When it comes to home improvement projects, having the right financial tools can make all the difference. Homedepot credit card offers provide homeowners and DIY enthusiasts with a convenient way to manage expenses while enjoying exclusive benefits. Whether you're renovating your kitchen, landscaping your yard, or simply updating your home's decor, these credit card deals can save you money and simplify your shopping experience.

Homedepot credit card offers are designed to cater to the needs of both casual shoppers and professional contractors. With features such as interest-free financing, cashback rewards, and special discounts, these cards are a must-have for anyone looking to maximize their savings. Additionally, these offers are tailored to help you stay within budget while tackling your next big project.

In this comprehensive guide, we will explore the various Homedepot credit card offers available, their benefits, and how you can make the most of them. Whether you're a first-time homeowner or a seasoned renovator, this article will provide you with all the information you need to make an informed decision. Let's dive in and discover how these credit card deals can enhance your shopping experience at The Home Depot.

Read also:Mastering Osrs Basilisk Sentinel A Comprehensive Guide For Runescape Enthusiasts

Table of Contents

- Introduction to Homedepot Credit Card Offers

- Types of Homedepot Credit Cards

- Exclusive Benefits of Homedepot Credit Card Offers

- Sign-Up Bonuses and Promotions

- Interest-Free Financing Options

- Rewards Programs and Cashback

- Comparison of Homedepot Credit Card Offers

- Eligibility Requirements

- Tips for Maximizing Your Homedepot Credit Card Benefits

- Frequently Asked Questions

Introduction to Homedepot Credit Card Offers

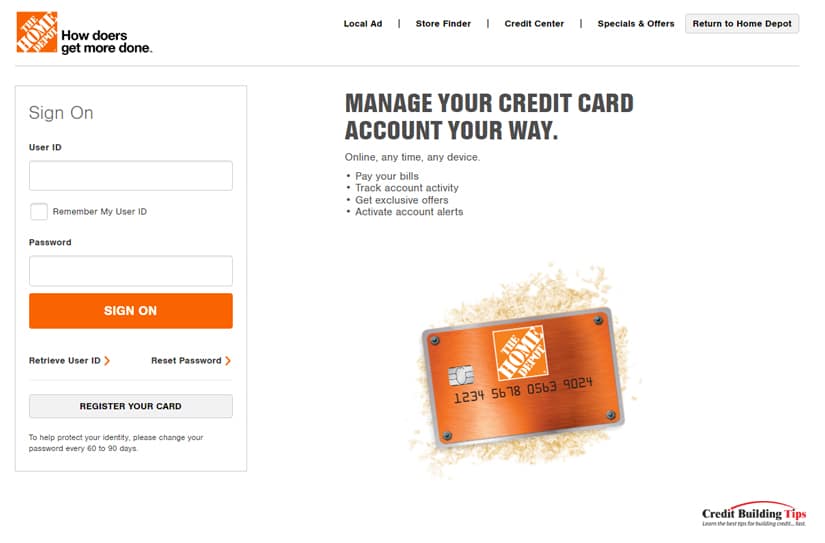

Homedepot credit card offers have become increasingly popular among homeowners and contractors alike. These cards are specifically designed to cater to the needs of individuals who frequently shop at The Home Depot, providing them with a range of benefits and perks. From exclusive discounts to interest-free financing, these offers can significantly reduce the cost of your home improvement projects.

One of the key advantages of using a Homedepot credit card is the ability to access special financing options. Whether you're purchasing a new appliance or undertaking a major renovation, these cards allow you to spread out your payments over time without incurring interest charges. Additionally, cardholders can enjoy cashback rewards, points, and other incentives that make shopping at The Home Depot even more rewarding.

Types of Homedepot Credit Cards

Homedepot offers two primary types of credit cards: the Homedepot Credit Card and the Homedepot Visa Card. Each card comes with its own set of features and benefits, making it important to choose the one that best suits your needs. Below is a brief overview of each card:

- Homedepot Credit Card: This card is designed for use exclusively at The Home Depot. It offers special financing options, discounts, and other perks that make it ideal for home improvement projects.

- Homedepot Visa Card: This card can be used anywhere Visa is accepted, in addition to providing the same benefits as the Homedepot Credit Card. It also offers cashback rewards and additional travel perks.

Exclusive Benefits of Homedepot Credit Card Offers

Homedepot credit card holders enjoy a variety of exclusive benefits that enhance their shopping experience. These benefits include:

- Special Financing: Enjoy interest-free financing on purchases over a certain amount, allowing you to pay off your balance over time without accruing interest.

- Exclusive Discounts: Cardholders receive special discounts on select products and services, helping them save money on their home improvement projects.

- Cashback Rewards: Earn cashback rewards on purchases made with your Homedepot Visa Card, which can be redeemed for statement credits or gift cards.

- Price Protection: If the price of an item you purchased drops within 30 days, you can receive a refund for the difference.

Sign-Up Bonuses and Promotions

When you sign up for a Homedepot credit card, you may qualify for sign-up bonuses and promotional offers. These incentives can include:

- Interest-free financing on your first purchase for a limited time.

- Additional discounts on select products during your first visit to The Home Depot after opening your account.

- Cashback rewards for spending a certain amount within the first few months of account opening.

Be sure to check the terms and conditions of each offer to ensure you meet the eligibility requirements and take full advantage of these promotions.

Read also:September 5 Kpkuang A Comprehensive Guide To Understanding The Significance And Impact

Interest-Free Financing Options

One of the most attractive features of Homedepot credit card offers is the availability of interest-free financing. This allows cardholders to make large purchases without worrying about accruing interest charges. To qualify for this benefit, you must:

- Purchase eligible items with your Homedepot credit card.

- Pay off the balance in full before the promotional period ends.

- Make minimum monthly payments as required.

Interest-free financing is particularly useful for major home improvement projects, such as replacing appliances, installing new flooring, or updating your bathroom. By spreading out your payments over time, you can better manage your budget and avoid financial strain.

Rewards Programs and Cashback

Homedepot credit card offers also include robust rewards programs that allow cardholders to earn points or cashback on their purchases. The Homedepot Visa Card, for example, provides:

- 5% cashback on purchases made at The Home Depot.

- 1% cashback on purchases made elsewhere.

- Additional rewards for spending in specific categories, such as gas and groceries.

These rewards can be redeemed for statement credits, gift cards, or other perks, depending on the card's terms and conditions. By maximizing your rewards, you can further reduce the cost of your home improvement projects and enjoy additional savings.

Comparison of Homedepot Credit Card Offers

When deciding which Homedepot credit card is right for you, it's important to compare the features and benefits of each option. Below is a table summarizing the key differences between the Homedepot Credit Card and the Homedepot Visa Card:

| Feature | Homedepot Credit Card | Homedepot Visa Card |

|---|---|---|

| Eligible Stores | The Home Depot | Anywhere Visa is accepted |

| Rewards | Exclusive discounts and financing | Cashback rewards and additional perks |

| Annual Fee | No | No |

Eligibility Requirements

To qualify for Homedepot credit card offers, you must meet certain eligibility requirements. These typically include:

- Being at least 18 years old.

- Having a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Demonstrating a stable income and good credit history.

It's important to note that approval for a Homedepot credit card is subject to credit approval, and your credit score may impact the terms and conditions of your offer. Be sure to review your credit report before applying to ensure accuracy and improve your chances of approval.

Tips for Maximizing Your Homedepot Credit Card Benefits

To make the most of your Homedepot credit card offers, consider the following tips:

- Take advantage of sign-up bonuses and promotional offers by meeting the spending requirements within the specified timeframe.

- Use your card for large purchases that qualify for interest-free financing, but be sure to pay off the balance in full before the promotional period ends.

- Track your rewards and redeem them regularly to ensure you don't miss out on any benefits.

- Stay within your budget by using your card responsibly and avoiding unnecessary debt.

By following these tips, you can maximize your savings and enjoy the full range of benefits offered by your Homedepot credit card.

Frequently Asked Questions

Here are some common questions about Homedepot credit card offers:

- Can I use my Homedepot credit card at other stores? The Homedepot Credit Card is designed for use exclusively at The Home Depot, while the Homedepot Visa Card can be used anywhere Visa is accepted.

- What happens if I don't pay off my balance during the interest-free period? If you don't pay off your balance in full before the promotional period ends, you will be charged interest on the remaining balance.

- Are there any annual fees for Homedepot credit cards? No, both the Homedepot Credit Card and the Homedepot Visa Card have no annual fees.

Kesimpulan

Homedepot credit card offers provide homeowners and DIY enthusiasts with a convenient and cost-effective way to manage their home improvement expenses. With features such as interest-free financing, cashback rewards, and exclusive discounts, these cards can help you save money and simplify your shopping experience. By choosing the right card and using it responsibly, you can maximize your benefits and enjoy peace of mind when tackling your next big project.

We encourage you to take advantage of these offers by signing up for a Homedepot credit card today. Don't forget to leave a comment below sharing your experiences with Homedepot credit cards, and be sure to check out our other articles for more tips and advice on home improvement and finance. Together, let's build a brighter future for your home!