Looking for ways to make the most out of your home improvement projects without breaking the bank? The Home Depot Card Interest Free offer could be your ultimate solution. Whether you're planning a major renovation or simply upgrading your living space, understanding how this financing option works can help you save significantly.

Home Depot, one of the largest home improvement retailers in the world, offers an attractive financing option through its credit card. The Home Depot Card Interest Free program allows customers to purchase products and services without worrying about interest charges for a specified period. This makes it an excellent choice for those who want to stretch their budgets while tackling their home improvement projects.

In this article, we will explore everything you need to know about the Home Depot Card Interest Free offer. From eligibility requirements to repayment strategies, we will provide you with actionable insights to help you make informed decisions. Let's dive in and discover how you can leverage this opportunity to enhance your home without compromising your financial stability.

Read also:Who Did Sza Date For 11 Years A Deep Dive Into Her Longterm Relationship

Table of Contents

- Introduction to Home Depot Card Interest Free

- Eligibility Requirements

- How to Apply for Home Depot Card

- Understanding the Interest-Free Period

- Benefits of Home Depot Card

- Fees and Charges

- Repayment Strategies

- Tips for Maximizing Your Savings

- Frequently Asked Questions

- Conclusion and Next Steps

Introduction to Home Depot Card Interest Free

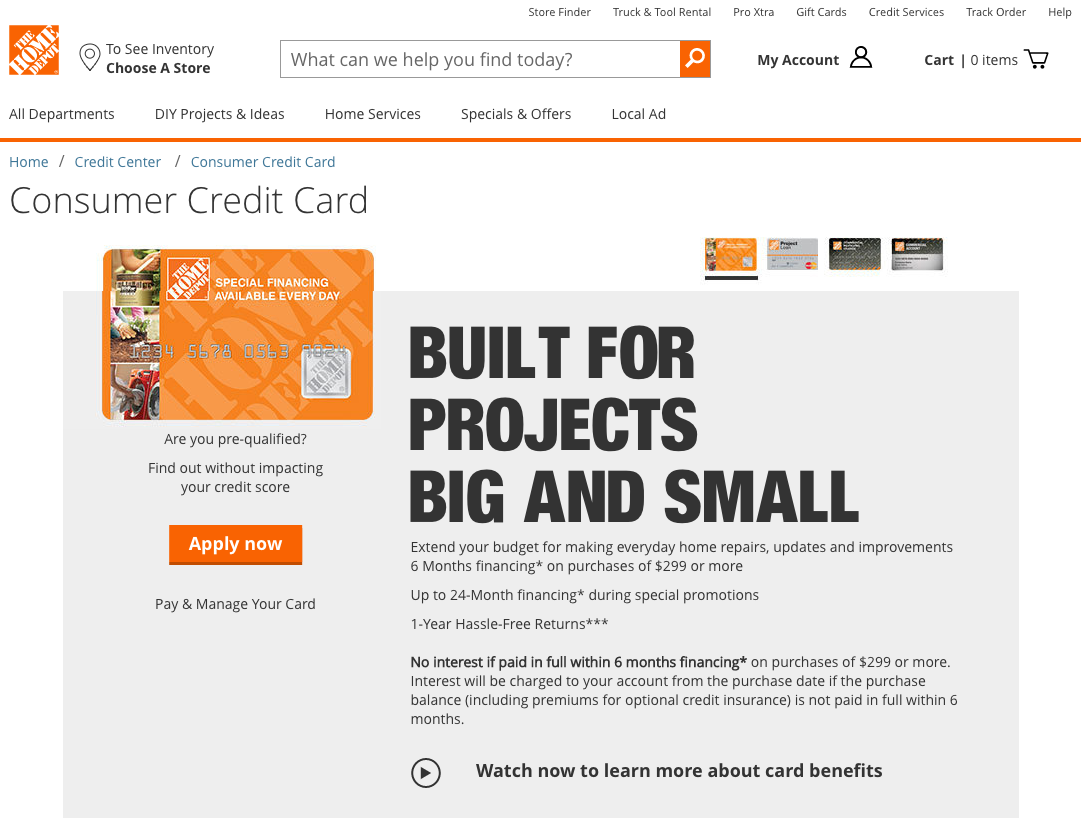

The Home Depot Card Interest Free program is designed to help customers finance their home improvement projects without the burden of interest charges. This special offer allows eligible cardholders to purchase products and services from Home Depot and pay them off over time without incurring interest for a specified period.

How It Works

When you apply for the Home Depot Card, you may qualify for a promotional financing offer. This means you can enjoy interest-free payments for a set period, typically ranging from 6 to 24 months, depending on the purchase amount and the specific promotion. To take full advantage of this offer, it's essential to pay off the balance before the promotional period ends.

Some key points to keep in mind:

- The interest-free period applies only to purchases made during the promotional period.

- Failure to pay off the balance within the promotional period may result in retroactive interest charges.

- Additional purchases made after the promotional period are subject to standard interest rates.

Eligibility Requirements

Not everyone qualifies for the Home Depot Card Interest Free offer. To be eligible, you must meet certain criteria, including:

Credit Score

Your credit score plays a crucial role in determining your eligibility. Generally, a good or excellent credit score increases your chances of approval. However, Home Depot may still consider applicants with lower credit scores on a case-by-case basis.

Income Verification

Home Depot may require proof of income to assess your ability to repay the debt. This can include pay stubs, bank statements, or tax returns. Providing accurate and up-to-date information can improve your chances of approval.

Read also:September 5 Kpkuang A Comprehensive Guide To Understanding The Significance And Impact

How to Apply for Home Depot Card

Applying for the Home Depot Card is a straightforward process. You can apply online, in-store, or by phone. Below are the steps to follow:

Online Application

Visit the official Home Depot website and navigate to the credit card application page. Fill out the required information, including your personal details, income, and employment status. Once submitted, you will receive an instant decision in most cases.

In-Store Application

If you prefer a more personal approach, you can apply for the Home Depot Card at any Home Depot store. A sales associate can assist you with the application process and answer any questions you may have.

Understanding the Interest-Free Period

The interest-free period is one of the most attractive features of the Home Depot Card. During this time, you can make purchases without worrying about interest charges. However, it's important to understand the terms and conditions to avoid unexpected fees.

Promotional Financing Offers

Home Depot offers various promotional financing options, such as:

- Special financing on purchases over a certain amount.

- Extended interest-free periods for major projects.

- Rebate offers on specific products or categories.

Be sure to read the fine print and understand the terms of each offer before making a purchase.

Benefits of Home Depot Card

Using the Home Depot Card Interest Free offer comes with several advantages, including:

Cost Savings

By avoiding interest charges, you can save a significant amount of money on your home improvement projects. This makes it easier to stay within your budget while still achieving your desired results.

Flexibility

The Home Depot Card provides flexibility in terms of payment options. You can choose to pay off the balance in full or make minimum payments during the promotional period, depending on your financial situation.

Fees and Charges

While the Home Depot Card Interest Free offer can save you money, it's important to be aware of potential fees and charges:

Annual Fee

Some versions of the Home Depot Card come with an annual fee, while others do not. Be sure to check the specific terms of the card you are applying for.

Late Payment Fees

Missing a payment can result in late fees and may negatively impact your credit score. To avoid this, set up automatic payments or reminders to ensure timely payments.

Repayment Strategies

To make the most of the Home Depot Card Interest Free offer, it's essential to have a solid repayment strategy. Here are some tips to consider:

Create a Budget

Before making any purchases, create a budget that outlines your expected expenses and repayment timeline. This will help you stay on track and avoid unnecessary debt.

Set Up Automatic Payments

Automating your payments ensures that you never miss a due date. This can help you avoid late fees and maintain a good credit score.

Tips for Maximizing Your Savings

Beyond the interest-free period, there are several ways to maximize your savings with the Home Depot Card:

Take Advantage of Rebates

Home Depot often offers rebates on specific products or categories. Keep an eye out for these promotions and take advantage of them to further reduce your costs.

Combine Offers

If possible, combine multiple offers, such as promotional financing and rebates, to maximize your savings. This requires careful planning and timing, but the rewards can be significant.

Frequently Asked Questions

Here are some common questions about the Home Depot Card Interest Free offer:

What happens if I don't pay off the balance within the promotional period?

If you fail to pay off the balance within the promotional period, you may be charged interest retroactively on the entire purchase amount. To avoid this, make sure to pay off the balance before the promotional period ends.

Can I use the Home Depot Card at other retailers?

No, the Home Depot Card is only accepted at Home Depot stores and their online platform. However, you can use it to purchase products and services from authorized Home Depot partners.

Conclusion and Next Steps

The Home Depot Card Interest Free offer provides an excellent opportunity for homeowners to finance their projects without the burden of interest charges. By understanding the eligibility requirements, application process, and repayment strategies, you can make informed decisions and maximize your savings.

Take the first step today by applying for the Home Depot Card and exploring the available financing options. Don't forget to share your experience in the comments below and check out our other articles for more tips and insights on home improvement financing.

For more information, visit the official Home Depot website.