When it comes to luxury vehicles, Lexus stands out as a premier brand offering exceptional quality, performance, and style. However, purchasing a Lexus can be a significant financial decision. This is where Lexus Financial Services comes into play, providing tailored financing solutions to make your dream of owning a Lexus more accessible.

Lexus Financial Services is designed to cater to a wide range of customer needs, offering flexible terms, competitive rates, and personalized options. Whether you're buying a new or pre-owned Lexus, these services simplify the process of acquiring your ideal vehicle without compromising on affordability.

In this comprehensive guide, we will delve into the world of Lexus Financial Services, exploring its offerings, benefits, and how it can help you achieve your automotive goals. Let's uncover the details that make this financial service a trusted partner for luxury car enthusiasts.

Read also:Tay Keith Net Worth The Untold Story Of Success And Influence

Table of Contents

- Introduction to Lexus Financial Services

- What Are the Services Offered?

- Benefits of Using Lexus Financial Services

- Eligibility and Requirements

- How to Apply for Financing

- Lexus Financial Services for New Cars

- Lexus Financial Services for Pre-Owned Cars

- Customer Reviews and Testimonials

- Common Questions About Lexus Financial Services

- Conclusion and Call to Action

Introduction to Lexus Financial Services

Lexus Financial Services is a subsidiary of Toyota Financial Services, dedicated to providing financing options for Lexus vehicles. Established with the aim of simplifying the luxury car purchasing process, this service has become a go-to solution for those looking to acquire a high-end vehicle.

The services offered by Lexus Financial Services are designed to meet the diverse needs of customers, ensuring that everyone can find a plan that suits their financial situation. From low-interest loans to flexible leasing options, Lexus Financial Services caters to both individual buyers and businesses.

With a reputation for reliability and customer satisfaction, Lexus Financial Services continues to innovate and adapt to the changing automotive market, offering cutting-edge solutions that keep pace with modern demands.

What Are the Services Offered?

Loan Options

Lexus Financial Services provides competitive loan options for purchasing new and pre-owned vehicles. These loans come with flexible terms and competitive interest rates, allowing customers to tailor their payments to their budget.

- Fixed interest rates

- Loan terms ranging from 24 to 72 months

- Customizable down payment options

Leasing Options

For those who prefer leasing over buying, Lexus Financial Services offers attractive leasing packages. These packages provide the opportunity to drive a luxury vehicle with lower monthly payments compared to traditional financing.

- Lease terms from 24 to 48 months

- Low mileage allowances

- End-of-lease purchase options

Special Promotions

Throughout the year, Lexus Financial Services runs special promotions and incentives to make luxury vehicles more accessible. These promotions often include reduced interest rates, cash-back offers, and special lease deals.

Read also:September 5 Kpkuang A Comprehensive Guide To Understanding The Significance And Impact

Benefits of Using Lexus Financial Services

Choosing Lexus Financial Services for your automotive financing needs comes with a host of benefits that set it apart from other financial institutions. Here are some of the key advantages:

- Competitive Rates: Enjoy some of the lowest interest rates in the industry, ensuring affordability.

- Flexible Terms: Customize your financing plan with terms that fit your lifestyle and budget.

- Expert Support: Access dedicated customer service representatives who are knowledgeable and ready to assist.

- Convenience: Streamlined application processes and online tools make it easy to secure financing.

Eligibility and Requirements

To qualify for Lexus Financial Services, applicants must meet certain criteria. These requirements ensure that only responsible and creditworthy individuals can access the services.

- Valid driver's license

- Good credit history

- Proof of income

- Down payment (if applicable)

Additionally, Lexus Financial Services considers factors such as employment history and debt-to-income ratio when evaluating applications.

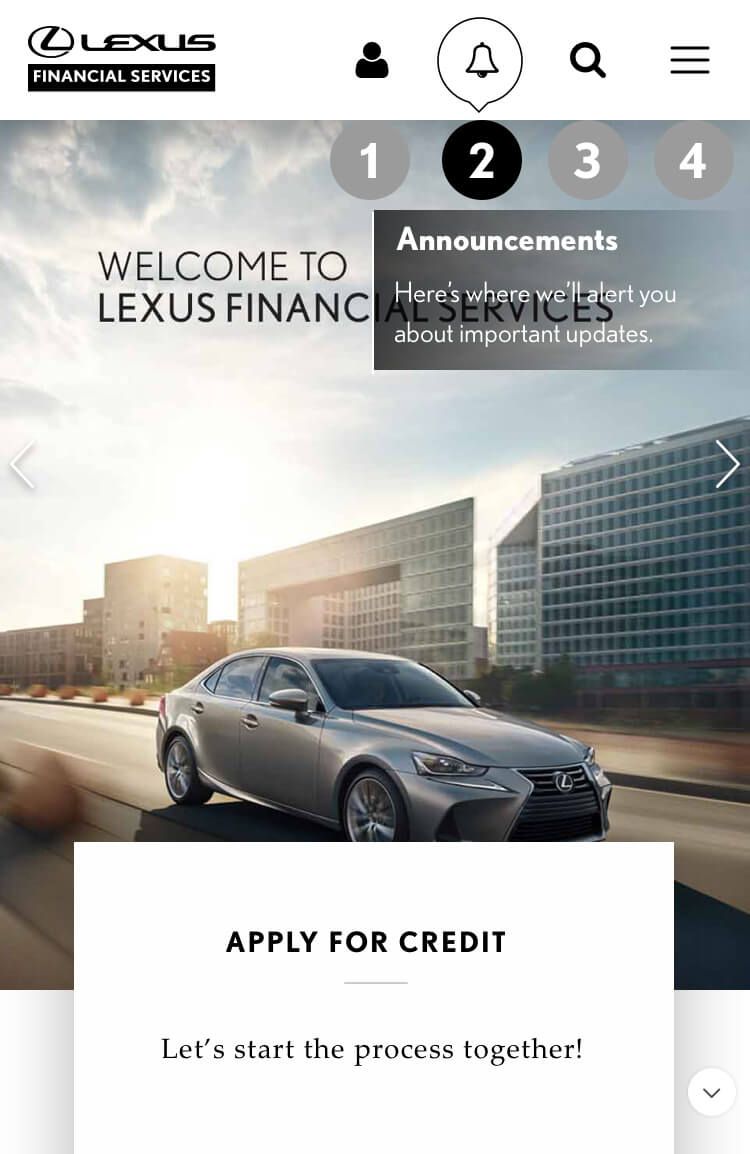

How to Apply for Financing

Applying for financing through Lexus Financial Services is a straightforward process. Follow these steps to get started:

- Visit the official Lexus website or contact your local Lexus dealership.

- Complete the online application form, providing necessary personal and financial information.

- Submit any required documentation, such as proof of income and identification.

- Receive a decision within a few business days, and finalize the financing agreement if approved.

Lexus Financial Services for New Cars

For those looking to purchase a brand-new Lexus, Lexus Financial Services offers specialized programs designed to make the process seamless. These programs include:

- Low-interest financing for new models

- Special incentives for recent graduates and military personnel

- Exclusive lease deals on select models

By choosing Lexus Financial Services for your new car purchase, you can enjoy peace of mind knowing that you're getting the best possible deal on your dream vehicle.

Lexus Financial Services for Pre-Owned Cars

Certified Pre-Owned Vehicles

Lexus Financial Services also extends its offerings to certified pre-owned vehicles, ensuring that buyers can acquire a high-quality used Lexus with confidence. These vehicles undergo rigorous inspections and come with warranties, making them an excellent choice for budget-conscious buyers.

- Competitive financing rates

- Extended warranties

- Flexible payment terms

Traditional Pre-Owned Vehicles

For non-certified pre-owned Lexuses, Lexus Financial Services provides tailored financing solutions that cater to the unique needs of each buyer. With options for varying credit scores and financial situations, Lexus Financial Services ensures that everyone has access to luxury.

Customer Reviews and Testimonials

Many customers have shared their positive experiences with Lexus Financial Services. Here are a few testimonials:

"I was pleasantly surprised by how easy it was to secure financing for my new Lexus. The team at Lexus Financial Services was incredibly helpful and made the process stress-free." – Sarah M.

"As a first-time luxury car buyer, I wasn't sure what to expect. Lexus Financial Services provided clear explanations and ensured I understood all my options." – John T.

Common Questions About Lexus Financial Services

What is the minimum credit score required?

While Lexus Financial Services does not publicly disclose a specific minimum credit score, applicants with higher credit scores are more likely to qualify for the best rates and terms.

Can I apply online?

Yes, you can apply for financing online through the official Lexus website or by visiting a local dealership.

Are there penalties for early repayment?

Lexus Financial Services does not impose prepayment penalties, allowing customers to pay off their loans early without incurring additional fees.

Conclusion and Call to Action

Lexus Financial Services provides an unparalleled platform for acquiring luxury vehicles with ease and confidence. With competitive rates, flexible terms, and expert support, it stands out as a leader in automotive financing. Whether you're purchasing a new Lexus or exploring certified pre-owned options, Lexus Financial Services has a solution tailored just for you.

We invite you to take the next step by applying for financing or learning more about the available options. Share your thoughts in the comments below, and don't forget to explore other articles on our site for additional insights into the world of automotive finance.