Deciding whether to rent or buy a home is one of the most significant financial choices you’ll ever make. The New York Times Rent vs Buy Calculator has emerged as an indispensable tool for those navigating this complex decision. This calculator not only simplifies the process but also provides personalized insights based on your unique financial situation. Whether you're a first-time homebuyer or someone reconsidering their living arrangements, understanding how this tool works can be transformative.

The Rent vs Buy Calculator NYTimes is more than just a financial calculator; it’s a decision-making companion. By factoring in variables such as property prices, mortgage rates, rental costs, and potential appreciation, it offers a comprehensive view of the long-term financial implications of renting versus buying. In an era where housing markets are volatile and economic uncertainties loom large, having access to such a resource can make all the difference.

As we delve deeper into this topic, we’ll explore how the calculator works, its key features, and how you can leverage it to make informed decisions. By the end of this guide, you’ll have a clear understanding of whether renting or buying aligns better with your financial goals and lifestyle. Let’s get started!

Read also:Rob Lowe Height Unveiling The True Measure Of A Hollywood Icon

Table of Contents

- Introduction to Rent vs Buy Calculator NYTimes

- How the Rent vs Buy Calculator Works

- Key Features of the Calculator

- Benefits of Using the Rent vs Buy Calculator NYTimes

- Common Questions About Renting vs Buying

- Financial Considerations When Renting or Buying

- Assessing the Accuracy of the Calculator

- Real-Life Examples Using the Calculator

- Expert Opinions on Rent vs Buy

- Conclusion: Making the Right Choice

Introduction to Rent vs Buy Calculator NYTimes

Understanding the Calculator's Purpose

The Rent vs Buy Calculator NYTimes is designed to help individuals weigh the financial pros and cons of renting versus buying a home. It considers a wide range of factors, including upfront costs, ongoing expenses, and long-term financial benefits. This makes it an invaluable resource for anyone trying to navigate the complexities of the housing market.

One of the standout features of the calculator is its ability to provide personalized results. By inputting specific data points like location, property value, and expected rent increases, users can gain a clearer picture of their financial future. Whether you’re in a bustling city or a quiet suburban neighborhood, the calculator adapts to your circumstances.

Why Choose the NYTimes Calculator?

Among the many rent vs buy calculators available online, the NYTimes version stands out for its transparency and depth of analysis. It doesn’t just compare monthly costs; it also considers long-term financial implications, such as equity accumulation and tax benefits. This holistic approach ensures that users make decisions based on a complete understanding of their financial landscape.

How the Rent vs Buy Calculator Works

Step-by-Step Guide to Using the Calculator

Using the Rent vs Buy Calculator NYTimes is straightforward. Here’s a step-by-step guide:

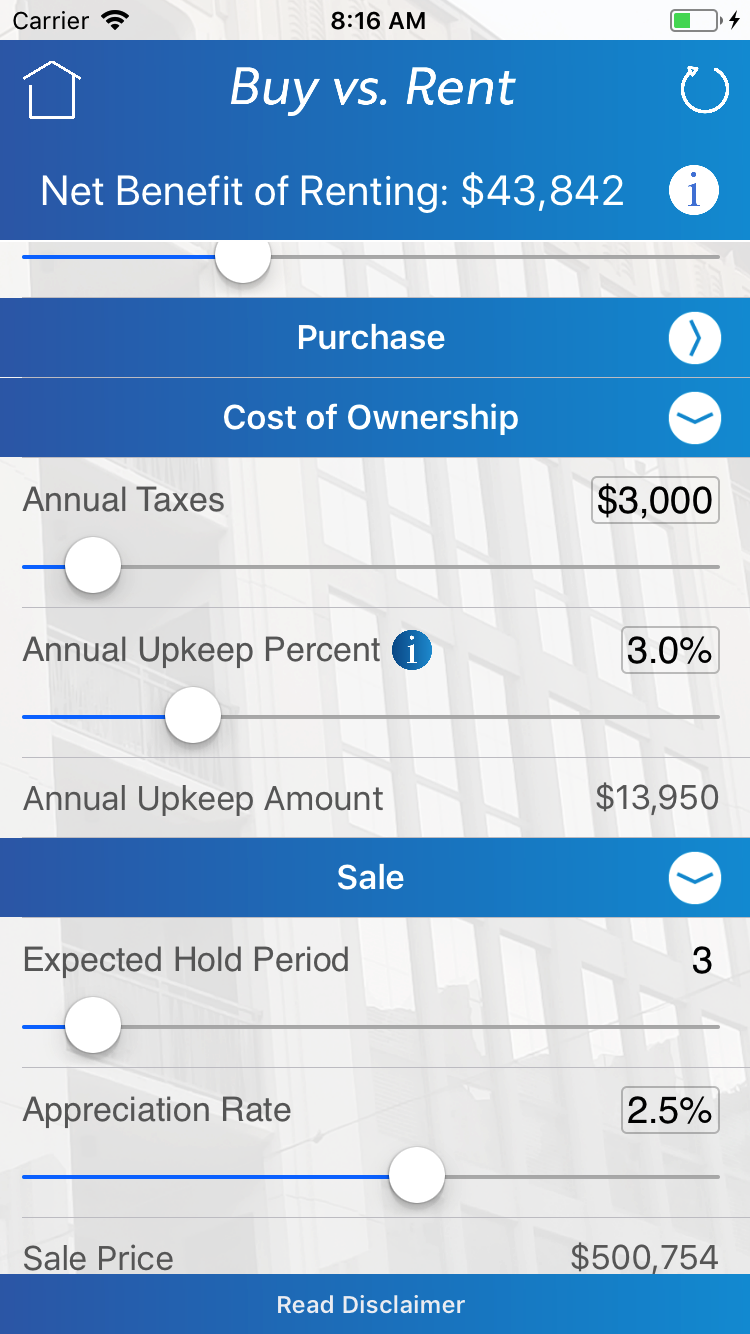

- Input the purchase price of the home you’re considering.

- Enter the estimated annual property taxes and insurance costs.

- Provide details about the mortgage, including interest rate and loan term.

- Estimate the annual rent for a comparable property in your area.

- Set assumptions for home price appreciation, rent increases, and investment returns.

- Review the results, which include a detailed breakdown of costs and potential savings.

This process ensures that users have a comprehensive understanding of the financial implications of their decision.

Key Features of the Calculator

Advanced Financial Modeling

The calculator uses advanced financial modeling to project costs over time. It considers factors such as inflation, market trends, and personal financial goals. This level of detail sets it apart from simpler calculators that only compare monthly payments.

Read also:Tanea Wallace Age Unveiling The Life And Achievements Of A Rising Star

Customizable Assumptions

One of the most powerful features of the calculator is its ability to allow users to customize assumptions. For example, you can adjust the expected rate of home price appreciation or the annual increase in rent. This flexibility ensures that the results are tailored to your specific situation.

Benefits of Using the Rent vs Buy Calculator NYTimes

Clarity in Decision-Making

The primary benefit of using the Rent vs Buy Calculator NYTimes is the clarity it provides. By presenting complex financial data in an easy-to-understand format, it empowers users to make informed decisions. Whether you’re trying to decide between renting a two-bedroom apartment or buying a starter home, the calculator can guide you toward the best option.

Long-Term Financial Planning

Another significant advantage is its focus on long-term financial planning. Unlike short-term solutions, the calculator considers how your decision will impact your finances over the next 5, 10, or even 30 years. This makes it an essential tool for anyone serious about building wealth and securing their financial future.

Common Questions About Renting vs Buying

Is Buying Always Better Than Renting?

Not necessarily. While buying a home can offer long-term financial benefits, such as equity accumulation and potential appreciation, it also comes with significant upfront costs and responsibilities. Renting, on the other hand, provides flexibility and freedom from maintenance costs. The Rent vs Buy Calculator NYTimes helps you weigh these factors and determine which option is right for you.

What Factors Should I Consider?

When deciding between renting and buying, consider factors such as:

- Current and projected housing market trends

- Personal financial situation, including savings and debt

- Long-term career and lifestyle plans

- Desire for stability versus flexibility

Each of these factors plays a crucial role in determining the best choice for your unique circumstances.

Financial Considerations When Renting or Buying

Upfront Costs

One of the most significant differences between renting and buying is the upfront costs. Buying a home typically requires a down payment, closing costs, and other fees, which can be substantial. Renting, on the other hand, usually only requires a security deposit and the first month’s rent. The Rent vs Buy Calculator NYTimes helps you compare these costs and assess their impact on your budget.

Ongoing Expenses

Both renting and buying come with ongoing expenses, but they differ significantly. Renters typically pay a fixed monthly rent, while homeowners must account for mortgage payments, property taxes, insurance, and maintenance costs. The calculator provides a detailed breakdown of these expenses, helping you understand the full financial picture.

Assessing the Accuracy of the Calculator

Limitations and Assumptions

While the Rent vs Buy Calculator NYTimes is highly accurate, it’s important to recognize its limitations. The results are based on assumptions about future market conditions, which can vary widely. Additionally, the calculator doesn’t account for subjective factors like emotional attachment to a home or personal preferences. However, it remains a reliable tool for making data-driven decisions.

Comparing with Other Calculators

Many other rent vs buy calculators exist online, but few match the depth and transparency of the NYTimes version. By comparing results from different calculators, you can gain a broader perspective on your options. However, the NYTimes calculator’s emphasis on long-term financial planning makes it a standout choice for serious decision-makers.

Real-Life Examples Using the Calculator

Case Study 1: Urban Professional

Meet Sarah, a 30-year-old marketing professional living in New York City. She’s considering whether to buy a one-bedroom condo or continue renting. By using the Rent vs Buy Calculator NYTimes, Sarah discovers that buying would save her $50,000 over 10 years, despite higher upfront costs. This revelation convinces her to pursue homeownership.

Case Study 2: Young Family

John and Emily, a young couple with two children, are debating whether to buy a suburban home or rent a townhouse. After running the numbers through the calculator, they find that buying offers better long-term value, even with higher maintenance costs. This insight helps them secure a mortgage and start building equity.

Expert Opinions on Rent vs Buy

What Economists Say

According to renowned economist Robert Shiller, “The decision to rent or buy depends on a complex interplay of economic factors and personal preferences.” He emphasizes the importance of using tools like the Rent vs Buy Calculator NYTimes to navigate this complexity. Shiller’s research highlights the role of market trends and individual circumstances in shaping the best choice.

Real Estate Experts Weigh In

Real estate experts agree that the calculator is an invaluable resource for homebuyers and renters alike. They appreciate its ability to provide personalized insights and encourage users to consider both short-term and long-term financial implications. As one expert noted, “It’s not just about the numbers; it’s about making the right choice for your life.”

Conclusion: Making the Right Choice

In conclusion, the Rent vs Buy Calculator NYTimes is an indispensable tool for anyone facing the rent vs buy dilemma. By offering personalized insights and comprehensive financial analysis, it empowers users to make informed decisions. Whether you choose to rent or buy, the calculator provides the clarity and confidence needed to secure your financial future.

We encourage you to explore the calculator further and share your experiences with others. By doing so, you can contribute to a broader understanding of the complexities involved in this important decision. And remember, the right choice is the one that aligns with your financial goals and lifestyle aspirations.

Don’t forget to leave a comment or share this article with others who might benefit from it. Together, we can create a community of informed decision-makers navigating the complexities of the housing market.