Buying or renting a home is one of the most significant financial decisions you'll ever make. The New York Times Rent vs Buy Calculator offers a powerful tool to help you weigh the pros and cons of each option. By analyzing factors like home prices, mortgage rates, and living expenses, this calculator empowers you to make an informed choice that aligns with your financial goals.

Whether you're a first-time homebuyer or a seasoned renter, understanding the dynamics of buying versus renting is essential. This decision affects not only your immediate financial situation but also your long-term wealth accumulation and lifestyle. The NYT Rent vs Buy Calculator simplifies the complexities of this choice, offering personalized insights tailored to your unique circumstances.

In this article, we'll delve into the features and functionalities of the NYT Rent vs Buy Calculator, explore its benefits, and provide expert tips to help you make the best decision for your future. Let's explore how this tool can transform the way you approach homeownership and housing.

Read also:How Old Was Eminem When He Had Hailie Exploring The Story Behind Eminems Family Life

Table of Contents

- Introduction to Rent vs Buy Calculator

- Key Features of NYT Rent vs Buy Calculator

- Benefits of Using the Calculator

- How the Calculator Works

- Rent vs Buy: A Detailed Comparison

- Long-Term Financial Implications

- Factors to Consider Before Using the Calculator

- Expert Tips for Using the Calculator

- Common Questions About Rent vs Buy

- Conclusion and Final Thoughts

Introduction to Rent vs Buy Calculator

The NYT Rent vs Buy Calculator has become a go-to resource for individuals and families navigating the complexities of homeownership. This tool provides a clear comparison between renting and buying, helping users understand the financial implications of each choice. By inputting specific data points, users can generate personalized recommendations that reflect their unique financial situations.

This calculator considers factors such as home prices, rental rates, maintenance costs, and inflation to provide an accurate assessment. Its user-friendly interface and robust analytical capabilities make it an invaluable resource for anyone considering a major housing decision.

Key Features of NYT Rent vs Buy Calculator

Comprehensive Data Analysis

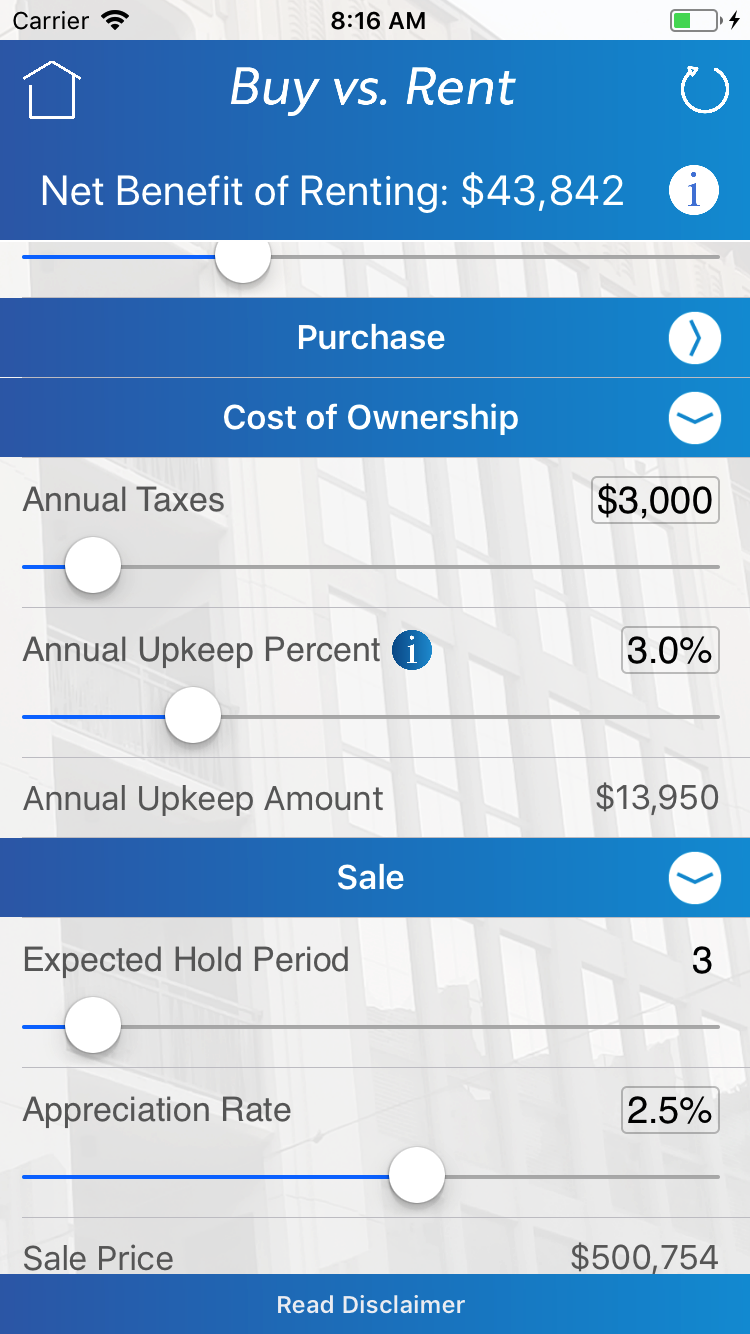

The calculator leverages advanced algorithms to analyze a wide range of data points, ensuring accurate results. Users can input specific details about their desired location, home price, and mortgage terms to receive tailored recommendations.

Customizable Inputs

One of the standout features of the NYT Rent vs Buy Calculator is its ability to accommodate customized inputs. Users can adjust variables such as down payment amounts, interest rates, and expected home appreciation rates to reflect their personal financial scenarios.

Interactive Visualizations

The tool provides interactive graphs and charts that visually represent the financial outcomes of renting versus buying. These visual aids make it easier for users to grasp complex financial concepts and make informed decisions.

Benefits of Using the Calculator

Using the NYT Rent vs Buy Calculator offers numerous advantages for individuals and families. It helps demystify the complexities of homeownership by providing clear, actionable insights. Some key benefits include:

Read also:Djena Nichole Graves The Rising Star Redefining Music And Fashion

- Improved financial clarity and understanding

- Personalized recommendations based on individual circumstances

- Enhanced ability to plan for long-term financial goals

- Reduced stress associated with major housing decisions

How the Calculator Works

The NYT Rent vs Buy Calculator operates by analyzing various financial factors that influence the decision to rent or buy. It considers both short-term and long-term costs associated with each option, providing a comprehensive view of the financial implications.

Data Input Process

Users begin by entering essential data points such as the desired home price, expected rental costs, and mortgage terms. The calculator then processes this information to generate a detailed comparison of the two options.

Financial Modeling

Behind the scenes, the calculator employs sophisticated financial modeling techniques to project future costs and benefits. It accounts for factors like inflation, property taxes, and maintenance expenses to ensure accurate results.

Rent vs Buy: A Detailed Comparison

Short-Term Considerations

When evaluating the rent vs buy decision, it's important to consider both short-term and long-term factors. In the short term, renting often offers greater flexibility and lower upfront costs, making it an attractive option for those who prefer mobility or have limited savings.

Long-Term Benefits

Over the long term, buying a home can provide significant financial benefits, including equity accumulation and potential appreciation. However, it also comes with added responsibilities and costs, such as maintenance and property taxes.

Long-Term Financial Implications

The decision to rent or buy has profound long-term financial implications. Homeownership can serve as a valuable investment, contributing to wealth accumulation over time. However, it also requires careful financial planning and a commitment to managing associated costs.

Building Equity

One of the primary advantages of homeownership is the opportunity to build equity. As property values increase and mortgage balances decrease, homeowners can accumulate significant wealth. This equity can serve as a financial safety net or be leveraged for future investments.

Investment Potential

Buying a home can also provide investment opportunities, such as rental income or property flipping. However, these opportunities require careful consideration of market conditions and potential risks.

Factors to Consider Before Using the Calculator

Before using the NYT Rent vs Buy Calculator, it's important to consider several key factors that may influence your decision. These include:

- Current financial situation and savings

- Desired location and housing market conditions

- Long-term career and lifestyle plans

- Potential changes in personal or financial circumstances

Expert Tips for Using the Calculator

Input Accurate Data

For the most reliable results, ensure that you input accurate and up-to-date information into the calculator. This includes realistic estimates of home prices, rental costs, and mortgage terms.

Consider Future Scenarios

When using the calculator, consider various future scenarios to account for potential changes in your financial situation or housing market conditions. This will help you make a more informed decision.

Seek Professional Advice

In addition to using the calculator, consider consulting with a financial advisor or real estate professional to gain additional insights and guidance tailored to your unique circumstances.

Common Questions About Rent vs Buy

Many individuals have questions about the rent vs buy decision. Below are some frequently asked questions and their answers:

Is Renting Always Cheaper Than Buying?

Not necessarily. While renting may offer lower upfront costs, buying a home can provide significant long-term financial benefits, including equity accumulation and potential appreciation.

How Long Should I Plan to Stay in a Home?

Experts generally recommend planning to stay in a home for at least five to seven years to fully realize the financial benefits of homeownership. However, this timeline can vary based on individual circumstances and market conditions.

Conclusion and Final Thoughts

The NYT Rent vs Buy Calculator is an invaluable tool for anyone navigating the complexities of homeownership. By providing personalized insights and detailed comparisons, it empowers users to make informed decisions that align with their financial goals and lifestyle preferences.

We encourage you to explore the calculator and take advantage of its powerful features to gain clarity on your housing options. Share your thoughts and experiences in the comments below, and don't forget to explore other informative articles on our site for additional guidance on financial planning and homeownership.

Remember, the decision to rent or buy is a deeply personal one that requires careful consideration of numerous factors. By leveraging tools like the NYT Rent vs Buy Calculator and seeking expert advice, you can make a choice that sets you on the path to financial success and stability.