Buying or renting a home is one of the most significant financial decisions you’ll ever make. Whether you’re a first-time homebuyer or considering a lifestyle change, understanding the pros and cons of renting versus buying is essential. The New York Times (NYT) has long been a trusted source for financial advice, and their insights into the rent vs. buy debate provide a solid foundation for making an informed choice.

Choosing between renting and buying a home involves evaluating personal circumstances, financial goals, and market conditions. While renting offers flexibility and lower upfront costs, buying a home can be a long-term investment that builds equity and provides stability. This guide will explore the nuances of the rent vs. buy decision, helping you weigh the options effectively.

This article dives deep into the factors influencing the rent vs. buy decision, drawing on insights from credible sources like the NYT, real estate experts, and financial advisors. By the end of this guide, you’ll have a clearer understanding of which option aligns best with your financial situation and lifestyle preferences.

Read also:Walmart Intercom Code Your Ultimate Guide To Understanding And Using It

Table of Contents

- Overview of Rent vs Buy

- Cost Comparison: Renting vs Buying

- Financial Considerations

- Long-Term Benefits of Buying

- Flexibility of Renting

- Impact of Market Conditions

- Personal Factors to Consider

- Tax Implications

- Emotional Considerations

- Final Recommendations

Overview of Rent vs Buy

The rent vs buy dilemma has been a topic of discussion for decades, with opinions often divided based on individual circumstances and economic conditions. According to the NYT, the decision should be based on a combination of financial analysis, lifestyle preferences, and market trends.

Why Renting Might Be the Right Choice

Renting offers several advantages, particularly for individuals who value flexibility and are unsure about long-term commitments. Some key reasons to consider renting include:

- No responsibility for property maintenance

- Lower upfront costs compared to buying

- Ability to relocate easily for career or personal reasons

Why Buying Might Be the Right Choice

Buying a home can be a sound financial investment, especially in markets with strong appreciation potential. Benefits of homeownership include:

- Building equity over time

- Potential tax benefits

- Stability and control over living environment

Cost Comparison: Renting vs Buying

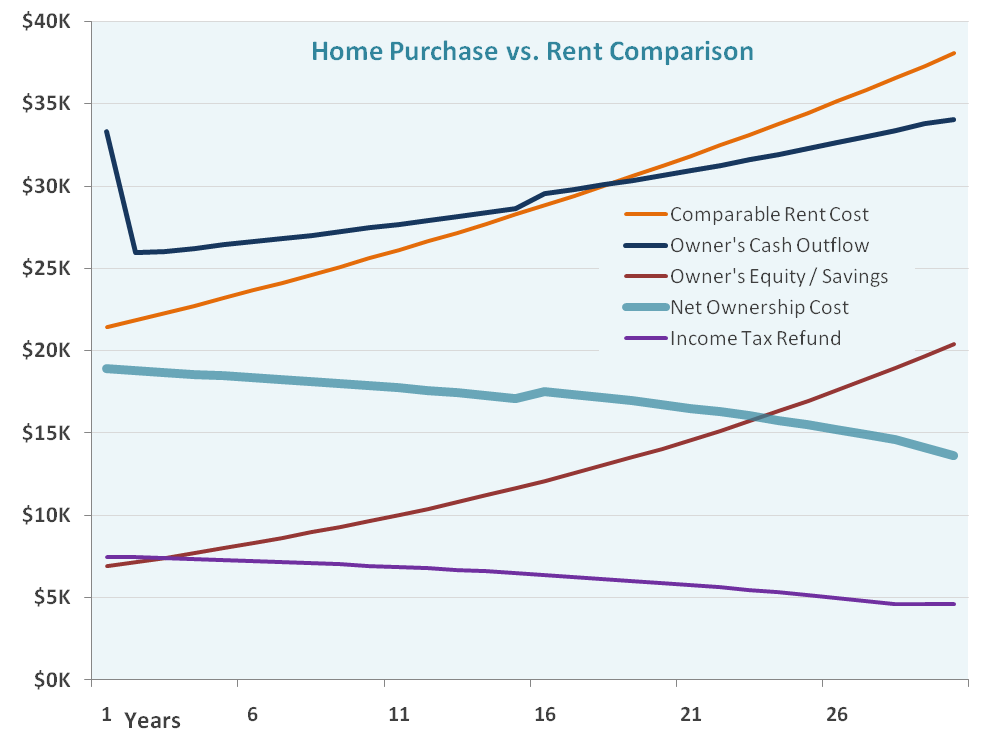

One of the primary considerations in the rent vs buy decision is cost. While renting typically involves lower monthly payments, buying may offer long-term financial advantages. Let’s break down the costs associated with each option.

Costs of Renting

Renting generally requires a security deposit and first month’s rent upfront, with ongoing monthly payments covering rent, utilities, and possibly renters insurance. According to a 2023 report by Zillow, the average rent for a two-bedroom apartment in the U.S. is approximately $2,000 per month.

Costs of Buying

Buying a home involves significant upfront costs, including a down payment, closing costs, and mortgage insurance. Monthly expenses include mortgage payments, property taxes, homeowners insurance, and maintenance costs. For example, a $400,000 home with a 20% down payment might result in a monthly mortgage payment of around $1,500, excluding taxes and insurance.

Read also:How Much Did Bethenny Frankel Sell Skinny Girl Cocktails For

Financial Considerations

When evaluating the rent vs buy decision, it’s crucial to consider your financial situation. Key factors to assess include:

- Income stability and job security

- Savings and ability to make a down payment

- Debt-to-income ratio and credit score

Financial experts recommend that your total housing costs (including mortgage, taxes, and insurance) do not exceed 28% of your gross monthly income. Additionally, having a solid emergency fund can help mitigate unexpected expenses associated with homeownership.

Long-Term Benefits of Buying

Buying a home can offer substantial long-term benefits, particularly in markets with strong appreciation potential. Over time, homeowners can build equity, which serves as a form of forced savings. According to the National Association of Realtors, the median existing-home price increased by 4.3% annually from 2012 to 2022.

Building Equity

As you pay down your mortgage and property values increase, you build equity in your home. This equity can be accessed through a home equity line of credit (HELOC) or used as a down payment on your next home.

Forced Savings

Mortgage payments act as a form of forced savings, as a portion of each payment goes toward reducing the principal balance. Over time, this can result in significant wealth accumulation.

Flexibility of Renting

Renting offers unparalleled flexibility, making it an attractive option for individuals who anticipate frequent moves or uncertain career paths. Renters are not responsible for property maintenance, which can be a significant advantage for those with busy lifestyles.

Relocation Ease

Renting allows you to relocate with minimal hassle, as lease agreements typically range from six months to one year. This flexibility is particularly beneficial for young professionals or individuals in transitional phases of life.

Impact of Market Conditions

Market conditions play a critical role in the rent vs buy decision. Factors such as interest rates, housing inventory, and economic trends can influence the affordability and feasibility of homeownership.

Interest Rates

Low interest rates can make homeownership more affordable, reducing monthly mortgage payments. Conversely, rising interest rates can increase borrowing costs, making renting a more attractive option in the short term.

Housing Inventory

In markets with limited housing inventory, competition among buyers can drive up prices, making renting a more cost-effective option. Conversely, buyer-friendly markets with ample inventory may offer opportunities for affordable homeownership.

Personal Factors to Consider

While financial considerations are crucial, personal factors such as lifestyle preferences and family needs should also be taken into account. Homeownership may be ideal for families seeking stability, while renting may better suit individuals who value mobility and minimal maintenance responsibilities.

Lifestyle Preferences

Consider whether you prioritize control over your living space or value the convenience of having a landlord handle repairs. Homeowners have the freedom to customize their homes, while renters benefit from reduced maintenance obligations.

Tax Implications

Homeownership offers potential tax benefits, including deductions for mortgage interest and property taxes. However, these benefits should be weighed against the overall financial implications of buying versus renting.

Mortgage Interest Deduction

The mortgage interest deduction allows homeowners to deduct the interest paid on their mortgage from their taxable income. This benefit can significantly reduce the cost of homeownership, particularly in the early years of a mortgage when interest payments are highest.

Emotional Considerations

Emotional factors, such as the desire for stability and pride of ownership, should not be overlooked in the rent vs buy decision. Homeownership can provide a sense of accomplishment and security, while renting may offer peace of mind in uncertain economic times.

Pride of Ownership

Many people derive satisfaction from owning their own home, viewing it as a symbol of success and stability. However, it’s important to balance emotional considerations with practical financial analysis.

Final Recommendations

In conclusion, the rent vs buy decision requires careful consideration of financial, personal, and market factors. While renting offers flexibility and reduced upfront costs, buying a home can be a sound long-term investment with potential tax benefits and equity accumulation.

Before making a decision, consult with a financial advisor or real estate professional to evaluate your unique circumstances. Additionally, consider using tools like the NYT’s rent vs buy calculator to compare the costs and benefits of each option.

We encourage you to share your thoughts and experiences in the comments below. If you found this guide helpful, please consider sharing it with others who may benefit from the information. For more insights on personal finance and real estate, explore our other articles on the site.