Deciding whether to rent or buy a home is one of the most critical financial decisions you'll ever make. The New York Times Rent vs Buy Calculator offers an invaluable tool that simplifies this complex decision-making process. By analyzing factors such as home prices, mortgage rates, and living costs, this calculator helps you understand the financial implications of both options.

In today's dynamic real estate market, understanding the true cost of renting versus buying is essential. Many people assume that buying is always the better financial decision, but this isn't always the case. The NYT Rent vs Buy Calculator provides personalized insights based on your unique circumstances, helping you make an informed choice.

Whether you're a young professional starting your career, a growing family looking for stability, or someone planning for retirement, this guide will walk you through the features and benefits of the Rent vs Buy Calculator. We'll explore how it works, the factors it considers, and how you can use it effectively to plan your future.

Read also:Chelsea Sik Unveiling The Age Biography And Achievements

Table of Contents

Introduction to Rent vs Buy Calculator NYT

How the Rent vs Buy Calculator Works

Advantages of Using the Calculator

Read also:Jr Ridinger Death A Comprehensive Look Into The Life Impact And Legacy

Features of the Rent vs Buy Calculator

Real-Life Examples and Case Studies

Expert Advice and Recommendations

Introduction to Rent vs Buy Calculator NYT

The New York Times Rent vs Buy Calculator is a powerful tool designed to help individuals and families evaluate the financial implications of renting versus buying a home. This calculator takes into account various factors, including home prices, mortgage rates, property taxes, and maintenance costs, to provide a comprehensive analysis of both options.

One of the primary reasons why this calculator stands out is its ability to personalize results based on your specific financial situation. Whether you're planning to live in a particular location for a few years or considering a long-term commitment, the calculator adjusts its calculations accordingly. This flexibility makes it an essential tool for anyone navigating the complexities of the housing market.

Additionally, the calculator incorporates real-time data and market trends to ensure its projections are as accurate as possible. By leveraging this information, users can make more informed decisions that align with their financial goals and lifestyle preferences.

How the Rent vs Buy Calculator Works

Inputting Key Data

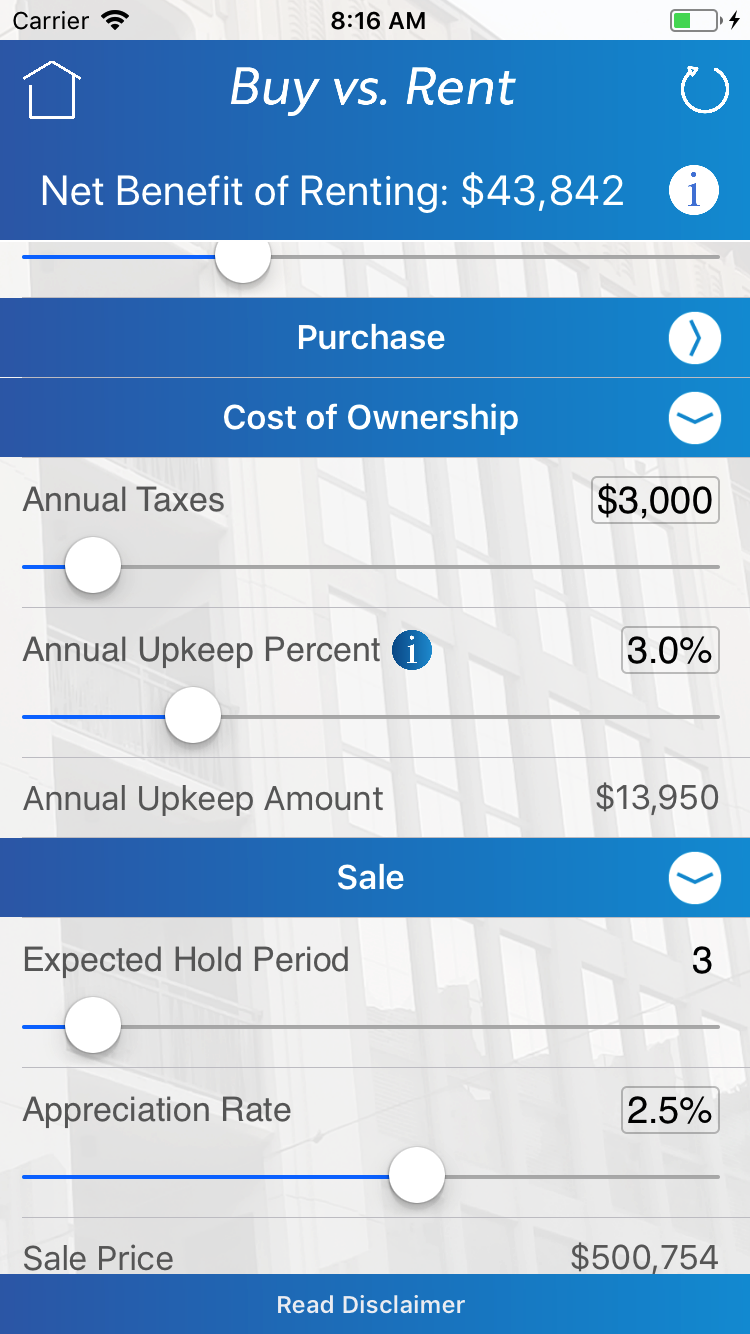

Using the Rent vs Buy Calculator is straightforward. You start by entering key information such as the purchase price of the home you're considering, the expected annual rent increase, and the down payment you plan to make. The calculator then uses this data to perform a detailed analysis of both options.

Calculating Costs

The calculator considers several costs associated with homeownership, including mortgage payments, property taxes, insurance, and maintenance expenses. On the rental side, it evaluates monthly rent payments and potential rent increases over time. By comparing these costs, the calculator provides a clear picture of which option is more financially advantageous.

Generating Results

Once you've entered all the necessary information, the calculator generates a detailed report outlining the total costs of renting versus buying over a specified period. This report includes graphs and charts that make it easy to visualize the differences between the two options. Users can then use this information to make an informed decision based on their unique circumstances.

Key Factors to Consider

Home Prices and Appreciation

One of the most significant factors to consider when using the Rent vs Buy Calculator is the expected appreciation of home prices. While historical data suggests that home values tend to increase over time, this isn't always the case. Local market conditions, economic factors, and other variables can impact home price trends, making it essential to analyze these factors carefully.

Mortgage Rates and Terms

Mortgage rates play a crucial role in determining the affordability of homeownership. The calculator allows users to input different mortgage terms and interest rates to see how these factors affect monthly payments and overall costs. Understanding how changes in mortgage rates impact your budget is essential for making an informed decision.

Property Taxes and Insurance

Property taxes and insurance are additional costs associated with homeownership that must be considered. These expenses can vary significantly depending on the location and value of the property. The calculator incorporates these costs into its analysis, providing a more accurate picture of the true cost of homeownership.

Advantages of Using the Calculator

Personalized Results

One of the primary advantages of the Rent vs Buy Calculator is its ability to provide personalized results. By entering specific data related to your financial situation and housing needs, you can receive customized recommendations tailored to your unique circumstances. This level of personalization makes it easier to make informed decisions that align with your goals.

Real-Time Data

The calculator uses real-time data to ensure its projections are as accurate as possible. This includes current mortgage rates, property tax rates, and other relevant information. By incorporating the latest data, the calculator helps users stay up-to-date with market trends and make more accurate predictions about future costs.

Comparative Analysis

Another advantage of the calculator is its ability to perform comparative analyses of renting versus buying. By comparing the total costs of both options over time, users can gain a better understanding of which option is more financially advantageous. This comparative approach helps eliminate guesswork and provides a clear path forward.

Cost Analysis and Comparison

Initial Costs

When considering the cost of buying a home, it's essential to account for initial expenses such as the down payment, closing costs, and moving fees. These costs can add up quickly and may require significant upfront investment. The calculator helps users estimate these costs and compare them to the initial expenses associated with renting.

Ongoing Expenses

In addition to initial costs, ongoing expenses such as mortgage payments, property taxes, and maintenance costs must be considered. The calculator provides a detailed breakdown of these expenses, allowing users to see how they compare to monthly rent payments. This information is invaluable for understanding the long-term financial implications of homeownership.

Long-Term Financial Impact

Finally, it's important to consider the long-term financial impact of renting versus buying. The calculator projects costs over a specified period, giving users a clear picture of how each option affects their financial future. By analyzing these projections, users can make decisions that align with their long-term goals and priorities.

Real Estate Market Trends

Current Market Conditions

Understanding current real estate market trends is essential for making informed decisions about renting versus buying. Factors such as supply and demand, interest rates, and economic conditions can significantly impact home prices and rental rates. The calculator incorporates this information to provide more accurate projections and recommendations.

Future Predictions

While predicting the future is impossible, analyzing historical data and current trends can help users make more informed decisions. The calculator uses this data to project future costs and provide insights into potential market changes. By staying informed about market trends, users can better prepare for the future and make decisions that align with their financial goals.

Regional Variations

Real estate markets can vary significantly from one region to another. Factors such as location, population growth, and local economic conditions can impact home prices and rental rates. The calculator accounts for these regional variations, providing users with a more accurate picture of the housing market in their specific area.

Features of the Rent vs Buy Calculator

User-Friendly Interface

The Rent vs Buy Calculator features a user-friendly interface that makes it easy for anyone to use. Its intuitive design allows users to input data quickly and efficiently, generating results in real-time. This simplicity ensures that even those with limited financial knowledge can benefit from its insights.

Comprehensive Analysis

One of the standout features of the calculator is its ability to perform a comprehensive analysis of both renting and buying options. By considering a wide range of factors, including home prices, mortgage rates, and ongoing expenses, the calculator provides a detailed comparison that helps users make informed decisions.

Customizable Scenarios

The calculator allows users to create customizable scenarios by adjusting various inputs such as home prices, mortgage terms, and expected rent increases. This flexibility enables users to explore different possibilities and see how changes in these factors impact their financial situation. By experimenting with different scenarios, users can gain a deeper understanding of the factors that influence their decision.

Common Mistakes to Avoid

Overlooking Hidden Costs

One of the most common mistakes people make when evaluating renting versus buying is overlooking hidden costs. These can include maintenance expenses, property taxes, and insurance premiums. The calculator helps users account for these costs, ensuring a more accurate comparison of both options.

Ignoring Long-Term Implications

Another mistake is focusing too much on short-term costs while ignoring long-term implications. While monthly rent payments may seem lower than mortgage payments, the long-term financial benefits of homeownership can outweigh these differences. The calculator projects costs over time, helping users understand the full picture.

Underestimating Market Volatility

Real estate markets can be volatile, with prices fluctuating due to economic conditions and other factors. Underestimating this volatility can lead to poor financial decisions. The calculator incorporates market data to provide more accurate projections and help users prepare for potential changes.

Real-Life Examples and Case Studies

Case Study 1: Urban Professional

Meet Sarah, a young professional living in a major city. She's considering whether to rent or buy a home and uses the Rent vs Buy Calculator to evaluate her options. After entering her data, she discovers that buying a home aligns better with her long-term financial goals, despite higher initial costs.

Case Study 2: Growing Family

The Johnson family is planning to expand and needs more space. They use the calculator to compare the costs of renting a larger apartment versus buying a home. The analysis reveals that homeownership offers significant long-term savings, making it the better choice for their situation.

Case Study 3: Retiree Planning

John, a retiree, is evaluating his housing options. Using the calculator, he determines that renting may be the better choice given his current financial situation and desire for flexibility. This decision allows him to maintain his lifestyle without the added burden of homeownership.

Expert Advice and Recommendations

Consulting Financial Advisors

While the Rent vs Buy Calculator is a valuable tool, consulting a financial advisor can provide additional insights and guidance. These professionals can help users navigate complex financial decisions and ensure their choices align with their overall financial plan.

Staying Informed

Staying informed about real estate market trends and economic conditions is essential for making sound financial decisions. Regularly reviewing data and projections can help users stay ahead of potential changes and make adjustments as needed.

Long-Term Planning

Finally, it's important to incorporate long-term planning into your decision-making process. Whether you choose to rent or buy, considering how this decision aligns with your future goals and aspirations is crucial. The calculator provides a solid foundation for this planning, helping you make choices that support your long-term success.

Conclusion and Final Thoughts

Deciding whether to rent or buy a home is a complex decision that requires careful consideration of various factors. The New York Times Rent vs Buy Calculator offers a powerful tool for simplifying this process, providing personalized insights and detailed analyses that help users make informed decisions.

By understanding the key factors to consider, leveraging the calculator's features, and avoiding common mistakes, you can make a choice that aligns with your financial goals and lifestyle preferences. We encourage you to explore the calculator further, experiment with different scenarios, and consult with financial professionals to ensure you're making the best decision for your future.

Don't forget to share your thoughts and experiences in the comments below. If you found this guide helpful, consider sharing it with others who may benefit from its insights. And be sure to check out our other articles for more valuable information on personal finance and real estate.