Home Depot credit card 0% interest offers are a game-changer for anyone looking to finance home improvement projects without the burden of high interest rates. Whether you're planning a major renovation or just need a few upgrades around the house, understanding how these offers work can help you save significantly. This article will guide you through everything you need to know about Home Depot's credit card promotions, ensuring you make the most of this opportunity.

Home Depot, one of the largest home improvement retailers in the world, has become synonymous with quality tools, materials, and services. Their credit card program is designed to make purchasing more accessible and affordable, especially when it comes to interest-free financing. By leveraging these offers, customers can enjoy extended payment periods without accruing interest charges.

Whether you're a seasoned homeowner or just starting out, understanding the nuances of the Home Depot credit card 0% interest promotions is essential. In this comprehensive guide, we'll break down the terms, conditions, and benefits of these offers, as well as provide tips on how to maximize your savings. Let's dive in!

Read also:Wtseticket Your Ultimate Guide To Seamless Travel Experiences

Understanding Home Depot Credit Card 0% Interest Offers

The Home Depot credit card 0% interest promotions are designed to help customers finance their home improvement projects without the added cost of interest. These offers typically come with an introductory period during which no interest is charged on purchases, allowing you to spread out payments over several months or even years.

One of the key benefits of these promotions is the ability to defer interest payments on qualifying purchases. However, it's important to note that if the balance is not paid off by the end of the promotional period, interest charges may apply retroactively. This section will explore the terms and conditions of these offers in detail.

How Long Does the 0% Interest Period Last?

The duration of the 0% interest period can vary depending on the specific promotion. Common terms include:

- 6 months

- 12 months

- 18 months

- 24 months

It's crucial to check the terms of each offer, as some may have different durations or eligibility requirements. Always ensure you understand the repayment schedule to avoid unexpected interest charges.

Eligibility Requirements for Home Depot Credit Card 0% Interest

Not everyone qualifies for the Home Depot credit card 0% interest offers. To be eligible, you must meet certain criteria set by Synchrony Bank, the financial institution that partners with Home Depot to provide these credit cards.

Key Eligibility Factors

Here are some of the factors that determine your eligibility:

Read also:Sarah Marie Erome The Rise Of A Digital Phenomenon

- Credit Score: A good or excellent credit score is often required to qualify for the best terms and conditions.

- Income Verification: Lenders may review your income to assess your ability to repay the loan.

- Employment History: A stable employment history can improve your chances of approval.

Additionally, applicants with a history of late payments or bankruptcy may face challenges in securing approval for these offers.

Advantages of Using Home Depot Credit Card 0% Interest

There are numerous advantages to using the Home Depot credit card 0% interest promotions. Here are some of the most significant benefits:

1. Interest-Free Financing

Perhaps the most obvious advantage is the ability to finance purchases without accruing interest during the promotional period. This can result in significant savings, especially for large projects.

2. Flexible Repayment Terms

With repayment terms ranging from 6 to 24 months, customers have the flexibility to choose a schedule that works best for their budget. This makes it easier to manage cash flow without the added stress of high monthly payments.

3. Exclusive Discounts and Rewards

Home Depot credit card holders often enjoy exclusive discounts and rewards, such as cashback on purchases, special financing offers, and access to member-only sales. These perks can further enhance the value of the card.

Common Misconceptions About Home Depot Credit Card 0% Interest

While the Home Depot credit card 0% interest offers are incredibly beneficial, there are some common misconceptions that could lead to financial pitfalls. Here are a few to watch out for:

1. Interest-Free Means No Cost

Many people mistakenly believe that interest-free financing means there are no costs associated with the card. However, if the balance is not paid off by the end of the promotional period, interest charges may apply retroactively. It's essential to understand the terms and make timely payments to avoid unexpected expenses.

2. No Impact on Credit Score

Using a credit card responsibly can actually improve your credit score. However, if you miss payments or carry a high balance, it could negatively impact your credit rating. Always manage your credit card usage wisely to maintain a healthy financial profile.

How to Apply for Home Depot Credit Card 0% Interest

Applying for the Home Depot credit card 0% interest offer is a straightforward process. Follow these steps to get started:

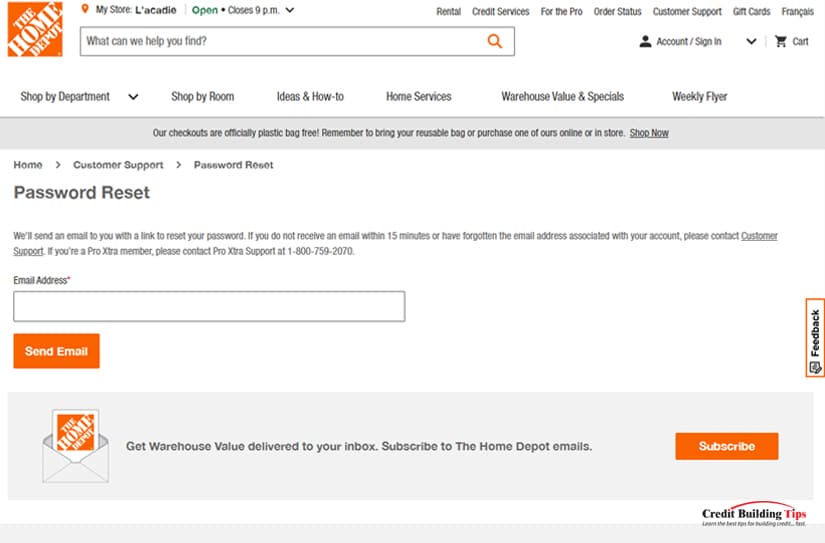

Step 1: Visit the Official Website

Go to the official Home Depot website and navigate to the credit card section. From there, you can find more information about the available offers and begin the application process.

Step 2: Complete the Application Form

Fill out the application form with your personal and financial information. Be sure to provide accurate details to increase your chances of approval.

Step 3: Review the Terms and Conditions

Before submitting your application, carefully review the terms and conditions of the offer. Understanding the repayment schedule, interest rates, and any fees associated with the card is crucial for making an informed decision.

Managing Your Home Depot Credit Card Responsibly

Once you've been approved for the Home Depot credit card 0% interest offer, it's important to manage it responsibly. Here are some tips to help you stay on track:

1. Set Up Automatic Payments

Automating your payments ensures that you never miss a deadline, which can help you avoid late fees and maintain a good credit score.

2. Keep Track of Your Balance

Regularly monitor your account to ensure you're on track to pay off the balance before the promotional period ends. This will help you avoid retroactive interest charges.

3. Use the Card for Large Purchases Only

Reserve the Home Depot credit card for large home improvement projects rather than everyday expenses. This will help you maximize the benefits of the 0% interest offer.

Home Depot Credit Card vs. Other Retail Credit Cards

When comparing the Home Depot credit card to other retail credit cards, it's important to consider the unique features and benefits each offers. Here's a breakdown of how the Home Depot card stacks up:

1. Interest Rates

While the Home Depot credit card offers 0% interest during the promotional period, standard rates can be higher than some competitors. Always compare rates before making a decision.

2. Rewards Programs

Home Depot's rewards program is one of the most generous in the industry, offering cashback and exclusive discounts on purchases. This can make the card more valuable in the long run.

3. Customer Support

Synchrony Bank, which partners with Home Depot, is known for its excellent customer service. This can be a significant advantage if you ever encounter issues with your account.

Expert Tips for Maximizing Your Savings

To make the most of your Home Depot credit card 0% interest offer, consider the following expert tips:

1. Plan Your Projects Carefully

Before making any purchases, carefully plan your projects to ensure you're using the card for the most cost-effective purposes. This will help you maximize your savings.

2. Take Advantage of Promotions

Keep an eye out for special promotions and discounts that can further enhance the value of your card. Combining these offers with the 0% interest promotion can result in significant savings.

3. Stay Informed

Regularly check the Home Depot website and your account for updates on promotions, terms, and conditions. Staying informed will help you make the most of your credit card experience.

Conclusion

The Home Depot credit card 0% interest offers provide an excellent opportunity for homeowners to finance their projects without the burden of high interest rates. By understanding the terms, conditions, and benefits of these promotions, you can make informed decisions that lead to significant savings.

We encourage you to take action by applying for the card and exploring the various promotions available. Don't forget to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our site for more tips and insights into home improvement financing.

Table of Contents

- Understanding Home Depot Credit Card 0% Interest Offers

- Eligibility Requirements for Home Depot Credit Card 0% Interest

- Advantages of Using Home Depot Credit Card 0% Interest

- Common Misconceptions About Home Depot Credit Card 0% Interest

- How to Apply for Home Depot Credit Card 0% Interest

- Managing Your Home Depot Credit Card Responsibly

- Home Depot Credit Card vs. Other Retail Credit Cards

- Expert Tips for Maximizing Your Savings

- Conclusion

For more detailed information, refer to trusted sources such as The Balance and Investopedia. These resources provide additional insights into credit card usage and financial management.