The debate over whether to rent or buy a home has been ongoing for decades, and with the rise of articles in The New York Times (NYT) discussing this topic, it has become an even more critical consideration for many people. Whether you're a first-time homebuyer or someone reconsidering your living situation, understanding the financial and lifestyle implications of renting versus buying is essential.

In this article, we will explore the advantages and disadvantages of renting and buying, helping you make an informed decision that aligns with your financial goals and personal preferences. Whether you're in a bustling city or a suburban neighborhood, the choice between renting and buying can significantly impact your long-term financial stability and quality of life.

Our discussion will cover various aspects, including market trends, economic factors, lifestyle considerations, and expert advice from financial planners and real estate professionals. By the end of this article, you'll have a clearer understanding of which option might be best for you.

Read also:Darth Talon R34 A Comprehensive Guide To The Iconic Sith Warrior

Table of Contents

- Rent vs Buy Overview

- Financial Aspects of Renting vs Buying

- Market Trends Impacting Rent vs Buy Decisions

- Lifestyle Considerations

- Long-Term Investment Perspective

- Tax Implications

- Emotional Factors in Rent vs Buy Decisions

- Case Studies from NYT Articles

- Expert Advice from Real Estate Professionals

- Conclusion and Final Thoughts

Rent vs Buy Overview

When it comes to the decision of whether to rent or buy, there are several factors to consider. The New York Times has frequently covered this topic, highlighting the pros and cons of each option. Renting offers flexibility and lower upfront costs, while buying can provide long-term financial benefits and stability.

Key Factors Influencing the Decision

Several key factors play a role in determining whether renting or buying is the right choice for you. These include:

- Financial stability

- Market conditions

- Lifestyle preferences

- Long-term goals

Financial Aspects of Renting vs Buying

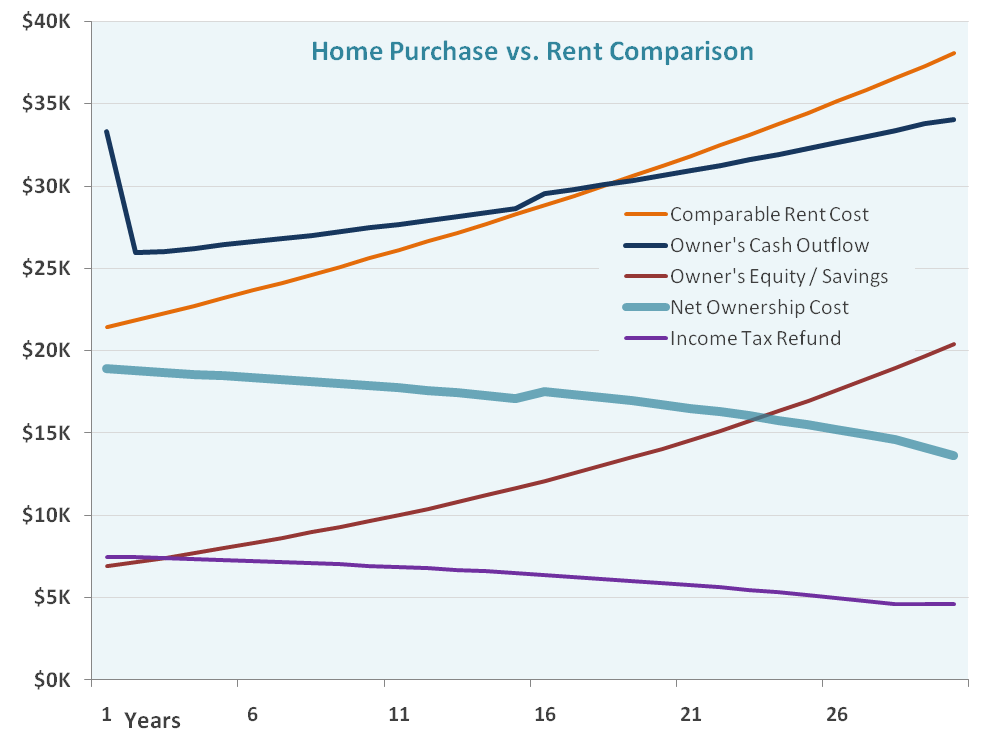

Understanding the financial implications of renting versus buying is crucial. The cost of renting can vary significantly depending on location, while buying involves additional expenses such as down payments, closing costs, and property taxes.

Initial Costs

When buying a home, you typically need a down payment, which can range from 3% to 20% of the home's value. Additionally, there are closing costs, which can add up to 2-5% of the purchase price. Renting, on the other hand, usually requires a security deposit and the first month's rent, making it a more affordable option upfront.

Market Trends Impacting Rent vs Buy Decisions

Market trends can significantly influence the decision to rent or buy. In recent years, The New York Times has reported on shifts in housing markets, particularly in urban areas where rental prices have increased while home prices have stabilized or even decreased.

Urban vs Suburban Markets

Urban markets often see higher rental prices due to demand, while suburban areas may offer more affordable homebuying opportunities. Understanding these trends can help you make a more informed decision.

Read also:Maxxx Kpkuang The Ultimate Guide To His Life Career And Legacy

Lifestyle Considerations

Your lifestyle plays a crucial role in the rent vs buy decision. Factors such as mobility, family size, and career stability can all impact which option is best for you.

Flexibility vs Stability

Renting offers greater flexibility, allowing you to move more easily if your circumstances change. Buying, however, provides stability and a sense of permanence, which can be important for families or those planning to stay in one place long-term.

Long-Term Investment Perspective

From an investment perspective, buying a home can be a wise decision. Over time, property values tend to appreciate, providing potential financial gains. However, market fluctuations and maintenance costs must also be considered.

Appreciation and Depreciation

While homes generally appreciate in value, there are instances where they can depreciate, particularly in declining markets. Understanding these risks is essential when evaluating the long-term investment potential of homeownership.

Tax Implications

Taxes play a significant role in the rent vs buy decision. Homeowners can benefit from tax deductions on mortgage interest and property taxes, which can reduce their overall tax liability.

Mortgage Interest Deduction

The mortgage interest deduction allows homeowners to deduct the interest paid on their mortgage from their taxable income, potentially saving thousands of dollars each year.

Emotional Factors in Rent vs Buy Decisions

Emotional factors should not be overlooked when deciding between renting and buying. The sense of pride and accomplishment that comes with homeownership can be a powerful motivator for many people.

Homeownership as a Dream

For many, owning a home is part of the American dream. It represents stability, independence, and a place to call your own. These emotional factors can influence the decision to buy, even if the financial aspects are less favorable.

Case Studies from NYT Articles

The New York Times has published numerous case studies exploring the rent vs buy dilemma. These stories often highlight real-life scenarios where individuals weigh the pros and cons of each option.

Urban Renters vs Suburban Buyers

One notable case study involves a young professional couple living in New York City. They faced the decision of whether to continue renting in the city or buy a home in the suburbs. Their story illustrates the trade-offs involved in such a decision.

Expert Advice from Real Estate Professionals

Real estate professionals offer valuable insights into the rent vs buy decision. Their expertise can help you navigate the complexities of the housing market and make an informed choice.

Tips for First-Time Buyers

For first-time buyers, real estate professionals recommend starting with a thorough financial assessment. Understanding your budget, credit score, and long-term goals is essential before entering the housing market.

Conclusion and Final Thoughts

In conclusion, the decision to rent or buy depends on a variety of factors, including financial stability, market conditions, lifestyle preferences, and long-term goals. The New York Times has provided valuable insights into this debate, helping readers make informed decisions.

We encourage you to consider all aspects before making your choice. Whether you decide to rent or buy, ensure it aligns with your financial and personal goals. Please share your thoughts and experiences in the comments below, and don't forget to explore other articles on our site for more insights into real estate and personal finance.