When it comes to choosing between renting and buying a home, the Rent vs Buy Calculator by The New York Times is an invaluable tool that simplifies the decision-making process. This calculator takes into account various factors such as property prices, interest rates, and living expenses to provide a clear financial analysis. Whether you're a first-time homebuyer or someone considering a lifestyle change, understanding the dynamics of renting versus buying is essential for long-term financial health.

The debate over whether to rent or buy has been ongoing for decades. Each option comes with its own set of advantages and disadvantages. Renting offers flexibility and fewer upfront costs, while buying can provide stability and potential long-term financial gains. However, the decision shouldn't be based solely on emotions or hearsay. It requires a thorough analysis of your financial situation and future goals.

This article will explore the Rent vs Buy Calculator from The New York Times in detail, helping you make an informed decision. We'll cover everything from how the calculator works to its key features, tips for maximizing its benefits, and insights into the factors that influence the decision. By the end of this guide, you'll have a comprehensive understanding of whether renting or buying is the right choice for you.

Read also:Noodlemagazine Your Ultimate Guide To Exploring Asian Cuisine And Culture

Table of Contents

- Introduction to Rent vs Buy Calculator

- How the Calculator Works

- Key Features of the Calculator

- Benefits of Using the Calculator

- Factors to Consider

- Rent vs Buy: A Comparative Analysis

- Long-Term Financial Impact

- Accuracy of the Calculator

- Common Mistakes to Avoid

- Conclusion and Call to Action

Introduction to Rent vs Buy Calculator

What is the Rent vs Buy Calculator?

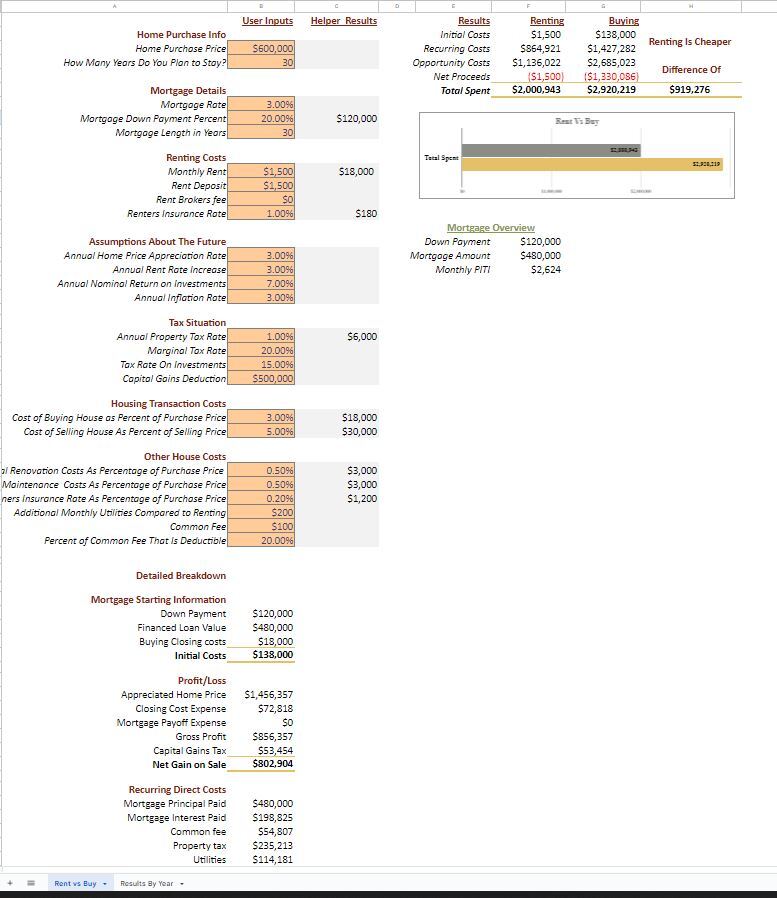

The Rent vs Buy Calculator is a powerful financial tool developed by The New York Times that helps users evaluate the financial implications of renting versus buying a home. By inputting specific details about your financial situation and preferences, the calculator generates a detailed comparison of the costs associated with each option over time.

This calculator is particularly useful for individuals who are at a crossroads in their housing decisions. It considers factors such as property prices, mortgage interest rates, tax implications, and inflation rates to provide a comprehensive analysis. Whether you're planning to settle down in a new city or looking to upgrade your current living situation, the Rent vs Buy Calculator can guide you through the complexities of homeownership versus renting.

How the Calculator Works

Step-by-Step Guide

Using the Rent vs Buy Calculator is straightforward. Here's how it works:

- Input Basic Information: Start by entering the purchase price of the property you're considering, the expected rent for a comparable home, and your current down payment amount.

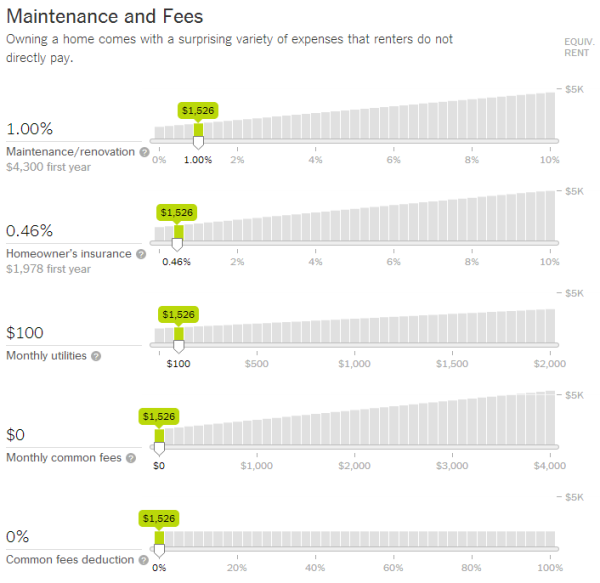

- Add Financial Details: Include details such as mortgage interest rates, property taxes, insurance costs, and maintenance expenses. These factors significantly impact the overall cost of homeownership.

- Adjust Assumptions: Customize assumptions about inflation rates, home price appreciation, and investment returns. These variables can influence the long-term financial outcomes of renting versus buying.

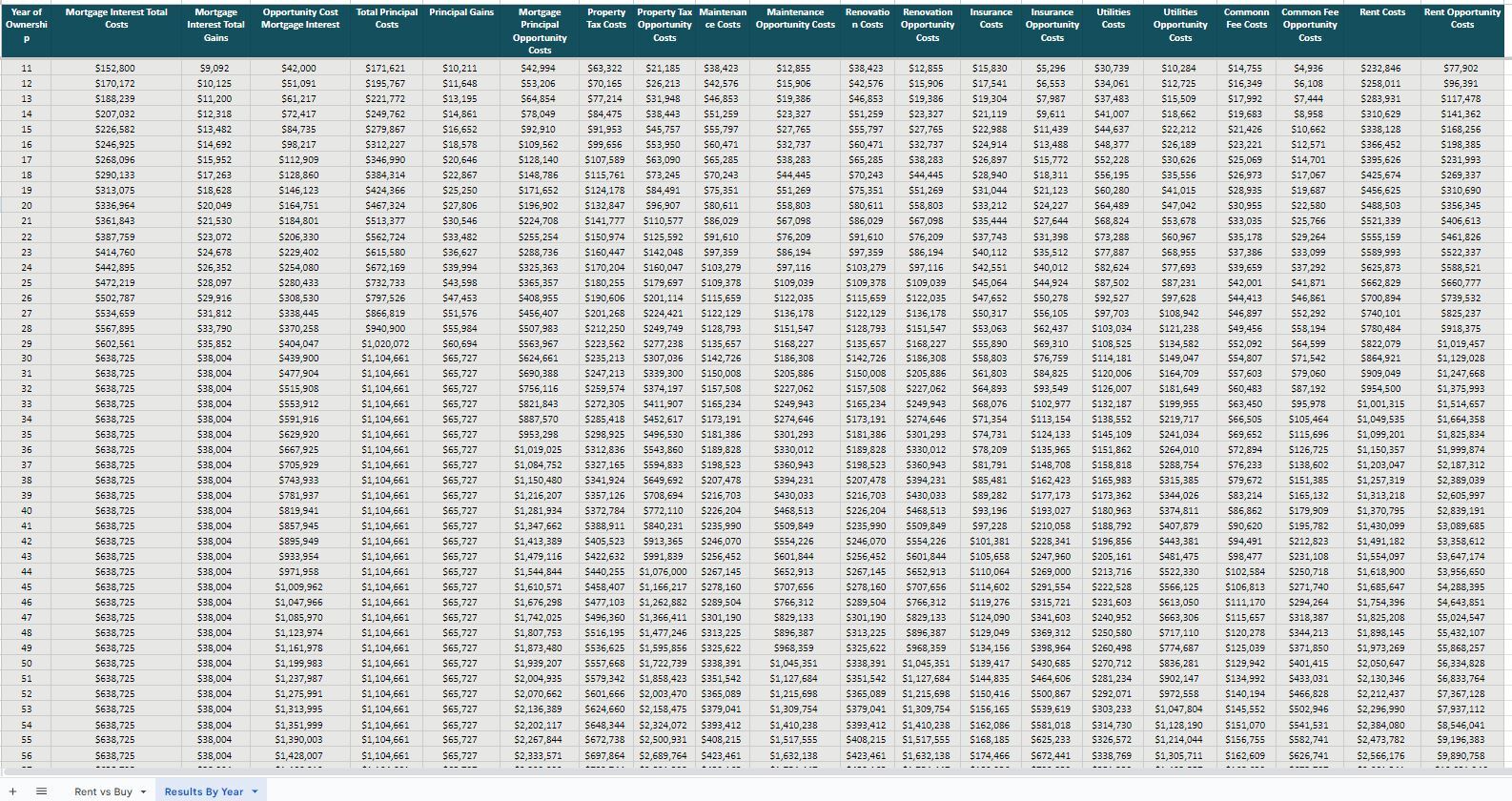

- Review Results: The calculator will generate a detailed report showing the costs associated with both renting and buying over a specified time period. It also highlights the break-even point where buying becomes more financially advantageous than renting.

Key Features of the Calculator

The Rent vs Buy Calculator by The New York Times offers several key features that make it a standout tool:

- Customizable Assumptions: Users can adjust variables such as inflation rates and home price appreciation to fit their unique financial situations.

- Comprehensive Analysis: The calculator considers a wide range of factors, including tax implications, maintenance costs, and investment returns, to provide a holistic view of the financial implications of each option.

- Break-Even Point Calculation: It calculates the point at which buying becomes more financially beneficial than renting, helping users make informed decisions based on their timelines.

Benefits of Using the Calculator

Why Should You Use the Rent vs Buy Calculator?

There are numerous benefits to using the Rent vs Buy Calculator:

- Clarity and Accuracy: The calculator provides a clear and accurate comparison of the financial implications of renting versus buying, eliminating guesswork from the decision-making process.

- Time-Saving: Instead of manually calculating costs and analyzing data, the calculator does the heavy lifting for you, saving you time and effort.

- Personalized Insights: By customizing assumptions and inputting specific financial details, users receive personalized insights tailored to their unique situations.

Factors to Consider

Understanding the Variables

Several factors can influence the results of the Rent vs Buy Calculator:

Read also:Myvidster Caught Unveiling The Truth Behind The Controversy

- Property Prices: The cost of purchasing a home is a significant factor in determining whether buying is financially viable.

- Mortgage Rates: Interest rates on mortgages directly impact monthly payments and overall costs.

- Rent Increases: Expected rent increases over time can affect the long-term cost of renting.

- Investment Opportunities: The potential returns on investments made with the money saved from renting versus the equity gained from homeownership should be carefully considered.

Rent vs Buy: A Comparative Analysis

Breaking Down the Costs

When comparing renting to buying, it's essential to consider both short-term and long-term costs:

- Short-Term Costs: Renting typically involves lower upfront costs, such as security deposits and moving expenses. Buying, on the other hand, requires a substantial down payment and closing costs.

- Long-Term Costs: Over time, homeownership can lead to significant financial gains through equity accumulation and potential property appreciation. However, it also comes with ongoing expenses such as maintenance, taxes, and insurance.

Long-Term Financial Impact

Building Wealth Through Homeownership

One of the primary advantages of buying a home is the potential for long-term wealth accumulation. As property values increase, homeowners build equity, which can serve as a valuable asset in retirement or for future investments. Additionally, mortgage payments act as a form of forced savings, helping homeowners steadily pay down their debt over time.

However, it's important to weigh these benefits against the risks associated with homeownership, such as market fluctuations and unexpected repair costs. The Rent vs Buy Calculator helps users assess these risks and determine whether the potential rewards of homeownership outweigh the costs.

Accuracy of the Calculator

How Reliable is the Rent vs Buy Calculator?

The accuracy of the Rent vs Buy Calculator depends on the quality of the input data and the assumptions made. While the calculator provides a reliable framework for comparing renting and buying, it's essential to remember that real-world outcomes may vary. Factors such as changes in the housing market, economic conditions, and personal circumstances can affect the actual costs and benefits of each option.

Common Mistakes to Avoid

Pitfalls to Watch Out For

When using the Rent vs Buy Calculator, it's important to avoid common mistakes that could lead to inaccurate results:

- Underestimating Costs: Failing to account for all associated costs, such as maintenance and repairs, can skew the results.

- Overestimating Appreciation: Assuming overly optimistic home price appreciation rates can lead to unrealistic expectations about the financial benefits of homeownership.

- Ignoring Personal Preferences: While financial considerations are important, personal preferences such as location and lifestyle should also be factored into the decision-making process.

Conclusion and Call to Action

In conclusion, the Rent vs Buy Calculator by The New York Times is an invaluable tool for anyone facing the dilemma of whether to rent or buy a home. By providing a comprehensive analysis of the financial implications of each option, the calculator empowers users to make informed decisions that align with their long-term goals.

We encourage you to try the Rent vs Buy Calculator today and explore how it can help you navigate the complexities of the housing market. Share your thoughts and experiences in the comments below, and don't forget to check out our other articles for more insights into personal finance and real estate.

References: