The New York Times Rent vs Buy Calculator is a powerful tool designed to help individuals and families make informed decisions about one of life's most significant financial choices: renting versus buying a home. Whether you're a first-time homebuyer or a seasoned renter, this calculator provides valuable insights into the long-term financial implications of each option. Understanding the complexities of homeownership and rental agreements can be daunting, but with this resource, you can confidently navigate the process.

Buying or renting a home is more than just a personal preference; it's a financial decision that can have lasting impacts on your life. The New York Times Rent vs Buy Calculator simplifies the decision-making process by breaking down complex financial factors into easy-to-understand terms. It considers variables like home prices, mortgage rates, property taxes, maintenance costs, and more, offering a holistic view of the financial landscape.

As housing costs continue to rise across the United States, understanding the true cost of homeownership versus renting has never been more important. This guide will walk you through everything you need to know about the New York Times Rent vs Buy Calculator, including how it works, its benefits, and how you can use it to make the best decision for your financial future.

Read also:Keith Sapsford The Ultimate Guide To His Career Achievements And Legacy

Table of Contents

- Introduction to Rent vs Buy

- Understanding the Calculator Basics

- Key Variables in the Rent vs Buy Equation

- Advantages of Renting

- Advantages of Buying

- Long-Term Financial Impact

- Case Study: Real-Life Scenarios

- Tips for Using the Calculator

- Common Mistakes to Avoid

- Conclusion and Next Steps

Introduction to Rent vs Buy

The debate between renting and buying has been ongoing for decades, and it's no surprise why. Both options come with their own set of advantages and challenges. Renting offers flexibility and lower upfront costs, while buying can provide stability and potential long-term wealth accumulation. The New York Times Rent vs Buy Calculator is designed to help you weigh these factors and make an informed decision.

This tool is particularly useful for those who are on the fence about whether to commit to homeownership or continue renting. By inputting your specific financial situation, you can see how different scenarios play out over time. It's not just about the monthly payment; it's about understanding the full financial picture.

Understanding the Calculator Basics

What Does the Calculator Do?

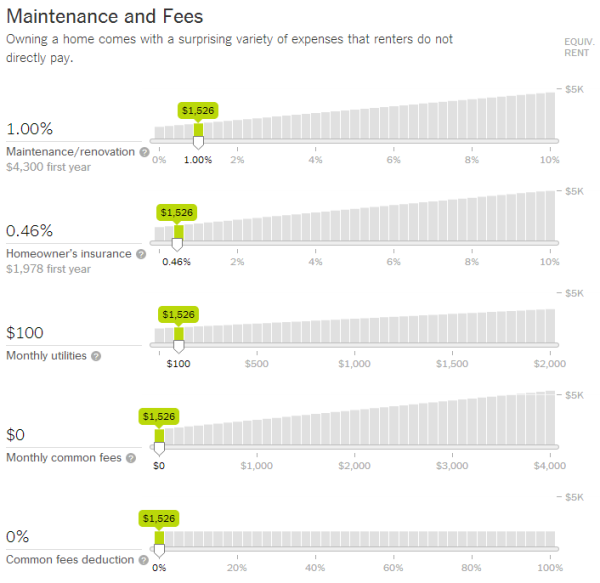

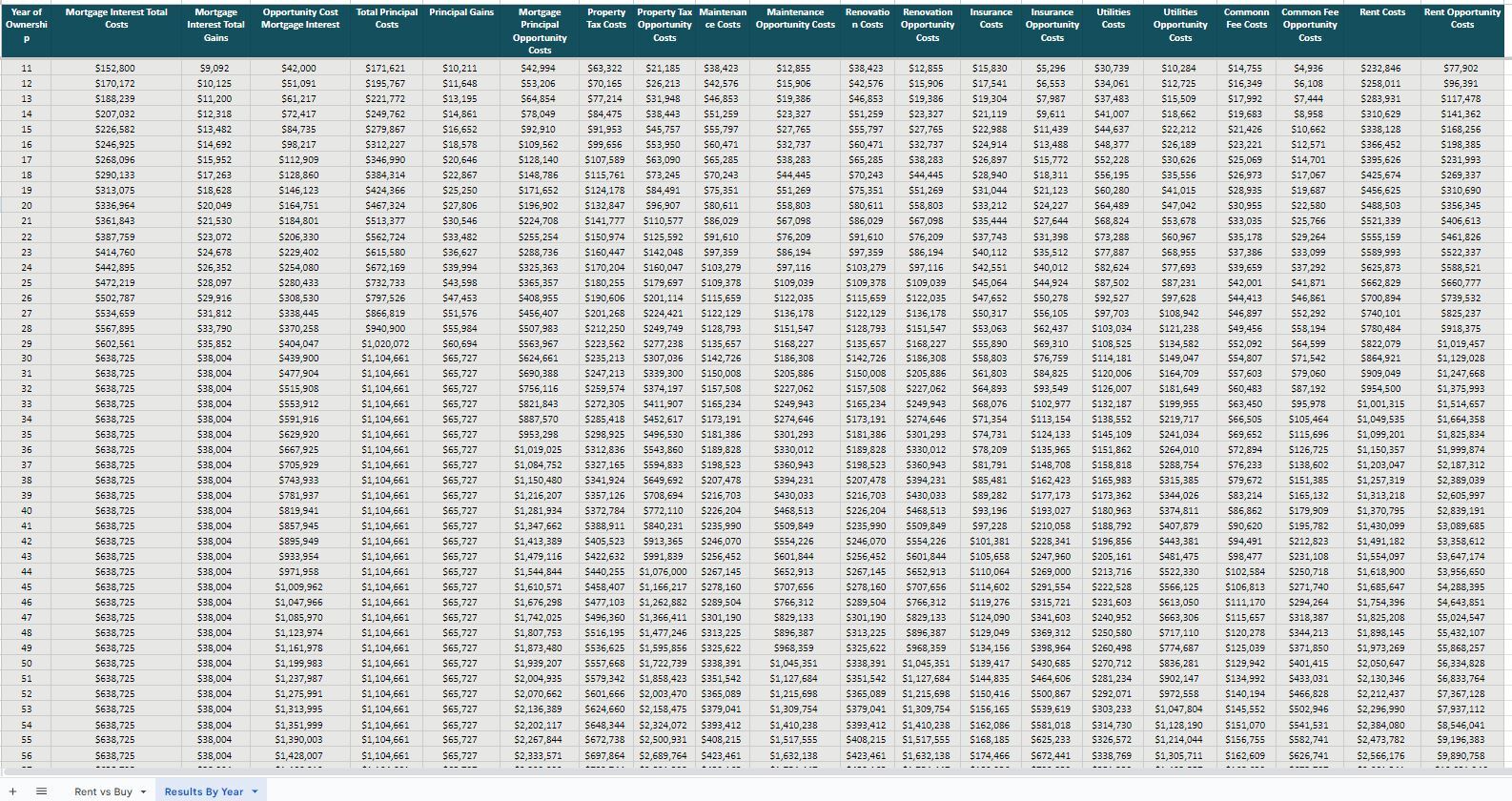

The New York Times Rent vs Buy Calculator evaluates the financial feasibility of renting versus buying a home based on several key inputs. These include the purchase price of a home, expected annual rent increases, mortgage interest rates, property taxes, maintenance costs, and more. The calculator then compares the total costs of each option over a specified period, typically ranging from 5 to 30 years.

One of the standout features of this calculator is its ability to account for inflation and investment returns. It considers how much you could potentially earn by investing the money you would otherwise spend on a down payment and monthly mortgage payments. This makes it a comprehensive tool for assessing the opportunity cost of homeownership.

How to Use the Calculator

Using the calculator is straightforward. Simply input your estimated home purchase price, the expected annual rent increase, your current rent, and other relevant financial details. The calculator will then generate a detailed report showing the total costs of renting versus buying over time. You can adjust the inputs to see how different scenarios affect the outcome.

Read also:Unveiling The Power Of Wwweastandardnet Your Ultimate Source For African News

Key Variables in the Rent vs Buy Equation

Purchase Price

The purchase price of a home is one of the most critical variables in the rent vs buy equation. It directly affects the size of your mortgage, property taxes, and insurance costs. A higher purchase price generally means higher monthly payments and a larger financial commitment.

Interest Rates

Mortgage interest rates play a significant role in determining the affordability of homeownership. Lower interest rates can significantly reduce the cost of borrowing, making buying a more attractive option. Conversely, higher interest rates can increase the total cost of homeownership over time.

Rent Increases

Renters often face annual rent increases, which can eat into their disposable income over time. The New York Times Rent vs Buy Calculator allows you to input an expected annual rent increase, helping you understand the long-term financial implications of renting.

Advantages of Renting

Renting offers several advantages that make it an attractive option for many people. Here are some of the key benefits:

- Flexibility: Renting allows you to move more easily if your circumstances change, such as a new job or family situation.

- Lower Upfront Costs: Renters typically don't need to pay a down payment or closing costs, making it easier to get started.

- No Maintenance Responsibility: Landlords are usually responsible for repairs and maintenance, saving you time and money.

Advantages of Buying

Buying a home also has its own set of advantages, particularly for those looking to build long-term wealth. Consider the following benefits:

- Equity Building: As you pay off your mortgage, you build equity in your home, which can be a valuable asset.

- Stability: Owning a home provides a sense of permanence and stability that renting often cannot offer.

- Potential Appreciation: Real estate values tend to increase over time, providing potential financial gains in the future.

Long-Term Financial Impact

When considering the long-term financial impact of renting versus buying, it's essential to look beyond monthly payments. Factors like inflation, investment returns, and property appreciation can significantly influence the decision. The New York Times Rent vs Buy Calculator helps you visualize these factors and understand their implications.

For example, if you invest the money you save by renting instead of buying, you could potentially earn returns that outweigh the costs of renting. On the other hand, homeownership can provide tax benefits and equity accumulation that renting does not.

Case Study: Real-Life Scenarios

Scenario 1: Urban Professional

A 35-year-old professional living in New York City is considering whether to buy a condo or continue renting. By inputting their financial details into the calculator, they discover that buying a condo would be more cost-effective over a 10-year period, despite the higher upfront costs.

Scenario 2: Young Family

A young family in Chicago is debating whether to purchase a suburban home or rent a townhouse. Using the calculator, they find that buying a home would offer greater financial stability and potential appreciation over the next 15 years.

Tips for Using the Calculator

To get the most out of the New York Times Rent vs Buy Calculator, consider the following tips:

- Be Honest About Your Financial Situation: Input accurate data to ensure the results reflect your true financial circumstances.

- Experiment with Different Scenarios: Try adjusting the inputs to see how different factors affect the outcome.

- Consider Non-Financial Factors: While the calculator focuses on financial aspects, don't forget to consider personal preferences and lifestyle needs.

Common Mistakes to Avoid

When using the New York Times Rent vs Buy Calculator, it's important to avoid common mistakes that could lead to inaccurate results. Here are a few to watch out for:

- Underestimating Costs: Be sure to include all relevant costs, such as property taxes, insurance, and maintenance.

- Ignoring Inflation: Inflation can significantly impact both rent and home values over time, so factor it into your calculations.

- Overestimating Returns: While investing can be profitable, it's important to use realistic estimates for investment returns.

Conclusion and Next Steps

The New York Times Rent vs Buy Calculator is an invaluable resource for anyone facing the decision of whether to rent or buy a home. By carefully considering the financial implications of each option, you can make a more informed choice that aligns with your long-term goals. Remember to take into account both financial and non-financial factors when making your decision.

We encourage you to share your thoughts and experiences in the comments below. Have you used the calculator before? What was your decision? Also, feel free to explore our other articles on personal finance and real estate for more insights. Together, let's make smarter financial decisions for a brighter future!

Source: The New York Times Rent vs Buy Calculator