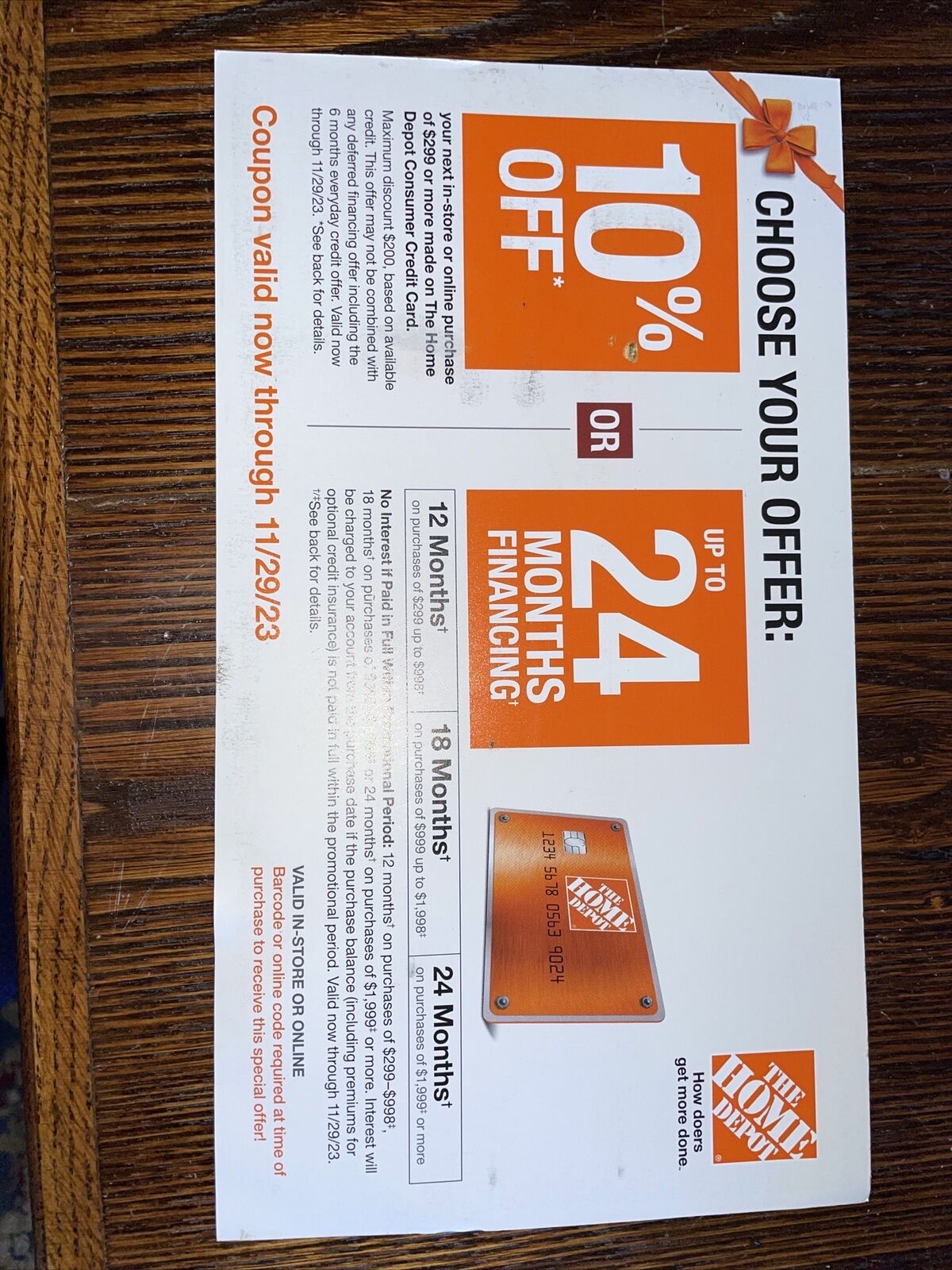

Are you looking for a way to finance your home improvement projects without worrying about interest rates? The Home Depot 24 months no interest financing option is a fantastic way to achieve this goal. This financing plan allows you to upgrade your home, purchase appliances, or tackle any renovation project without the added burden of interest payments for two years.

Home Depot, one of the largest home improvement retailers in the world, offers an enticing credit card program that enables customers to enjoy 24 months of no interest on purchases over a certain amount. This is perfect for those planning significant home upgrades or purchases of large items like appliances, flooring, or furniture.

In this comprehensive guide, we will explore everything you need to know about Home Depot's 24 months no interest financing. From eligibility requirements and how the program works to tips for maximizing the benefits, we've got you covered. Let’s dive in!

Read also:Keith Sapsford The Ultimate Guide To His Career Achievements And Legacy

Table of Contents

- Introduction to Home Depot 24 Months No Interest

- Eligibility Requirements

- How the Home Depot 24 Months No Interest Works

- Benefits of Choosing Home Depot Financing

- Common Items Purchased with No Interest Financing

- Steps to Apply for Home Depot Credit Card

- Understanding the Payment Plan

- How to Avoid Interest Charges

- Frequently Asked Questions

- Conclusion

Introduction to Home Depot 24 Months No Interest

The Home Depot 24 months no interest financing plan is designed to help customers finance their home improvement projects without the added cost of interest. Whether you're remodeling your kitchen, installing new windows, or purchasing a new refrigerator, this financing option can significantly ease the financial burden.

Why Choose Home Depot Financing?

Home Depot’s financing plan offers several advantages, including:

- Zero interest for up to 24 months

- Access to exclusive discounts and promotions

- Flexible payment options

By taking advantage of this financing option, you can spread out the cost of your purchase over two years without incurring additional charges.

Eligibility Requirements

Before you can take advantage of Home Depot's 24 months no interest offer, you must meet certain eligibility criteria. Here’s what you need to know:

Credit Score Requirements

One of the primary factors in determining your eligibility is your credit score. Home Depot typically requires a good credit score to qualify for their financing plan. While the exact score needed may vary, having a score of 670 or higher significantly increases your chances of approval.

In addition to your credit score, Home Depot will also review your credit history to assess your financial responsibility.

Read also:Alex Karp Partner Exploring The Visionary Force Behind Palantir Technologies

How the Home Depot 24 Months No Interest Works

Understanding how the financing plan works is crucial to making the most of it. Here’s a step-by-step breakdown:

Step 1: Make a Qualifying Purchase

First, you need to make a purchase that qualifies for the 24 months no interest financing. Typically, this includes items over a certain dollar amount, such as appliances, furniture, or major home improvement projects.

Step 2: Apply for Home Depot Credit Card

Next, you’ll need to apply for the Home Depot credit card. This can be done online or in-store. The application process is quick and straightforward, and you’ll receive an instant decision in most cases.

Step 3: Pay Off Your Balance Within 24 Months

To avoid interest charges, you must pay off the full balance of your purchase within the 24-month period. If you fail to do so, interest will be charged retroactively from the date of purchase.

Benefits of Choosing Home Depot Financing

There are numerous benefits to using Home Depot's 24 months no interest financing plan:

1. Zero Interest for 24 Months

One of the most significant advantages is the ability to finance your purchases without paying any interest for two years. This allows you to budget your payments more effectively.

2. Exclusive Discounts

Home Depot cardholders often receive exclusive discounts and promotions, further reducing the cost of your purchases.

3. Flexible Payment Options

With flexible payment options, you can choose a payment plan that suits your financial situation, ensuring you stay on track to pay off your balance within the 24-month period.

Common Items Purchased with No Interest Financing

Many customers use Home Depot's 24 months no interest financing to purchase a variety of items. Here are some of the most common:

- Appliances (refrigerators, ovens, dishwashers)

- Furniture (sofas, beds, dining tables)

- Home improvement materials (lumber, tiles, flooring)

- Landscaping equipment (lawn mowers, trimmers, sprinklers)

These items often come with a higher price tag, making the financing plan an attractive option for many buyers.

Steps to Apply for Home Depot Credit Card

Applying for the Home Depot credit card is a simple process. Follow these steps to get started:

Step 1: Gather Necessary Information

Before applying, ensure you have the necessary information, including your Social Security number, income details, and billing address.

Step 2: Complete the Application

You can apply for the Home Depot credit card either online or in-store. The application process is quick and usually takes just a few minutes.

Step 3: Receive Your Decision

Once you submit your application, you’ll receive an instant decision in most cases. If approved, you can begin using your card immediately.

Understanding the Payment Plan

Understanding your payment plan is essential to avoiding interest charges. Here’s what you need to know:

Minimum Monthly Payments

While you are not required to pay off the full balance immediately, you must make minimum monthly payments to keep your account in good standing. Failing to make these payments can result in penalties and affect your credit score.

Final Payment Due Date

It’s crucial to know the final payment due date to ensure you pay off your balance within the 24-month period. Mark this date on your calendar and plan accordingly.

How to Avoid Interest Charges

Avoiding interest charges is simple if you follow these tips:

- Make regular monthly payments

- Set up automatic payments to ensure you never miss a due date

- Pay off the full balance before the 24-month period ends

By sticking to these guidelines, you can enjoy the full benefits of Home Depot's 24 months no interest financing plan.

Frequently Asked Questions

Q: What happens if I don’t pay off my balance within 24 months?

A: If you fail to pay off your balance within the 24-month period, interest will be charged retroactively from the date of purchase.

Q: Can I use the Home Depot credit card for other purchases?

A: Yes, the Home Depot credit card can be used for any purchase at Home Depot stores or on their website.

Q: Is there an annual fee for the Home Depot credit card?

A: No, the Home Depot credit card does not have an annual fee.

Conclusion

Home Depot's 24 months no interest financing plan is an excellent option for those looking to finance their home improvement projects or large purchases without the added burden of interest. By understanding the eligibility requirements, how the plan works, and tips for avoiding interest charges, you can make the most of this fantastic offer.

We encourage you to take advantage of this financing option and start planning your next home improvement project. Don’t forget to share your thoughts and experiences in the comments section below. For more informative articles like this, be sure to explore our website further!