GEICO, which stands for Government Employees Insurance Company, is one of the largest auto insurance providers in the United States. For customers seeking assistance, knowing the 1-800 number to GEICO customer service is essential for resolving issues, managing policies, or getting answers to important questions. This article will provide a comprehensive guide to GEICO's customer service hotline and related information, ensuring you are well-prepared to contact their support team.

GEICO has been a trusted name in the insurance industry since its establishment in 1936. With millions of customers across the U.S., the company offers a wide range of insurance products, including auto, home, life, and more. The 1-800 number to GEICO customer service serves as a direct line for policyholders and potential customers who need help navigating their services.

This guide will not only provide the 1-800 number to GEICO customer service but also delve into other methods of contacting the company, understanding their services, and troubleshooting common issues. Whether you're looking to update your policy, file a claim, or simply learn more about GEICO's offerings, this article will equip you with the necessary information.

Read also:What Did Suzanne Pleshette Die Of A Comprehensive Look At Her Life Career And Legacy

Table of Contents:

- Biography of GEICO

- What is the 1-800 Number to GEICO Customer Service?

- Alternative Ways to Contact GEICO

- Services Offered by GEICO

- Common Issues and Solutions

- GEICO's Customer Support Reputation

- Hours of Operation for GEICO Customer Service

- Online Resources for GEICO Customers

- Tips for a Successful Call to GEICO

- Conclusion

Biography of GEICO

GEICO was founded in 1936 by Leo Goodwin, a former insurance agent who believed in offering affordable insurance to government employees. Over the years, the company expanded its services to include a broader customer base, becoming one of the leading insurance providers in the United States. GEICO is now part of the Berkshire Hathaway family of companies, owned by Warren Buffett.

Below is a brief overview of GEICO's key milestones:

- 1936: GEICO was founded in Washington, D.C., targeting government employees as its primary customer base.

- 1948: The company opened its first branch office in San Francisco, California.

- 1995: GEICO went public, allowing investors to purchase shares in the company.

- 1996: Berkshire Hathaway acquired GEICO, solidifying its position as a major player in the insurance industry.

Data and Biodata of GEICO

| Category | Details |

|---|---|

| Founded | 1936 |

| Founder | Leo Goodwin |

| Headquarters | Bethesda, Maryland |

| Parent Company | Berkshire Hathaway |

| Products | Auto, home, life, boat, motorcycle insurance |

What is the 1-800 Number to GEICO Customer Service?

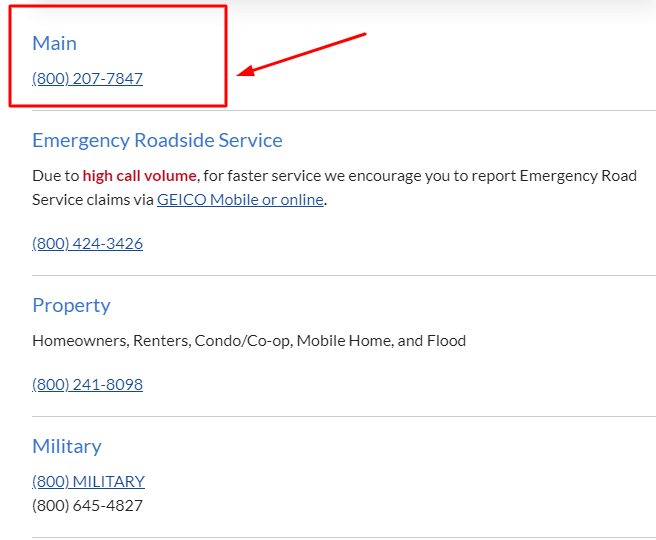

The official 1-800 number to GEICO customer service is 1-800-943-4356. This number connects customers directly to GEICO's customer service representatives, who can assist with inquiries related to policies, claims, billing, and more. Whether you're a new customer or an existing policyholder, this hotline is your primary resource for resolving issues and obtaining support.

Using this number, you can:

- Update your policy information.

- File a claim or check the status of an existing claim.

- Get answers to billing questions.

- Speak with a representative about additional coverage options.

While the 1-800 number is the most direct way to contact GEICO, it's important to note that the company also offers other methods of communication, which we will explore in the next section.

Read also:World Art Tawdirectories Exploring The Global Canvas Of Creativity

Alternative Ways to Contact GEICO

1. Online Chat

In addition to the 1-800 number to GEICO customer service, the company offers an online chat feature on its website. This option allows customers to communicate with representatives in real-time without the need for a phone call. The chat feature is particularly useful for quick inquiries or issues that don't require extensive discussion.

2. Mobile App

GEICO's mobile app provides a convenient way for customers to manage their policies, file claims, and access customer support. The app is available for both iOS and Android devices and includes features such as policy management, roadside assistance, and claim submission.

3. Email Support

For less urgent matters, customers can reach out to GEICO via email. While email support may not offer immediate assistance, it is a reliable option for submitting detailed inquiries or documentation. Be sure to include your policy number in any correspondence for faster processing.

Services Offered by GEICO

GEICO offers a wide range of insurance products designed to meet the needs of its diverse customer base. Below are some of the key services provided by the company:

- Auto Insurance: GEICO is best known for its affordable auto insurance policies, which cover cars, motorcycles, and other vehicles.

- Homeowners Insurance: Protect your home and belongings with comprehensive coverage options.

- Renter's Insurance: Ideal for individuals renting apartments or homes, GEICO's renter's insurance covers personal property and liability.

- Life Insurance: Secure your family's future with GEICO's term and whole life insurance plans.

Common Issues and Solutions

1. Policy Changes

One of the most common reasons customers contact GEICO is to make changes to their policies. Whether you're adding a new vehicle, updating your address, or adjusting coverage limits, the process is straightforward. Simply call the 1-800 number to GEICO customer service or log in to your account online to make the necessary updates.

2. Claims Filing

Filing a claim with GEICO can be done through multiple channels, including the 1-800 number, mobile app, or website. Ensure you have all relevant information, such as police reports and photos of damage, before initiating the process to expedite resolution.

GEICO's Customer Support Reputation

GEICO has consistently received high marks for its customer service, ranking among the top insurance providers in terms of customer satisfaction. The company's commitment to providing prompt, professional assistance has earned it a loyal customer base. However, like any large organization, GEICO is not immune to occasional complaints, particularly regarding wait times during peak hours.

Hours of Operation for GEICO Customer Service

GEICO's customer service team operates on an extended schedule to accommodate customers in different time zones. The 1-800 number to GEICO customer service is available:

- Monday to Friday: 8:00 AM to 10:00 PM EST

- Saturday: 8:00 AM to 8:00 PM EST

- Sunday: 9:00 AM to 6:00 PM EST

It's important to note that hours may vary during holidays, so it's advisable to check GEICO's website for any updates.

Online Resources for GEICO Customers

GEICO offers a wealth of online resources to help customers manage their policies and stay informed. These include:

- Customer Portal: Access your account details, pay bills, and view policy documents.

- Blog and Articles: Stay updated on the latest trends in insurance and driving safety.

- FAQ Section: Find answers to common questions without needing to contact customer service.

Tips for a Successful Call to GEICO

Calling the 1-800 number to GEICO customer service can be a smooth process if you follow these tips:

- Have your policy number and relevant documents ready before the call.

- Be clear and concise when explaining your issue to the representative.

- Take notes during the call to document any important information or instructions.

- If you encounter a problem, remain calm and polite to ensure a productive conversation.

Conclusion

In conclusion, knowing the 1-800 number to GEICO customer service is crucial for anyone seeking assistance with their insurance needs. Whether you're looking to update your policy, file a claim, or simply learn more about GEICO's offerings, the resources provided in this article will help you navigate the process effectively.

We encourage you to share this article with others who may benefit from the information. For further insights into insurance and customer service, explore our other articles or leave a comment below with your thoughts and experiences. Together, let's make informed decisions about our financial and personal well-being.