are subject to change, so it's essential to check directly with the bank for the most up-to-date information.

Read also:Christoph Sanders Partner A Comprehensive Guide To His Life Career And Impact

Factors Influencing CD Rates

Several factors can influence CD rates, including:

- Federal Reserve policies

- Economic conditions

- Market demand

Benefits of Choosing TIAA Bank CDs

TIAA Bank's CDs offer numerous advantages that make them an attractive option for savers. Some of the key benefits include:

Higher Interest Rates

TIAA Bank typically offers higher interest rates on CDs compared to traditional savings accounts, allowing you to grow your savings more effectively.

Potential Risks to Consider

While CDs are generally considered low-risk investments, there are still some factors to consider:

Early Withdrawal Penalties

Withdrawing your money before the CD matures can result in penalties, so it's crucial to ensure you can commit to the term.

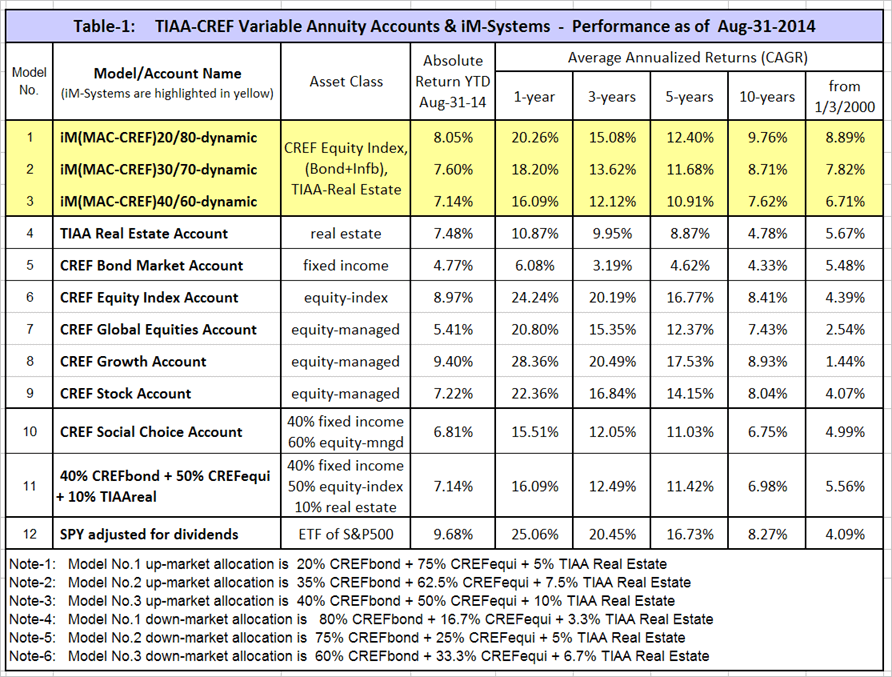

Comparing TIAA Bank Rates with Other Banks

When evaluating CD options, it's important to compare rates across different banks. TIAA Bank often competes favorably with other financial institutions, offering competitive rates and additional benefits.

Key Factors for Comparison

- Interest rates

- Terms and conditions

- Customer service

Eligibility and Requirements

To open a TIAA Bank CD, you must meet certain eligibility requirements. These typically include being at least 18 years old and providing necessary identification documents.

Documents Needed

- Government-issued ID

- Proof of address

- Initial deposit

How to Open a TIAA Bank CD Account

Opening a CD account with TIAA Bank is a straightforward process. You can do so online or by visiting a local branch.

Steps to Open an Account

- Visit the TIAA Bank website

- Select the CD option that suits your needs

- Provide the required documentation

- Make your initial deposit

Tips for Maximizing Your Returns

To get the most out of your TIAA Bank 1-year CD, consider the following tips:

Invest Early

The earlier you invest, the more time your money has to grow. Take advantage of current rates by opening a CD as soon as possible.

Frequently Asked Questions

Q: Can I withdraw my money early from a TIAA Bank CD?

While it's possible to withdraw your money early, doing so may result in penalties. It's best to ensure you can commit to the full term before opening a CD.

Q: Are TIAA Bank CDs FDIC insured?

Yes, TIAA Bank CDs are FDIC insured up to the maximum allowed by law, providing additional peace of mind for investors.

Conclusion

TIAA Bank 1 Year CD Rates offer a secure and reliable way to grow your savings. By understanding the benefits, risks, and requirements, you can make an informed decision about whether this investment option is right for you. We encourage you to take action by exploring TIAA Bank's offerings and opening a CD account to start earning competitive interest rates.

Feel free to leave your comments or questions below, and don't hesitate to share this article with others who may find it useful. For more financial insights and tips, explore our other articles on the website.