Insurance is one of the most critical financial decisions you can make, and GEICO offers some of the best rates in the industry. If you're looking to get a call GEICO insurance quote, this article will guide you through the process step by step. Whether you're a first-time buyer or a seasoned policyholder, understanding the nuances of insurance quoting can save you significant money.

GEICO, or Government Employees Insurance Company, has been a trusted name in the insurance industry for decades. Their reputation for affordability and customer service makes them a top choice for millions of drivers. In this article, we'll explore how to get a call GEICO insurance quote and make the most out of your insurance plan.

Before diving into the details, it's essential to understand why obtaining a call GEICO insurance quote is crucial. Insurance premiums vary widely depending on several factors, including your driving history, location, and the type of vehicle you own. By knowing how to navigate the quoting process, you can ensure you're getting the best deal possible.

Read also:How Old Was Eminem When He Had Hailie Exploring The Story Behind Eminems Family Life

Table of Contents

- Introduction to GEICO Insurance

- Why Choose GEICO for Your Insurance Needs?

- How to Get a Call GEICO Insurance Quote

- Factors Affecting Your Insurance Premiums

- Common Discounts Offered by GEICO

- Understanding Your GEICO Insurance Policy

- GEICO's Customer Service: What to Expect

- Frequently Asked Questions About GEICO Insurance

- Comparison with Other Insurance Providers

- Conclusion and Next Steps

Introduction to GEICO Insurance

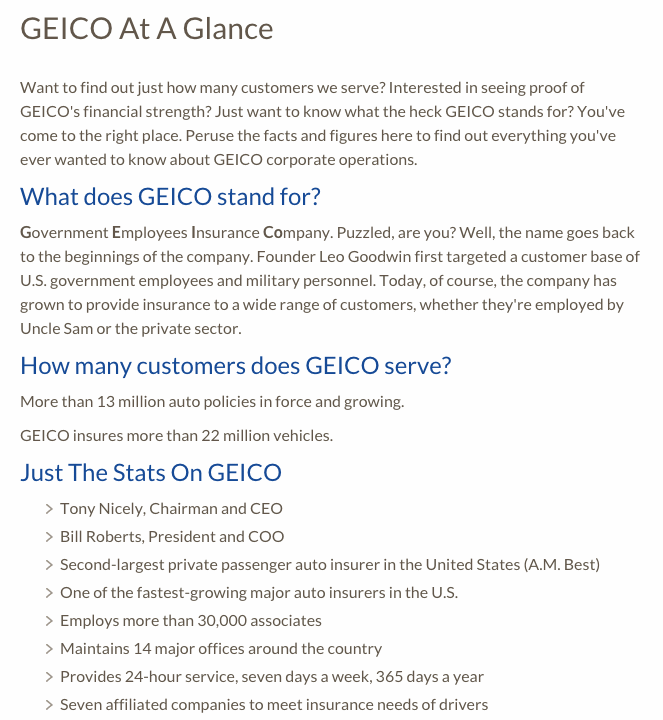

GEICO is one of the largest auto insurance providers in the United States, serving millions of customers annually. Established in 1936, the company has built a reputation for offering competitive rates and exceptional customer service. If you're considering a call GEICO insurance quote, it's important to understand the company's background and offerings.

History of GEICO

GEICO started as a small company catering exclusively to government employees. Over the years, they expanded their services to include a broader customer base. Today, they offer a wide range of insurance products, including auto, motorcycle, boat, and home insurance.

Why GEICO Stands Out

- Competitive pricing

- Wide range of coverage options

- Excellent customer service

- Convenient online and phone services

Why Choose GEICO for Your Insurance Needs?

Choosing the right insurance provider can be overwhelming, but GEICO offers several advantages that set it apart from competitors. When you opt for a call GEICO insurance quote, you're not just getting a number; you're gaining access to a comprehensive insurance solution.

Customer-Centric Approach

GEICO prioritizes customer satisfaction, ensuring that every interaction is smooth and hassle-free. Their dedicated agents are available 24/7 to assist with any questions or concerns you may have.

Flexible Coverage Options

Whether you need basic liability coverage or comprehensive protection, GEICO has a plan that suits your needs. Their flexible policies allow you to customize your coverage to match your budget and lifestyle.

How to Get a Call GEICO Insurance Quote

Getting a call GEICO insurance quote is easier than you might think. Follow these steps to ensure you receive an accurate and personalized quote:

Read also:September 5 Kpkuang A Comprehensive Guide To Understanding The Significance And Impact

Contacting GEICO

- Call the official GEICO hotline at 1-800-947-3539

- Provide your personal and vehicle information

- Discuss your coverage preferences with a representative

What to Expect During the Call

During your call, a GEICO agent will guide you through the quoting process. They will ask for details about your driving history, vehicle specifications, and desired coverage levels. Be prepared to answer questions honestly to ensure an accurate quote.

Factors Affecting Your Insurance Premiums

Several factors influence the cost of your call GEICO insurance quote. Understanding these factors can help you identify areas where you can save money:

Driving History

Your driving record plays a significant role in determining your premiums. Safe drivers with no accidents or violations typically receive lower rates.

Vehicle Type

The make, model, and year of your vehicle affect your insurance costs. Luxury cars or high-performance vehicles often come with higher premiums due to their increased value and repair costs.

Common Discounts Offered by GEICO

GEICO offers a variety of discounts to help you save on your insurance premiums. Here are some of the most popular ones:

- Safe Driver Discount

- Military Discount

- Multiple Policy Discount

- Low Mileage Discount

Understanding Your GEICO Insurance Policy

Once you've obtained your call GEICO insurance quote, it's essential to review your policy carefully. Understanding the terms and conditions ensures you're fully protected in case of an accident or other covered events.

Key Policy Components

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

GEICO's Customer Service: What to Expect

GEICO prides itself on delivering exceptional customer service. Their agents are trained to handle inquiries promptly and efficiently, ensuring a seamless experience for policyholders.

Available Resources

- 24/7 Phone Support

- Online Account Management

- Mobile App Features

Frequently Asked Questions About GEICO Insurance

Here are some common questions people have about GEICO insurance:

How Long Does It Take to Get a Quote?

Getting a call GEICO insurance quote typically takes around 10-15 minutes, depending on the complexity of your request.

Can I Modify My Policy After Purchase?

Yes, you can adjust your coverage at any time by contacting a GEICO representative. They will assist you in making the necessary changes.

Comparison with Other Insurance Providers

While GEICO is a top contender in the insurance market, it's always wise to compare options before making a decision. Here's how GEICO stacks up against other providers:

Price Comparison

GEICO consistently offers competitive rates, often lower than those of major competitors. However, prices can vary based on individual circumstances.

Service Quality

GEICO's customer service ratings are consistently high, with many customers praising their responsiveness and professionalism.

Conclusion and Next Steps

Obtaining a call GEICO insurance quote is a smart move for anyone looking to secure affordable and reliable auto insurance. By following the steps outlined in this guide, you can ensure you're getting the best deal possible.

We encourage you to take action today by contacting GEICO for a personalized quote. Don't forget to explore the various discounts available to maximize your savings. If you found this article helpful, please share it with others and leave a comment below. For more tips and guides on insurance, explore our other resources on the website.

Data source: GEICO Official Website