Are you planning a home improvement project but worried about financing costs? No interest Home Depot offers can help you complete your dream projects without the burden of interest payments. In this comprehensive guide, we will explore everything you need to know about no interest Home Depot financing options, helping you make informed decisions for your home improvement needs.

Home Depot is one of the largest retailers in the world, offering a wide range of products for home improvement, construction, and gardening. With its extensive inventory and customer-friendly policies, Home Depot has become a go-to destination for homeowners and contractors alike. However, one of the most attractive features of Home Depot is its no interest financing options, which allow customers to purchase high-value items without worrying about interest charges.

Whether you're remodeling your kitchen, installing a new HVAC system, or upgrading your outdoor space, no interest Home Depot financing can make these projects more affordable. In this article, we will delve into the details of Home Depot's financing programs, explore eligibility criteria, and provide tips to maximize your savings. Let's get started!

Read also:Sarah Marie Erome The Rise Of A Digital Phenomenon

Table of Contents

- What is No Interest Home Depot Financing?

- Eligibility Criteria for No Interest Financing

- How Does No Interest Home Depot Financing Work?

- Home Depot Credit Card Options

- Advantages of No Interest Home Depot Financing

- Potential Disadvantages to Consider

- Tips for Maximizing Your No Interest Financing

- Common Questions About No Interest Home Depot Financing

- Alternative Financing Options

- Conclusion: Make the Most of No Interest Home Depot Financing

What is No Interest Home Depot Financing?

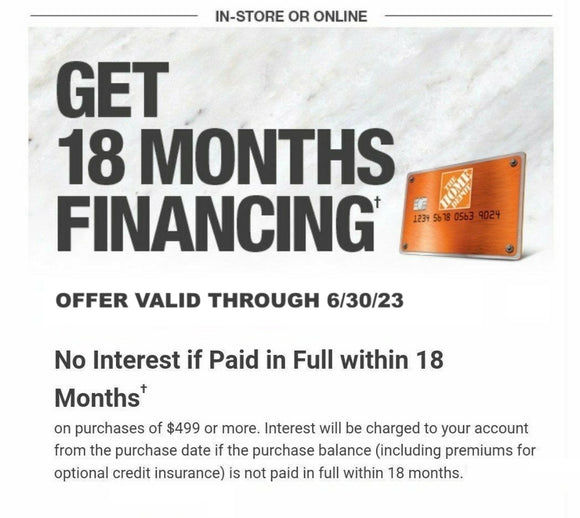

No interest Home Depot financing is a promotional offer that allows customers to purchase eligible items without paying interest for a specified period. This option is particularly beneficial for large purchases such as appliances, furniture, or major home improvement projects. By taking advantage of these offers, you can spread out your payments over several months without incurring additional costs.

How No Interest Financing Benefits Homeowners

Here are some key benefits of no interest Home Depot financing:

- Deferred Interest Payments: Customers can avoid interest charges if the balance is paid in full before the promotional period ends.

- Flexibility: You can purchase high-value items without the immediate financial burden.

- Improved Cash Flow: By spreading payments over time, you can allocate funds to other expenses.

According to a survey by the National Association of Home Builders (NAHB), 60% of homeowners prefer financing options when undertaking major home improvement projects. No interest Home Depot financing aligns perfectly with this trend, offering an attractive solution for budget-conscious consumers.

Eligibility Criteria for No Interest Financing

To qualify for no interest Home Depot financing, you must meet certain eligibility criteria. These requirements ensure that only responsible borrowers can take advantage of the program.

Key Eligibility Factors

- Credit Score: A good or excellent credit score is typically required to qualify for no interest financing.

- Income Verification: In some cases, Home Depot may request proof of income to assess your ability to repay.

- Eligible Purchases: Not all items qualify for no interest financing. Check the product details to confirm eligibility.

For example, Home Depot's Red Card offers no interest financing on purchases of $299 or more. However, specific promotions may have additional requirements or limitations.

How Does No Interest Home Depot Financing Work?

Understanding how no interest Home Depot financing works is essential to avoid unexpected charges. Here's a step-by-step explanation:

Read also:How Much Did Bethenny Frankel Sell Skinny Girl Cocktails For

- Apply for the Home Depot Credit Card: You can apply online or in-store for the Home Depot Red Card or Home Depot Visa Card.

- Select Eligible Items: Choose products that qualify for no interest financing during the promotional period.

- Pay Off the Balance: Make regular payments and ensure the full balance is paid before the promotional period ends to avoid interest charges.

It's important to note that if the balance is not paid in full by the end of the promotional period, interest will be applied retroactively to the original purchase amount. Therefore, planning your payments carefully is crucial.

Home Depot Credit Card Options

Home Depot offers two primary credit card options for customers interested in no interest financing:

Home Depot Red Card

- No Annual Fee: The Red Card does not charge an annual fee, making it an affordable option for regular shoppers.

- 5% Savings: Cardholders receive 5% off every purchase made at Home Depot.

- No Interest Financing: Eligible purchases of $299 or more qualify for no interest financing for up to 12 months.

Home Depot Visa Card

- World Elite Mastercard Benefits: The Visa Card offers additional perks such as travel rewards and purchase protection.

- Extended Financing: Certain purchases qualify for extended no interest periods of up to 24 months.

- Flexibility: Use the Visa Card at any merchant that accepts Mastercard.

Choosing the right card depends on your specific needs and spending habits. Both options provide valuable benefits for Home Depot shoppers.

Advantages of No Interest Home Depot Financing

No interest Home Depot financing offers several advantages that make it an attractive option for homeowners:

- Cost Savings: Avoiding interest charges can result in significant savings, especially for large purchases.

- Convenience: Spreading payments over time allows you to manage your budget more effectively.

- Exclusive Discounts: Cardholders often receive exclusive discounts and promotions not available to non-cardholders.

A study by J.D. Power found that customers who use store credit cards report higher satisfaction levels due to the added benefits and flexibility.

Potential Disadvantages to Consider

While no interest Home Depot financing has many benefits, it's important to consider potential drawbacks:

- Retroactive Interest: If the balance is not paid in full by the end of the promotional period, interest will be charged retroactively to the original purchase date.

- High APR: After the promotional period ends, the standard APR may be higher than other credit cards.

- Eligibility Restrictions: Not all purchases qualify for no interest financing, and credit approval is required.

Before committing to no interest financing, carefully evaluate your ability to repay the balance within the promotional period to avoid unexpected costs.

Tips for Maximizing Your No Interest Financing

To make the most of no interest Home Depot financing, follow these tips:

- Plan Your Purchases: Only use no interest financing for items you truly need and can afford to pay off within the promotional period.

- Set Up Automatic Payments: Ensure timely payments by setting up automatic transfers to avoid missing deadlines.

- Monitor Your Balance: Keep track of your remaining balance to ensure it is paid in full before the promotional period ends.

By implementing these strategies, you can fully leverage the benefits of no interest Home Depot financing while minimizing risks.

Common Questions About No Interest Home Depot Financing

Can I Combine No Interest Financing with Other Discounts?

In most cases, no interest financing cannot be combined with other discounts or promotions. However, cardholder discounts such as the 5% savings on the Red Card may still apply.

What Happens if I Don't Pay Off the Balance in Time?

If the balance is not paid in full by the end of the promotional period, interest will be charged retroactively to the original purchase date. This can result in significant additional costs, so it's important to plan your payments carefully.

Can I Use No Interest Financing for Online Purchases?

Yes, no interest Home Depot financing is available for both in-store and online purchases. Simply apply for the Home Depot Red Card or Visa Card during checkout to access the promotional offer.

Alternative Financing Options

If no interest Home Depot financing isn't suitable for your needs, consider these alternative financing options:

- Personal Loans: A personal loan may offer lower interest rates and more flexible repayment terms than credit cards.

- Home Equity Loans: For larger projects, a home equity loan can provide access to funds at a lower interest rate.

- Manufacturer Financing: Some appliance manufacturers offer their own no interest financing programs that may be worth exploring.

Each option has its own advantages and drawbacks, so it's important to evaluate your financial situation before making a decision.

Conclusion: Make the Most of No Interest Home Depot Financing

No interest Home Depot financing provides a valuable opportunity for homeowners to complete their projects without the burden of interest charges. By understanding the eligibility criteria, how the program works, and potential risks, you can make informed decisions about your financing options.

We encourage you to take action by applying for the Home Depot Red Card or Visa Card today and exploring the available promotions. Don't forget to share this article with friends and family who may benefit from the information. For more tips and advice on home improvement financing, explore our other articles on the site.