Home Depot interest-free payments have become a popular choice for homeowners and DIY enthusiasts looking to finance home improvement projects without incurring additional costs. Whether you're remodeling your kitchen, updating your bathroom, or simply upgrading your outdoor living space, these financing options provide an excellent opportunity to enhance your home while managing your budget effectively. Understanding how these programs work and how to maximize their benefits can help you achieve your dream home without financial strain.

Home Depot, one of the largest home improvement retailers in the world, offers a range of financial solutions to make your home improvement dreams a reality. Among these solutions, interest-free payment plans stand out as a smart financial choice. By taking advantage of these offers, you can spread the cost of your purchases over time without worrying about extra interest charges.

In this comprehensive guide, we will explore everything you need to know about Home Depot interest-free payments, including eligibility requirements, how to apply, common terms and conditions, and tips to make the most of these offers. Whether you're a seasoned homeowner or a first-time buyer, this article will provide valuable insights to help you make informed decisions about financing your next project.

Read also:Understanding Subgaleal Hemorrhage Causes Symptoms And Treatment

Table of Contents

- Introduction to Home Depot Interest-Free Payments

- Eligibility Requirements for Home Depot Financing

- How Home Depot Interest-Free Payments Work

- Benefits of Using Home Depot Financing

- Common Terms and Conditions

- Types of Financing Offers

- How to Apply for Home Depot Interest-Free Payments

- Tips for Maximizing Your Financing Options

- Frequently Asked Questions

- Conclusion and Call to Action

Introduction to Home Depot Interest-Free Payments

Home Depot interest-free payments are designed to help customers manage the costs of their home improvement projects by allowing them to pay off their purchases over time without incurring interest charges. These financing options are particularly useful for larger projects that require significant upfront investment, such as kitchen renovations, bathroom upgrades, or landscaping projects.

One of the key advantages of Home Depot's interest-free payment plans is the flexibility they offer. Customers can choose from a variety of financing options, depending on the size of their project and their financial situation. Additionally, these plans often come with promotional offers, such as extended interest-free periods or cashback rewards, making them even more attractive to budget-conscious shoppers.

However, it's important to understand the terms and conditions associated with these financing options. Failure to meet the payment deadlines or minimum payment requirements can result in interest charges being applied retroactively, which could significantly increase the overall cost of your purchase. In the following sections, we'll delve deeper into the details of Home Depot interest-free payments and provide practical advice to help you make the most of these offers.

Eligibility Requirements for Home Depot Financing

To qualify for Home Depot interest-free payments, you must meet certain eligibility criteria. While the specific requirements may vary depending on the financing option you choose, there are some general guidelines to keep in mind:

Key Eligibility Factors

- Credit Score: You will need to have a good or excellent credit score to qualify for most financing options. Home Depot typically partners with major financial institutions to provide these services, and they will assess your creditworthiness based on your credit history.

- Age: You must be at least 18 years old to apply for a Home Depot credit card or financing plan.

- Residency: In most cases, you must be a resident of the United States to qualify for Home Depot financing.

It's worth noting that even if you don't meet all the eligibility requirements, you may still be able to secure financing at a higher interest rate. However, to take full advantage of the interest-free period, it's essential to ensure that you meet the minimum criteria.

How Home Depot Interest-Free Payments Work

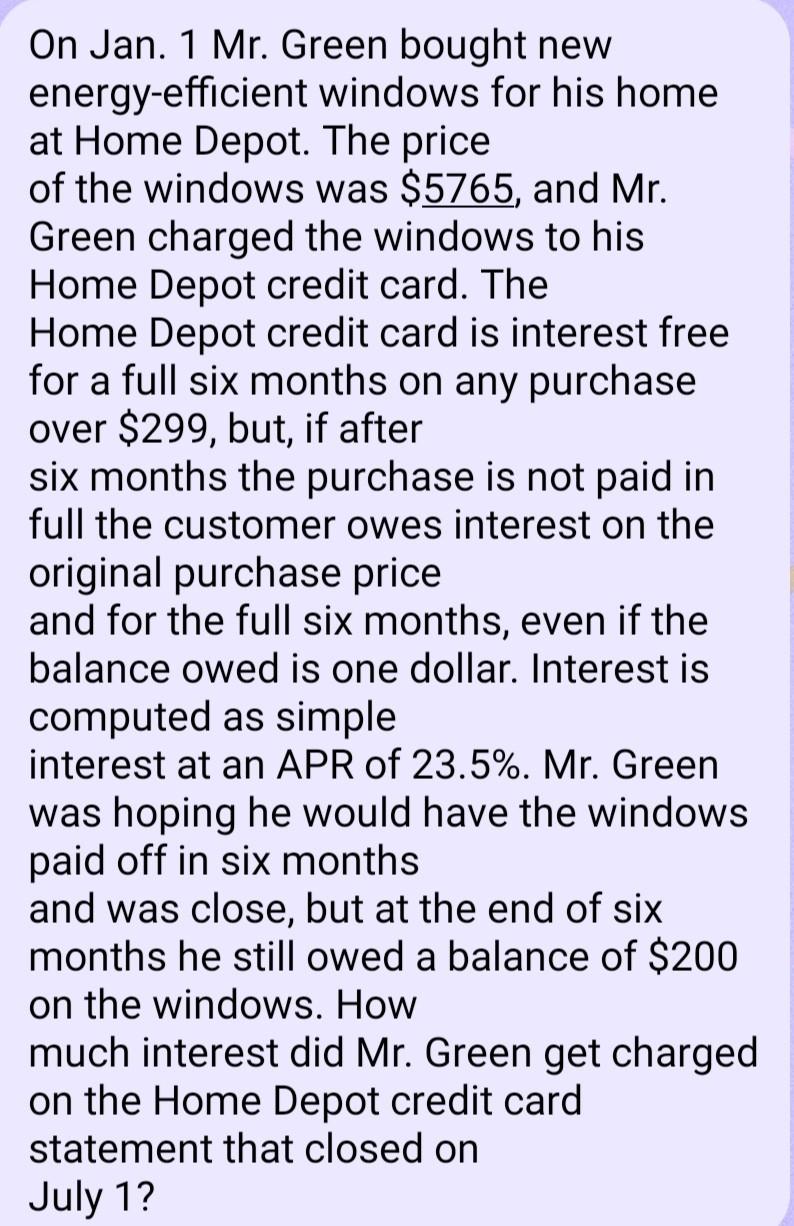

Home Depot interest-free payments work by allowing you to defer interest charges on eligible purchases for a specified period. During this time, you can pay off your balance without incurring additional costs. However, if you fail to pay off the full balance by the end of the promotional period, interest charges will be applied retroactively from the date of purchase.

Read also:Top 2010 Tv Shows A Nostalgic Journey Through The Golden Era Of Television

Here's a step-by-step breakdown of how these financing options typically work:

Step-by-Step Process

- Step 1: Apply for Financing – You can apply for Home Depot financing online or in-store. The application process is quick and straightforward, and you'll receive an instant decision in most cases.

- Step 2: Make Eligible Purchases – Once approved, you can use your financing to make eligible purchases at Home Depot stores or on their website.

- Step 3: Pay Off Your Balance – During the promotional period, you must make regular payments and pay off the full balance by the end of the interest-free period to avoid interest charges.

It's crucial to carefully review the terms and conditions of your financing agreement to ensure you understand your obligations and avoid any unexpected fees or charges.

Benefits of Using Home Depot Financing

There are numerous benefits to using Home Depot interest-free payments for your home improvement projects. Some of the key advantages include:

Top Benefits

- Interest-Free Period: The ability to pay off your purchases over time without incurring interest charges can help you manage your budget more effectively.

- Flexible Payment Options: Home Depot offers a variety of financing options, including 6-month, 12-month, and even 24-month interest-free periods, depending on the size of your purchase.

- Exclusive Discounts: Many financing plans come with additional perks, such as exclusive discounts, cashback rewards, or special promotions.

- Convenience: With Home Depot's financing options, you can finance your entire project in one place, saving time and effort.

By taking advantage of these benefits, you can enhance your home while maintaining financial flexibility.

Common Terms and Conditions

Before applying for Home Depot interest-free payments, it's important to familiarize yourself with the terms and conditions associated with these financing options. Some of the most common terms include:

Key Terms to Know

- Promotional Period: The length of time during which you can pay off your balance without incurring interest charges. This period typically ranges from 6 to 24 months.

- Minimum Payment Requirements: You must make regular monthly payments during the promotional period to avoid defaulting on your financing agreement.

- Retroactive Interest: If you fail to pay off the full balance by the end of the promotional period, interest charges will be applied retroactively from the date of purchase.

It's essential to read the fine print carefully and ensure you understand all the terms and conditions before committing to a financing plan.

Types of Financing Offers

Home Depot offers a variety of financing options to suit different needs and budgets. Some of the most popular financing offers include:

Popular Financing Options

- Home Depot Credit Card: The Home Depot Credit Card offers a range of benefits, including interest-free financing on eligible purchases, exclusive discounts, and cashback rewards.

- Special Financing Plans: These plans are often available for larger purchases, such as appliances, flooring, or major home improvement projects. They typically offer extended interest-free periods and additional perks.

- Project Financing: Designed specifically for homeowners undertaking large-scale projects, these financing options provide flexible terms and competitive rates.

Choosing the right financing option depends on the size of your project, your budget, and your financial goals.

How to Apply for Home Depot Interest-Free Payments

Applying for Home Depot interest-free payments is a simple and straightforward process. You can apply online or in-store, and you'll receive an instant decision in most cases. Here's how to apply:

Steps to Apply

- Step 1: Visit the Home Depot Website – Navigate to the financing section of the Home Depot website and select the option that best suits your needs.

- Step 2: Complete the Application Form – Fill out the application form with your personal and financial information. This process typically takes just a few minutes.

- Step 3: Receive Your Decision – Once your application is processed, you'll receive an instant decision. If approved, you can start using your financing immediately.

Alternatively, you can apply in-store by speaking to a Home Depot associate, who can guide you through the process and answer any questions you may have.

Tips for Maximizing Your Financing Options

To make the most of Home Depot interest-free payments, consider the following tips:

Practical Tips

- Plan Your Purchases Carefully: Before making any purchases, create a detailed budget and prioritize your most important projects.

- Pay Off Your Balance on Time: To avoid interest charges, ensure you pay off the full balance by the end of the promotional period.

- Take Advantage of Exclusive Offers: Keep an eye out for special promotions and discounts that can help you save even more money.

By following these tips, you can maximize the benefits of Home Depot financing and achieve your home improvement goals without breaking the bank.

Frequently Asked Questions

Here are some of the most common questions about Home Depot interest-free payments:

FAQ Section

- Q: Can I use Home Depot financing for any purchase? A: Home Depot financing is typically available for purchases over a certain amount, and some items may not be eligible for interest-free financing.

- Q: What happens if I don't pay off my balance by the end of the promotional period? A: If you fail to pay off the full balance by the end of the promotional period, interest charges will be applied retroactively from the date of purchase.

- Q: Can I combine multiple financing offers? A: In most cases, you cannot combine multiple financing offers, but you can apply for separate financing plans for different purchases.

Conclusion and Call to Action

Home Depot interest-free payments provide an excellent opportunity to finance your home improvement projects without incurring additional costs. By understanding the eligibility requirements, terms and conditions, and available financing options, you can make informed decisions and maximize the benefits of these offers.

We encourage you to take advantage of Home Depot's financing solutions to enhance your home and achieve your dream living space. Don't forget to share your experiences and insights in the comments section below, and consider exploring other informative articles on our website for more tips and advice.

Thank you for reading, and we wish you all the best in your home improvement journey!