Obtaining a USDA loan with a co-signer is an excellent option for those seeking to purchase a home in eligible rural areas but may face challenges due to credit scores or income limitations. The USDA loan program, designed to assist low- to moderate-income families, offers competitive interest rates and flexible repayment terms. By involving a co-signer, borrowers can strengthen their application and increase their chances of approval.

The concept of a co-signer in a USDA loan is straightforward yet powerful. A co-signer is an individual who agrees to take responsibility for the loan repayment if the primary borrower defaults. This added layer of security can make lenders more comfortable extending credit, especially to borrowers with less-than-perfect credit histories. Understanding the intricacies of co-signing and the USDA loan program can open doors to homeownership for many aspiring buyers.

In this comprehensive guide, we will delve into the world of USDA loans with co-signers, exploring the benefits, requirements, and considerations involved. Whether you're a potential borrower or a prospective co-signer, this article will provide the insights you need to make informed decisions about one of the most significant financial commitments in your life.

Read also:Unveiling The Starstudded Mi4 Cast A Comprehensive Guide

Table of Contents

- Introduction to USDA Loans

- Eligibility Criteria for USDA Loans

- The Role of a Co-Signer in USDA Loans

- Benefits of Adding a Co-Signer

- Risks and Responsibilities for Co-Signers

- Impact on Credit Scores

- Choosing the Right Co-Signer

- The Application Process

- Alternatives to Co-Signing

- Conclusion and Call to Action

Introduction to USDA Loans

USDA loans, officially known as USDA Rural Development Guaranteed Housing Loans, are part of a government-backed program aimed at promoting homeownership in rural and suburban areas. These loans are designed to assist families with limited financial resources to purchase, build, or repair homes in eligible locations. Unlike conventional loans, USDA loans do not require a down payment, making them an attractive option for first-time homebuyers and low-income individuals.

Key Features of USDA Loans

USDA loans offer several unique features that set them apart from other mortgage options:

- No Down Payment Requirement: Borrowers are not required to make an initial down payment, reducing the upfront costs significantly.

- Competitive Interest Rates: USDA loans often come with lower interest rates compared to traditional mortgages.

- Flexible Credit Criteria: The program is more forgiving regarding credit scores, allowing borrowers with less-than-perfect credit histories to qualify.

- Long Repayment Terms: Borrowers can benefit from extended repayment periods, usually up to 30 years, which lowers monthly payments.

Eligibility Criteria for USDA Loans

While USDA loans provide numerous advantages, they come with specific eligibility requirements. To qualify, applicants must meet income limits, residency criteria, and property location stipulations.

Income Limits

The USDA sets income caps based on the median income of the area where the property is located. Borrowers' household income cannot exceed 115% of the area's median income. For example, in areas with a median income of $50,000, the maximum allowable household income would be $57,500.

Residency Requirements

USDA loans are intended for primary residences only. Borrowers must occupy the property as their main home and cannot use the loan for investment or vacation properties.

Property Location

Properties must be located in designated rural or suburban areas as determined by the USDA. Prospective borrowers can check the eligibility of a specific address using the USDA's interactive map tool.

Read also:Understanding Subgaleal Hemorrhage Causes Symptoms And Treatment

The Role of a Co-Signer in USDA Loans

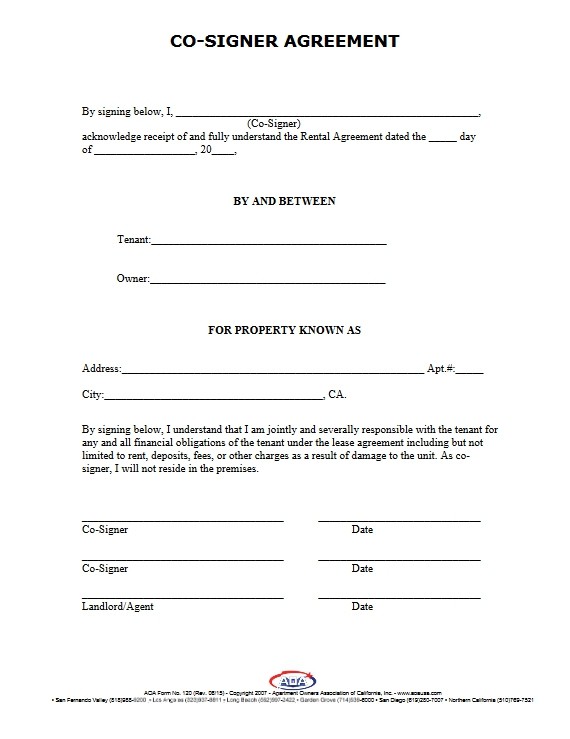

A co-signer plays a crucial role in the USDA loan process, particularly for borrowers who may struggle to meet the program's credit or income requirements. By co-signing, an individual agrees to assume financial responsibility for the loan if the primary borrower fails to make payments.

Responsibilities of a Co-Signer

- Financial Obligation: Co-signers are legally obligated to repay the loan if the borrower defaults.

- Credit Impact: The loan appears on the co-signer's credit report, affecting their credit score and borrowing capacity.

- Legal Implications: Co-signers must understand the legal ramifications of co-signing, including the potential for collection actions if payments are missed.

Benefits of Adding a Co-Signer

Incorporating a co-signer into a USDA loan application can offer several advantages:

Improved Loan Approval Chances

Borrowers with limited credit histories or lower credit scores can enhance their application by adding a co-signer with a strong credit profile. This additional financial backing reassures lenders of the loan's security.

Lower Interest Rates

Co-signers with excellent credit scores may help borrowers secure more favorable interest rates, reducing the overall cost of the loan.

Increased Borrowing Capacity

With a co-signer's income included in the application, borrowers may qualify for larger loan amounts, enabling them to purchase more expensive homes.

Risks and Responsibilities for Co-Signers

While co-signing can facilitate a borrower's path to homeownership, it is not without risks. Co-signers must carefully consider the potential consequences before committing.

Credit Score Impact

Co-signing affects the co-signer's credit score. Any missed payments by the borrower will reflect negatively on the co-signer's credit report, potentially impacting their ability to secure future loans.

Financial Burden

In the event of borrower default, co-signers are responsible for repaying the outstanding loan balance. This financial obligation can strain personal relationships and create financial hardship.

Impact on Credit Scores

Both borrowers and co-signers must be aware of how USDA loans affect credit scores. For borrowers, timely payments can improve credit scores, while missed payments can have severe negative consequences. Co-signers also face credit score fluctuations based on the loan's performance.

Building Credit Responsibly

Borrowers can use USDA loans as a tool to build credit responsibly. By maintaining consistent, on-time payments, borrowers can demonstrate financial reliability, boosting their creditworthiness.

Choosing the Right Co-Signer

Selecting the right co-signer is a critical decision. Borrowers should consider individuals with strong credit histories, stable incomes, and a genuine willingness to support their homeownership journey.

Factors to Consider

- Credit History: Co-signers with excellent credit scores enhance loan approval chances and interest rates.

- Income Stability: A co-signer's financial stability ensures they can meet loan obligations if necessary.

- Relationship Dynamics: Borrowers and co-signers should have a trusting relationship to mitigate potential conflicts.

The Application Process

Applying for a USDA loan with a co-signer involves several steps, from gathering documents to finalizing the loan agreement.

Required Documentation

- Proof of income for both borrower and co-signer

- Credit reports and scores

- Property appraisal and eligibility verification

- Loan application forms

Loan Approval Timeline

The USDA loan application process typically takes several weeks to complete. Borrowers and co-signers should prepare for thorough underwriting and verification procedures.

Alternatives to Co-Signing

While co-signing is a viable option, borrowers may explore alternative solutions if a suitable co-signer is unavailable. These include improving credit scores, increasing income, or seeking assistance from down payment programs.

Down Payment Assistance Programs

Various state and local programs offer down payment assistance for USDA borrowers. These programs can reduce the financial burden on borrowers and eliminate the need for a co-signer.

Conclusion and Call to Action

In conclusion, USDA loans with co-signers provide an excellent opportunity for aspiring homeowners to achieve their dreams, even with financial or credit challenges. By understanding the role of co-signers, the associated risks, and the benefits, both borrowers and co-signers can make informed decisions that lead to successful homeownership.

We encourage readers to take the next step by consulting with a qualified lender or mortgage specialist to explore their USDA loan options. Don't forget to share this article with others who may benefit from the insights provided. Together, we can empower more individuals and families to secure their dream homes through the USDA loan program.