Michigan tax rate is a critical consideration for residents, businesses, and anyone planning to relocate to the state. Understanding how taxes are structured can significantly impact financial planning and decision-making. Whether you're dealing with income tax, sales tax, or property tax, having a clear grasp of these rates will help you avoid unexpected expenses.

Taxes play a pivotal role in funding public services, infrastructure, and government operations. In Michigan, the tax system is designed to balance revenue collection with taxpayer fairness. This article will delve into the intricacies of Michigan's tax rates, offering insights into how they affect individuals and businesses alike.

By exploring various aspects of Michigan's tax structure, we aim to provide a clear and actionable guide for navigating the state's fiscal landscape. Whether you're a taxpayer seeking clarity or a business owner analyzing costs, this guide will equip you with the knowledge to make informed decisions.

Read also:Exploring Deva Cassels Eye Color A Comprehensive Guide

Table of Contents

- Introduction to Michigan Tax

- Income Tax Overview

- Sales and Use Tax

- Property Tax Details

- Business Tax Considerations

- Tax Exemptions and Credits

- Filing Taxes in Michigan

- Recent Tax Updates

- Michigan Tax Resources

- Conclusion and Next Steps

Introduction to Michigan Tax

Understanding the Michigan tax rate begins with recognizing the state's commitment to fiscal responsibility and equitable taxation. Michigan implements a flat-rate income tax, a fixed sales tax, and a localized property tax system. Each of these components contributes to the state's revenue and supports essential services.

Key Components of Michigan Tax

The primary tax categories in Michigan include:

- Income Tax: A flat rate applied to all taxpayers

- Sales Tax: A fixed percentage charged on most goods and services

- Property Tax: Assessed based on property value and local millage rates

These taxes collectively ensure that the state can fund education, infrastructure, healthcare, and public safety initiatives.

Income Tax Overview

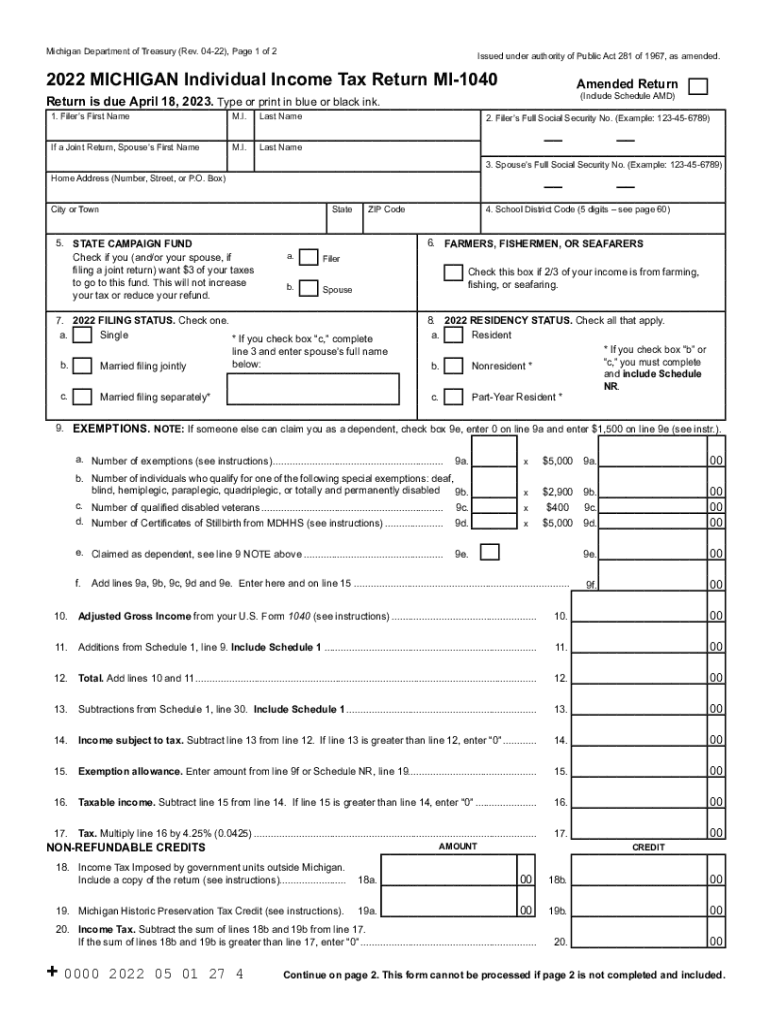

Michigan imposes a flat income tax rate of 4.25% on individuals and businesses. This simplicity sets it apart from states with progressive tax brackets. The flat rate ensures that all taxpayers contribute equally, relative to their income.

Who Pays Michigan Income Tax?

All residents and non-residents earning income within Michigan are subject to the state's income tax. This includes wages, salaries, tips, and other forms of taxable income. Business entities, such as corporations and partnerships, also pay the same flat rate on their net income.

For example, if an individual earns $50,000 annually, their Michigan income tax liability would be $2,125 ($50,000 x 4.25%).

Read also:Christoph Sanders Partner A Comprehensive Guide To His Life Career And Impact

Sales and Use Tax

The Michigan sales tax rate is set at 6%. This applies to most retail transactions, including tangible goods and certain services. However, some items, such as groceries and prescription medications, are exempt from sales tax.

Key Points About Sales Tax

- 6% state sales tax rate

- Exemptions for essential goods like food and medicine

- Local jurisdictions cannot impose additional sales taxes

Businesses collecting sales tax must remit these funds to the Michigan Department of Treasury. Failure to comply can result in penalties and interest charges.

Property Tax Details

Property taxes in Michigan are assessed based on the taxable value of a property and local millage rates. The taxable value is typically lower than the market value and is capped at the rate of inflation or 5%, whichever is less. Millage rates vary by locality, with some areas imposing additional millage for schools or infrastructure projects.

Calculating Property Tax

To calculate property tax, multiply the taxable value by the millage rate and divide by 1,000. For instance, if a property has a taxable value of $100,000 and the millage rate is 20, the annual property tax would be $2,000 ($100,000 x 20 ÷ 1,000).

Homeowners may qualify for exemptions or reductions, such as the Homestead Property Tax Credit, which offsets a portion of the tax burden for primary residences.

Business Tax Considerations

Businesses operating in Michigan must adhere to specific tax obligations, including income tax, sales tax, and other applicable levies. The state's flat 4.25% income tax rate applies to corporations, partnerships, and sole proprietorships.

Additional Business Taxes

Depending on the nature of the business, additional taxes may apply, such as:

- Corporate Franchise Tax

- Unemployment Insurance Tax

- Environmental Response Taxes

Businesses should consult with a tax professional to ensure compliance with all state and local regulations.

Tax Exemptions and Credits

Michigan offers various exemptions and credits to alleviate the tax burden on eligible individuals and businesses. These programs aim to promote economic growth, support low-income families, and encourage sustainable practices.

Popular Tax Credits

- Homestead Property Tax Credit

- Childcare Credit

- Renewable Energy Credits

Eligibility requirements vary by program, so it's essential to review the specific criteria for each credit or exemption.

Filing Taxes in Michigan

Taxpayers in Michigan must file their state income tax returns by April 15th each year. Extensions are available upon request, but any outstanding taxes must still be paid by the deadline to avoid penalties.

Methods for Filing Taxes

Taxpayers can file their Michigan income tax returns through:

- Online filing via the Michigan Department of Treasury website

- Paper filing by mailing completed forms

- Third-party tax preparation services

Using electronic filing methods often expedites the refund process and reduces the likelihood of errors.

Recent Tax Updates

Mitchigan's tax landscape evolves to address changing economic conditions and legislative priorities. Recent updates include adjustments to income tax brackets, modifications to property tax exemptions, and new initiatives to support small businesses.

Key Updates in 2023

- Increased Homestead Property Tax Credit limits

- New incentives for renewable energy investments

- Expanded eligibility for childcare credits

Staying informed about these updates ensures that taxpayers can maximize their benefits and comply with current regulations.

Michigan Tax Resources

Accessing reliable resources is crucial for navigating Michigan's tax system. The Michigan Department of Treasury provides comprehensive guides, forms, and calculators to assist taxpayers. Additionally, local tax offices and certified professionals can offer personalized guidance.

Recommended Resources

- Michigan Department of Treasury Website

- IRS Publication 519: U.S. Tax Guide for Aliens

- Local Tax Preparation Services

Utilizing these resources can simplify the tax filing process and help taxpayers avoid common mistakes.

Conclusion and Next Steps

In conclusion, understanding Michigan tax rate and its implications is vital for financial planning and compliance. From the flat income tax rate to the fixed sales tax and localized property tax, each component plays a role in shaping the state's fiscal environment. By leveraging available exemptions, credits, and resources, taxpayers can optimize their financial strategies.

We encourage readers to take the following actions:

- Review your tax obligations and explore available credits

- Consult with a tax professional for personalized advice

- Stay updated on legislative changes affecting Michigan taxes

Feel free to share this article with others who may benefit from its insights. Your feedback and questions are also welcome in the comments section below. Together, we can build a community of informed taxpayers navigating Michigan's fiscal landscape successfully.