Buying or renting a home is one of the most significant financial decisions you will ever make. The New York Times (NYTimes) has consistently provided valuable insights into the housing market, helping millions of readers weigh the pros and cons of each option. Whether you're a first-time homebuyer or a seasoned renter, understanding the nuances of buying versus renting can shape your financial future.

In this article, we will explore the key factors that influence the buy vs rent debate, backed by expert analysis from NYTimes and other trusted sources. You'll learn about the financial implications, lifestyle considerations, and long-term benefits of each option, enabling you to make an informed decision.

By the end of this guide, you'll have a clear understanding of whether buying or renting aligns with your personal and financial goals. Let's dive into the details and uncover the answers to your most pressing questions.

Read also:Pop Melodie R34 Unveiling The Iconic Music Sensation

Table of Contents

- Introduction to Buy vs Rent NYTimes

- Financial Analysis of Buying vs Renting

- Lifestyle Considerations

- Long-Term Investment Potential

- Market Trends Influencing Buy vs Rent

- Tax Implications of Buying vs Renting

- Emotional Factors to Consider

- Case Studies: Real-Life Examples

- Expert Advice from NYTimes

- Conclusion and Call to Action

Introduction to Buy vs Rent NYTimes

Why the Debate Matters

The buy vs rent NYTimes debate has been a hot topic for decades, especially in the wake of economic changes, housing market fluctuations, and shifting societal values. NYTimes has covered this topic extensively, offering readers a balanced perspective on the financial and emotional aspects of homeownership.

With the rise of remote work and changing urban dynamics, the decision to buy or rent has become even more complex. Understanding the nuances of each option can help you align your housing choice with your long-term goals.

Financial Analysis of Buying vs Renting

Cost Comparison

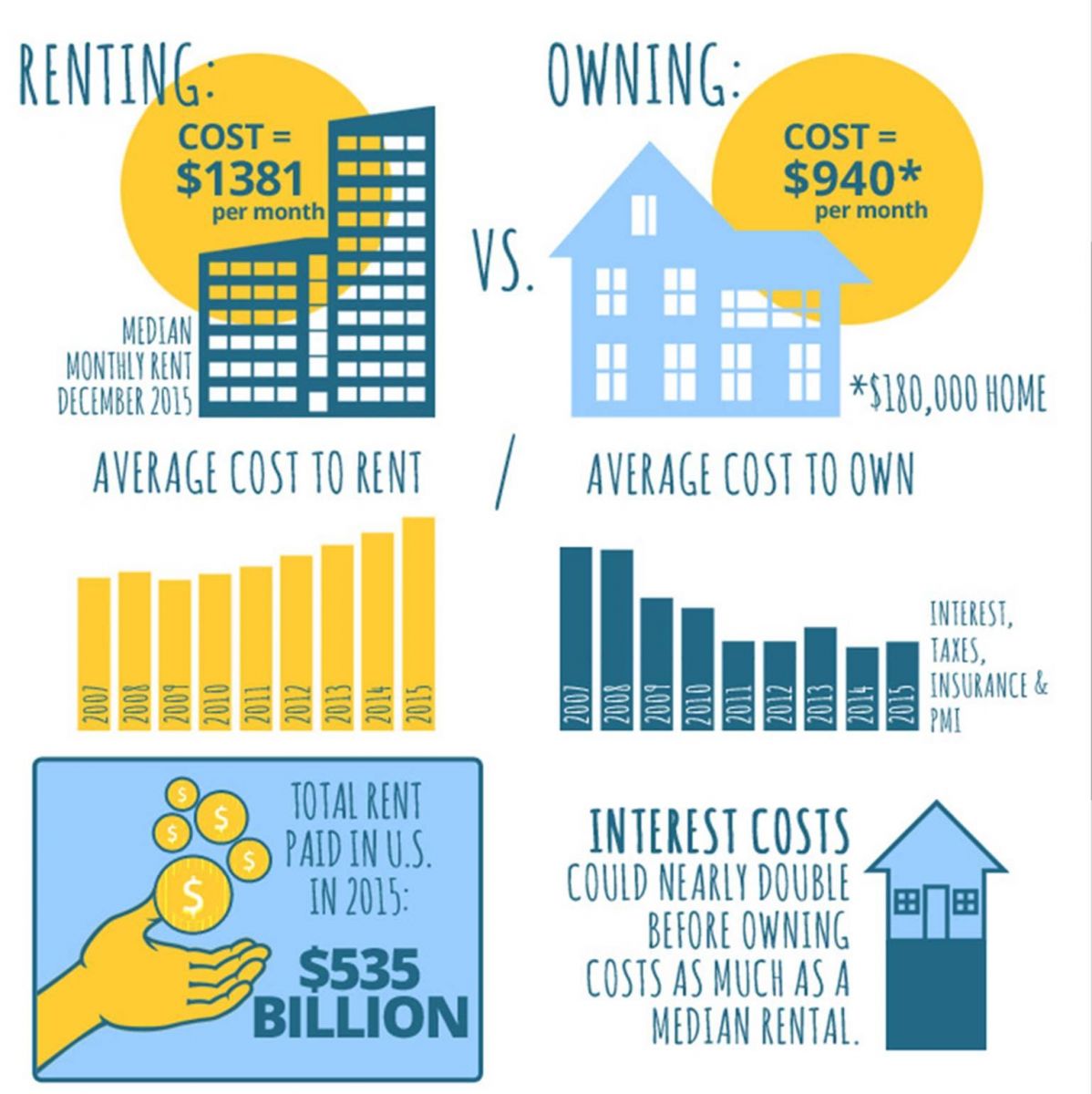

When evaluating whether to buy or rent, cost is often the primary consideration. According to NYTimes, the financial analysis involves comparing monthly payments, down payments, maintenance costs, and potential appreciation.

Key Factors to Consider:

- Down payment requirements

- Monthly mortgage payments vs rental costs

- Maintenance and repair expenses

- Property taxes and insurance

- Potential home value appreciation

Data from the National Association of Realtors (NAR) shows that while rental costs have increased by 5% annually over the past decade, home prices have appreciated by an average of 4% annually.

Lifestyle Considerations

Flexibility vs Stability

Renting offers greater flexibility, allowing individuals to move more easily and adapt to changing circumstances. On the other hand, buying provides stability and a sense of permanence, which can be appealing for families or those planning to stay in one location for an extended period.

Read also:Art Listings On Tawartlist Your Ultimate Guide To Discovering And Selling Art

Questions to Ask Yourself:

- How long do I plan to stay in this location?

- Do I value flexibility over stability?

- Am I prepared for the responsibilities of homeownership?

Long-Term Investment Potential

Building Equity

One of the primary advantages of buying a home is the opportunity to build equity over time. As you pay down your mortgage and the property appreciates in value, your net worth increases. NYTimes reports that homeownership can be a powerful wealth-building tool, especially in markets with strong appreciation potential.

Factors Influencing Equity Growth:

- Market conditions

- Property maintenance

- Location

Market Trends Influencing Buy vs Rent

Current Housing Market Dynamics

The housing market is constantly evolving, influenced by factors such as interest rates, economic conditions, and demographic shifts. NYTimes has highlighted several trends that impact the buy vs rent decision, including the rise of urbanization, the affordability crisis, and the growing popularity of suburban living.

According to a report by Freddie Mac, mortgage rates have remained historically low, making buying more attractive for many consumers. However, rental demand has also surged, particularly in major metropolitan areas.

Tax Implications of Buying vs Renting

Homeownership Tax Benefits

Buying a home comes with several tax advantages, including deductions for mortgage interest and property taxes. NYTimes advises readers to consult with a tax professional to fully understand the implications of homeownership on their tax liability.

Key Tax Considerations:

- Mortgage interest deduction

- Property tax deductions

- Capital gains exclusion

Emotional Factors to Consider

The Psychology of Homeownership

Beyond the financial aspects, the decision to buy or rent is often influenced by emotional factors. Owning a home can provide a sense of pride and accomplishment, while renting may offer greater freedom and less stress. NYTimes emphasizes the importance of considering your personal values and lifestyle when making this decision.

Emotional Benefits of Homeownership:

- Sense of pride and accomplishment

- Control over living space

- Long-term stability

Case Studies: Real-Life Examples

Success Stories from NYTimes

NYTimes has featured numerous case studies highlighting the experiences of individuals who have navigated the buy vs rent decision. One such story involves a young couple in New York City who opted to buy a condo despite rising prices, ultimately benefiting from significant appreciation. Another case study showcases a family who chose to rent due to job uncertainty, allowing them to relocate without the burden of selling a home.

Expert Advice from NYTimes

Insights from Real Estate Experts

NYTimes regularly consults with real estate experts to provide readers with the latest insights and advice. These experts emphasize the importance of conducting thorough research, considering both short-term and long-term goals, and understanding the local market dynamics.

Top Tips from NYTimes Experts:

- Assess your financial readiness

- Research local market conditions

- Consider both financial and emotional factors

Conclusion and Call to Action

In conclusion, the buy vs rent NYTimes debate is complex and multifaceted, requiring careful consideration of financial, lifestyle, and emotional factors. By understanding the key differences between buying and renting, you can make a decision that aligns with your personal and financial goals.

We encourage you to leave a comment below sharing your thoughts on this topic. Have you faced the buy vs rent dilemma? What factors influenced your decision? Additionally, feel free to explore other articles on our site for more valuable insights into the housing market and personal finance.