When it comes to saving money, TIAA Bank 1-year CD stands out as a smart financial instrument for individuals looking to grow their wealth securely. Certificates of Deposit (CDs) have long been a trusted option for conservative investors who want to earn guaranteed returns without exposing themselves to the volatility of the stock market. In this article, we will explore why the TIAA Bank 1-year CD is an excellent choice for savers, how it works, and the benefits it offers.

The financial landscape can be overwhelming, especially for those new to investing. However, understanding the basics of TIAA Bank's 1-year CD can empower you to make informed decisions about your money. This article will provide you with all the essential information you need to know before committing to this savings product.

Whether you're looking to secure your financial future or simply want to earn interest on your savings, the TIAA Bank 1-year CD offers a competitive solution. Let's dive into the details and discover why this product is worth considering.

Read also:Top Site For Ticket Sale Gamification Summit Your Ultimate Guide

Table of Contents

- What is a Certificate of Deposit (CD)?

- TIAA Bank Overview

- Features of TIAA Bank 1-Year CD

- Benefits of Choosing TIAA Bank 1-Year CD

- How to Open a TIAA Bank 1-Year CD

- Rates and Returns on TIAA Bank 1-Year CD

- Early Withdrawal Penalties

- Comparison with Other Banks

- FAQ About TIAA Bank 1-Year CD

- Conclusion

What is a Certificate of Deposit (CD)?

A Certificate of Deposit (CD) is a savings product offered by banks and credit unions that allows individuals to deposit a fixed amount of money for a predetermined period. In return, the depositor earns interest at a fixed rate. CDs are known for their safety and predictability, making them an ideal choice for risk-averse investors.

Why Choose CDs Over Regular Savings Accounts?

While regular savings accounts offer liquidity, CDs provide higher interest rates in exchange for locking up funds for a specific term. This makes CDs particularly attractive for individuals who are comfortable committing their money for a set duration.

- Higher Interest Rates: CDs typically offer better rates compared to traditional savings accounts.

- Guaranteed Returns: With a CD, you know exactly how much interest you will earn over the term.

- Federal Insurance: CDs are FDIC-insured, ensuring your money is protected up to $250,000.

TIAA Bank Overview

TIAA Bank, part of the TIAA family of companies, is a financial institution dedicated to providing innovative banking solutions. Known for its commitment to customer satisfaction, TIAA Bank offers a wide range of products, including CDs, that cater to the needs of modern savers.

Key Facts About TIAA Bank

TIAA Bank has built a reputation for reliability and transparency. As a trusted financial partner, it serves millions of customers across the United States. Below are some highlights:

- FDIC Insurance: All deposits are insured by the Federal Deposit Insurance Corporation (FDIC).

- Customer-Centric Approach: TIAA Bank prioritizes customer service and offers personalized solutions.

- Wide Product Range: From savings accounts to loans, TIAA Bank provides a comprehensive suite of financial products.

Features of TIAA Bank 1-Year CD

The TIAA Bank 1-year CD offers several features that make it an attractive option for savers. Below are some of the key characteristics:

1. Fixed Interest Rate

One of the main advantages of the TIAA Bank 1-year CD is its fixed interest rate. This means that you can predict your earnings accurately without worrying about fluctuations.

Read also:Ask The 8 Ball Indra Your Ultimate Guide To Unlocking Lifes Answers

2. Short-Term Commitment

With a 1-year term, this CD is ideal for individuals who want to lock in a competitive rate without tying up their money for an extended period.

3. FDIC Insurance

All TIAA Bank CDs are backed by FDIC insurance, ensuring that your funds are secure up to the legal limit.

Benefits of Choosing TIAA Bank 1-Year CD

There are numerous benefits to choosing the TIAA Bank 1-year CD over other savings options. Here are some of the most compelling reasons:

1. Competitive Interest Rates

TIAA Bank consistently offers competitive interest rates on its CDs, allowing you to maximize your returns.

2. Flexibility

While the 1-year term provides structure, it also offers flexibility for those who may need access to their funds in the near future.

3. Security

With FDIC insurance, you can rest assured that your money is safe and protected from loss.

How to Open a TIAA Bank 1-Year CD

Opening a TIAA Bank 1-year CD is a straightforward process. Follow these steps to get started:

Step 1: Visit the TIAA Bank Website

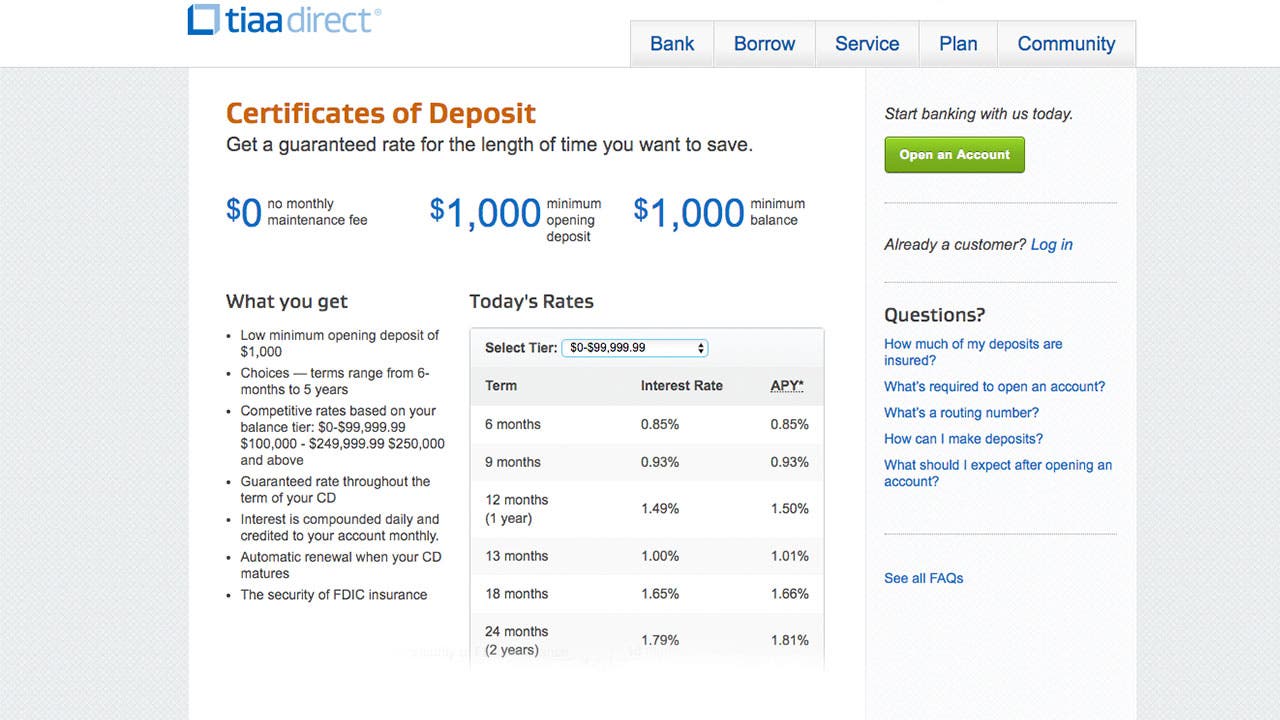

Go to the official TIAA Bank website and navigate to the CDs section. Here, you can find detailed information about the available options.

Step 2: Choose the Right CD

Select the 1-year CD that aligns with your financial goals. Consider factors such as the deposit amount and interest rate.

Step 3: Complete the Application

Fill out the application form and provide any necessary documentation, such as proof of identity and account information.

Step 4: Fund Your CD

Transfer the required funds to open your CD. Once the process is complete, you can sit back and watch your money grow.

Rates and Returns on TIAA Bank 1-Year CD

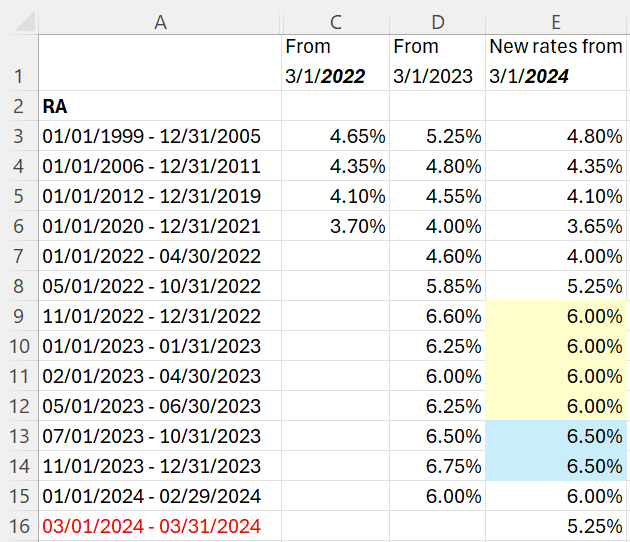

TIAA Bank's 1-year CD offers competitive rates that are subject to change based on market conditions. As of the latest update, the interest rate stands at X% APY. This rate is compounded annually, ensuring maximum growth for your investment.

Factors Affecting CD Rates

Several factors influence the interest rates on CDs, including:

- Economic Conditions: The overall health of the economy can impact CD rates.

- Federal Reserve Policies: Changes in monetary policy can lead to fluctuations in rates.

- Market Demand: High demand for CDs may result in higher rates.

Early Withdrawal Penalties

It's important to note that withdrawing funds from a CD before the term ends may result in penalties. For the TIAA Bank 1-year CD, the penalty typically amounts to a portion of the interest earned. Be sure to review the terms and conditions carefully before opening a CD.

How to Avoid Penalties

To avoid early withdrawal penalties, consider the following tips:

- Plan Ahead: Ensure that you won't need the funds during the CD term.

- Explore Laddering Strategies: Use CD laddering to stagger maturity dates and maintain liquidity.

Comparison with Other Banks

When evaluating CDs, it's essential to compare offerings from different banks. TIAA Bank's 1-year CD stacks up well against competitors, offering competitive rates and excellent customer service.

Key Points of Comparison

- Interest Rates: TIAA Bank often provides better rates compared to national averages.

- Customer Support: TIAA Bank is known for its exceptional customer service.

- Account Features: Additional features, such as online account management, enhance the user experience.

FAQ About TIAA Bank 1-Year CD

1. Is TIAA Bank 1-Year CD Safe?

Yes, TIAA Bank CDs are FDIC-insured, ensuring that your funds are protected up to $250,000.

2. Can I Add Money to My CD After Opening It?

No, once you open a CD, you cannot add additional funds. However, you can open multiple CDs if needed.

3. What Happens When My CD Matures?

Upon maturity, you can choose to renew the CD, withdraw your funds, or transfer the balance to another account.

Conclusion

The TIAA Bank 1-year CD is an excellent choice for individuals seeking a secure and predictable way to grow their savings. With competitive interest rates, FDIC insurance, and a user-friendly application process, this product stands out in the financial marketplace.

We encourage you to take the next step by exploring TIAA Bank's offerings further. Don't hesitate to reach out with any questions or concerns. Additionally, feel free to share this article with others who may benefit from the information. Together, let's build a brighter financial future!