Deciding whether to rent or buy a home in New York City is one of the most crucial financial decisions you will ever make. The New York Times Rent vs Buy debate has been a hot topic for years, and with good reason. As one of the most expensive cities in the world, understanding the nuances of this decision is vital. Whether you're a young professional, a growing family, or someone planning for retirement, this guide will help you navigate the complexities of renting versus buying in NYC.

The decision to rent or buy isn't just about finances; it's also about lifestyle, long-term goals, and personal preferences. This guide will delve into the key factors you need to consider, from market trends and property taxes to emotional considerations and long-term value. We'll also explore insights from experts and real-world examples to help you make an informed choice.

By the end of this article, you'll have a clearer understanding of the New York Times Rent vs Buy dilemma and how it applies to your unique situation. Let's dive in and explore the factors that can help you decide whether renting or buying is the better option for you.

Read also:Teresa Muchnik Rosenblum A Remarkable Journey Through Life Advocacy And Achievements

Table of Contents

- Overview of Rent vs Buy in NYC

- Cost Analysis: Breaking Down the Numbers

- Market Trends: Understanding the Current Landscape

- Financial Considerations: Beyond the Price Tag

- Long-Term Value: Appreciation and Depreciation

- Lifestyle Factors: Flexibility vs Stability

- Emotional Impact: The Psychological Side of Homeownership

- Expert Insights: What the Numbers Don't Tell You

- Case Studies: Real-Life Scenarios

- Conclusion: Making the Right Choice for You

Overview of Rent vs Buy in NYC

Living in New York City comes with its own set of challenges, and one of the biggest is deciding whether to rent or buy. The New York Times Rent vs Buy debate centers around the financial implications, lifestyle preferences, and long-term goals of individuals and families. While renting offers flexibility and lower upfront costs, buying provides the potential for long-term wealth accumulation and stability.

In this section, we'll explore the basics of the rent vs buy decision in NYC. We'll discuss the advantages and disadvantages of each option, as well as the key factors that influence the decision-making process. Whether you're a first-time homebuyer or a seasoned renter, this overview will set the stage for the detailed analysis to come.

Why Renting Might Be the Better Option

Renting in NYC has several advantages, especially for those who value flexibility and lower upfront costs. Here are some of the key benefits:

- No Down Payment Required: Renting doesn't require a large upfront payment, making it more accessible for those just starting their careers.

- Flexibility: Renters can move more easily, which is ideal for those who anticipate job changes or lifestyle shifts.

- Lower Maintenance Costs: Landlords typically handle maintenance and repairs, saving renters time and money.

Why Buying Might Be the Better Option

Buying a home in NYC can be a significant investment, but it also offers long-term benefits. Here's why homeownership might be the right choice for you:

- Building Equity: Over time, homeowners build equity, which can be a valuable asset in retirement.

- Stability: Owning a home provides a sense of permanence and security, which many find appealing.

- Tax Benefits: Homeowners may qualify for tax deductions on mortgage interest and property taxes.

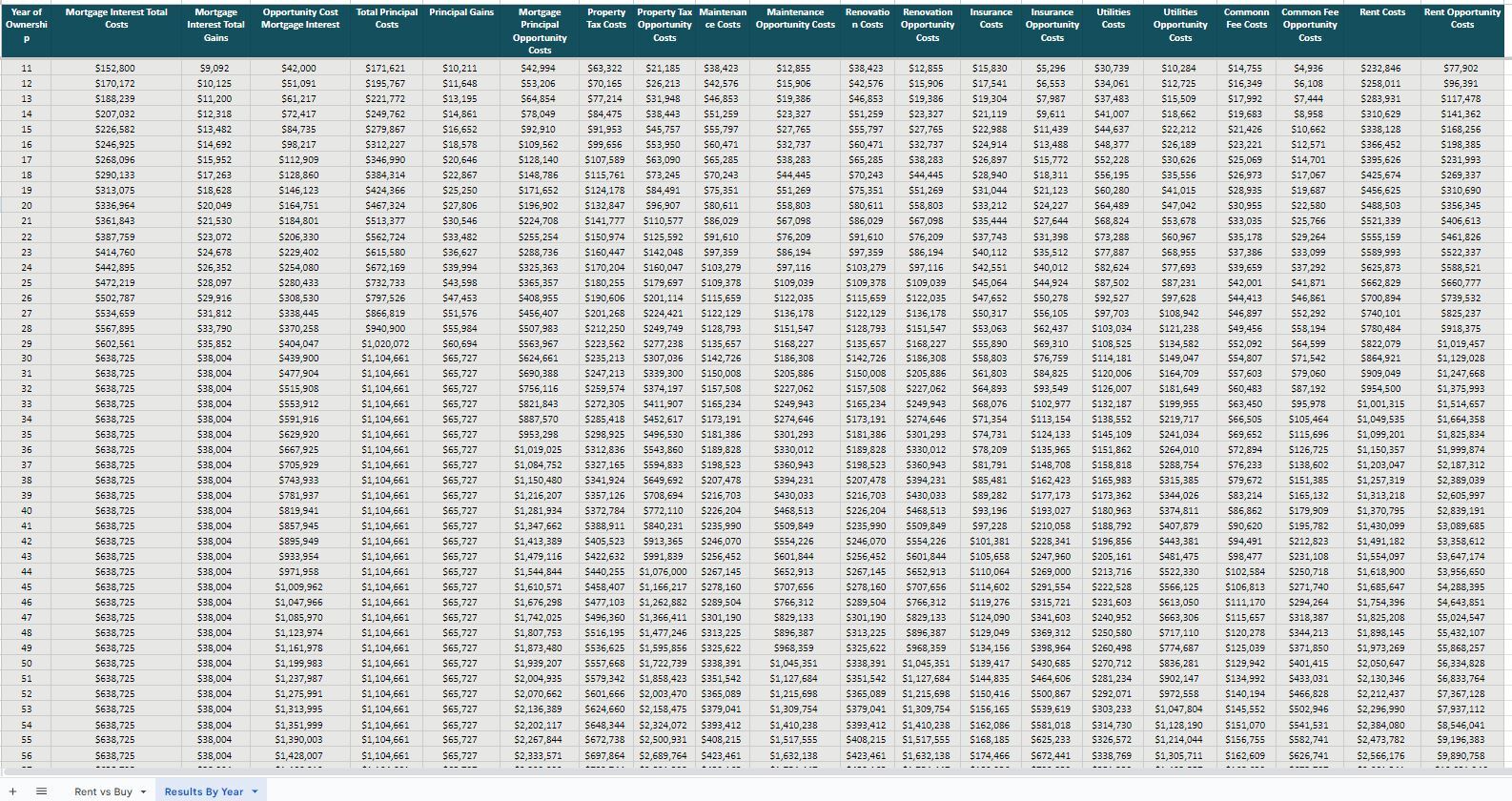

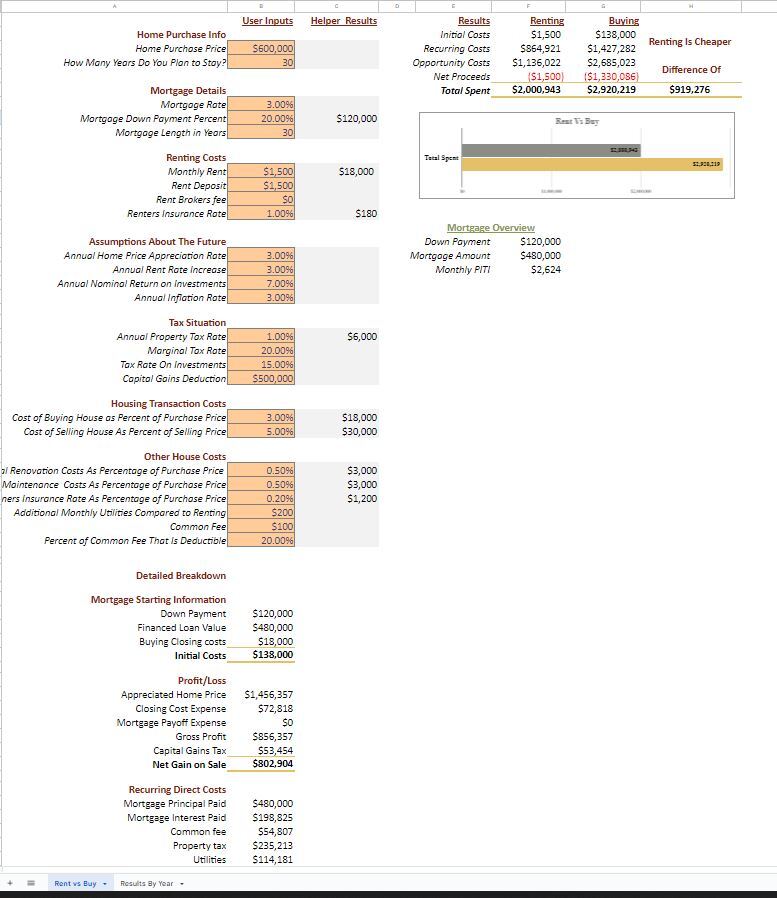

Cost Analysis: Breaking Down the Numbers

When it comes to the New York Times Rent vs Buy debate, cost is often the primary consideration. In this section, we'll break down the numbers to help you understand the financial implications of each option.

According to recent data from the U.S. Census Bureau, the median home price in NYC is significantly higher than the national average. Meanwhile, rental prices continue to rise, making the decision even more complex. Let's take a closer look at the costs associated with renting and buying in NYC.

Read also:Rob Lowe Height Unveiling The True Measure Of A Hollywood Icon

Costs of Renting in NYC

Renting in NYC can be expensive, but it also offers predictable monthly expenses. Here's a breakdown of the typical costs:

- Rent: The average rent for a one-bedroom apartment in NYC is around $3,500 per month.

- Utilities: Expect to pay an additional $200-$300 per month for utilities, depending on your usage.

- Security Deposit: Most landlords require a security deposit equivalent to one or two months' rent.

Costs of Buying in NYC

Buying a home in NYC requires a significant financial commitment, but it can also offer long-term rewards. Here's what you need to consider:

- Down Payment: Most buyers need to put down at least 20% of the home's purchase price, which can be a substantial amount in NYC.

- Mortgage Payments: Monthly mortgage payments depend on the loan amount, interest rate, and loan term.

- Property Taxes: NYC property taxes are among the highest in the country, averaging around 1% of the home's assessed value.

Market Trends: Understanding the Current Landscape

To make an informed decision in the New York Times Rent vs Buy debate, it's essential to understand the current market trends. The real estate market in NYC is constantly evolving, influenced by factors such as economic conditions, interest rates, and demographic shifts.

As of 2023, the NYC real estate market is showing signs of stabilization after the initial shock of the pandemic. Prices have begun to rise again, and inventory remains tight, particularly in desirable neighborhoods like Manhattan and Brooklyn.

Interest Rates and Their Impact

Interest rates play a crucial role in the decision to buy a home. When rates are low, buying becomes more attractive because monthly mortgage payments are lower. Conversely, high interest rates can make renting a more appealing option.

Demographic Shifts

Young professionals and families are driving demand in the NYC housing market. Many are drawn to the city's vibrant culture, job opportunities, and amenities. However, the cost of living remains a significant barrier for many, leading some to opt for renting instead of buying.

Financial Considerations: Beyond the Price Tag

While cost is a critical factor in the New York Times Rent vs Buy decision, there are other financial considerations to keep in mind. These include insurance, maintenance costs, and potential tax benefits.

Homeowners need to budget for homeowners insurance, which can vary based on the location and condition of the property. Additionally, maintenance and repairs can add up over time, making it important to set aside funds for unexpected expenses.

Tax Benefits for Homeowners

One of the key advantages of buying a home is the potential tax benefits. Homeowners may be able to deduct mortgage interest and property taxes from their federal income taxes, which can significantly reduce their tax liability.

Long-Term Value: Appreciation and Depreciation

When considering the New York Times Rent vs Buy debate, it's important to think about the long-term value of homeownership. While property values in NYC have historically appreciated over time, there are no guarantees in real estate.

Historical data from the New York Federal Reserve shows that home prices in NYC have increased by an average of 3-5% annually over the past few decades. However, economic downturns and other factors can lead to periods of depreciation, making it important to consider the long-term outlook.

Lifestyle Factors: Flexibility vs Stability

While financial considerations are important, lifestyle factors also play a significant role in the New York Times Rent vs Buy decision. Renting offers flexibility, while buying provides stability, and each option has its own set of advantages and disadvantages.

For those who value the ability to move easily, renting is often the better choice. On the other hand, homeownership can provide a sense of permanence and security, which many find appealing.

Flexibility of Renting

Renting allows you to live in different neighborhoods and explore different parts of the city. This can be especially appealing for young professionals who are still figuring out where they want to settle down.

Stability of Buying

Owning a home provides a sense of stability and control over your living environment. Homeowners can make renovations and customize their space to suit their preferences, which can be a significant advantage over renting.

Emotional Impact: The Psychological Side of Homeownership

The New York Times Rent vs Buy debate isn't just about numbers; it's also about the emotional aspects of homeownership. Many people view owning a home as a symbol of success and stability, while others prefer the freedom that renting offers.

Psychological studies have shown that homeowners tend to report higher levels of satisfaction and well-being than renters. However, this can vary depending on individual preferences and circumstances.

Expert Insights: What the Numbers Don't Tell You

While data and statistics can provide valuable insights into the New York Times Rent vs Buy decision, they don't tell the whole story. Experts in the real estate industry offer additional perspectives that can help you make a more informed choice.

According to real estate analysts, one of the key factors to consider is your long-term goals. If you plan to stay in NYC for several years, buying may be the better option. However, if you anticipate frequent moves or job changes, renting might be the more practical choice.

Case Studies: Real-Life Scenarios

To better understand the New York Times Rent vs Buy debate, let's explore some real-life scenarios. These case studies highlight the different factors that influence the decision-making process and provide valuable insights for readers.

Case Study 1: The Young Professional

John is a 30-year-old marketing professional who has been renting in Brooklyn for the past five years. He's considering buying a condo but is concerned about the upfront costs and long-term commitment. By analyzing his financial situation and long-term goals, we can help John make an informed decision.

Case Study 2: The Growing Family

Sarah and her husband are expecting their second child and are looking to move from their current rental apartment to a larger home. They're weighing the pros and cons of buying versus renting and need guidance on which option makes the most sense for their family.

Conclusion: Making the Right Choice for You

Deciding whether to rent or buy in NYC is a complex decision that requires careful consideration of financial, lifestyle, and emotional factors. The New York Times Rent vs Buy debate highlights the importance of understanding the nuances of this decision and making a choice that aligns with your unique circumstances.

As you weigh your options, remember to consider your long-term goals, financial situation, and personal preferences. Whether you choose to rent or buy, the most important thing is to make a decision that works for you and your family.

We encourage you to leave a comment or share this article with others who might find it helpful. For more insights into NYC real estate, be sure to explore our other articles and resources.