In today's financial landscape, improving your credit score is more important than ever. Experian Boost offers a unique opportunity to enhance your credit score by including utility and telecom bill payments. But what bills qualify for Experian Boost? Understanding the eligibility criteria and process is crucial for maximizing this service's benefits.

Experian Boost is designed to help individuals build credit history by leveraging everyday bill payments. By incorporating non-traditional financial data, users can potentially boost their credit scores and improve their financial standing. This article will delve into the specifics of which bills qualify, how the process works, and how you can take advantage of this tool.

As we explore this topic, we will provide actionable insights, expert advice, and data-driven recommendations to ensure you make the most of Experian Boost. Whether you're new to credit building or looking to optimize your financial health, this guide will serve as your ultimate resource.

Read also:Shawn Wayans Height Unveiling The Starrsquos True Stature And More

Table of Contents

- Introduction to Experian Boost

- What Bills Qualify for Experian Boost?

- How Does Experian Boost Work?

- Eligibility Criteria for Experian Boost

- Benefits of Using Experian Boost

- Limitations of Experian Boost

- Step-by-Step Guide to Using Experian Boost

- Common Questions About Experian Boost

- Alternatives to Experian Boost

- Conclusion and Call to Action

Introduction to Experian Boost

Experian Boost is a revolutionary credit-building tool that allows users to include their utility, telecom, and streaming service payments in their credit file. Traditionally, credit scores are based on factors like credit card payments, loans, and mortgages. However, Experian Boost expands the scope of credit data, offering a more comprehensive view of an individual's financial responsibility.

How It Differs from Traditional Credit Reporting

Unlike traditional credit reporting methods, Experian Boost focuses on non-traditional payment data. This means that payments such as cell phone bills, internet services, and streaming subscriptions can positively impact your credit score. By incorporating these payments, Experian Boost provides a more accurate representation of your financial habits.

Why Experian Boost Matters

For individuals with limited or no credit history, Experian Boost can be a game-changer. It offers a pathway to build credit without the need for credit cards or loans. Additionally, it can help those with existing credit challenges improve their scores by showcasing a broader range of responsible financial behavior.

What Bills Qualify for Experian Boost?

Understanding which bills qualify for Experian Boost is essential for maximizing its benefits. Below, we break down the types of payments that are eligible for inclusion:

Utility Bills

Utility bills, including electricity, water, and gas, are among the most common payments that qualify for Experian Boost. These essential services are often overlooked in traditional credit reporting but play a significant role in demonstrating financial responsibility.

Telecommunication Bills

Cell phone and landline bills are also eligible for inclusion. If you consistently pay your telecom bills on time, this can positively influence your credit score. Experian Boost allows you to leverage these payments to build a stronger credit profile.

Read also:Unveiling The Power Of Wwweastandardnet Your Ultimate Source For African News

Streaming Services

Streaming services like Netflix, Hulu, and Spotify are increasingly being recognized as part of modern household expenses. By including these payments in your credit file, you can demonstrate a broader range of financial reliability.

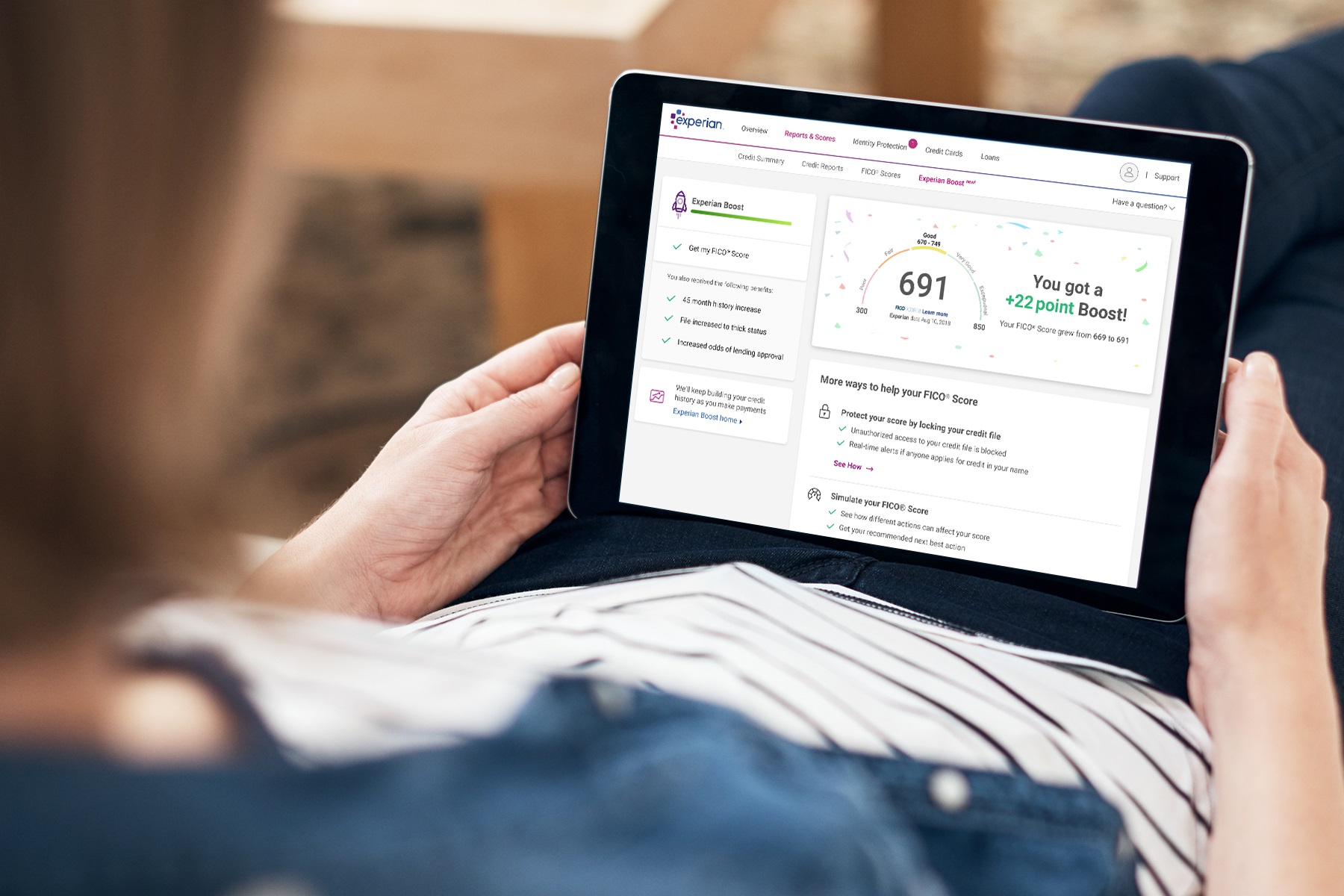

How Does Experian Boost Work?

Experian Boost works by connecting to your bank account to identify eligible payments. Once connected, the system scans your transaction history and identifies qualifying bills. Users can then choose which payments they want to include in their credit file.

Connecting Your Bank Account

The process begins by linking your bank account to the Experian Boost platform. This secure connection ensures that only relevant and accurate data is used to enhance your credit profile. It's important to note that Experian Boost does not access or store your bank account information; it only reviews transaction history.

Identifying Eligible Payments

After connecting your bank account, Experian Boost scans your transaction history to identify eligible payments. The system uses advanced algorithms to detect utility, telecom, and streaming service payments. Users can review and confirm which payments they want to include before finalizing the process.

Eligibility Criteria for Experian Boost

To qualify for Experian Boost, certain criteria must be met. Below are the key eligibility requirements:

- You must have an active Experian account.

- Your bank account must be linked to the Experian Boost platform.

- You must have eligible payments in your transaction history.

- Your payments must be made on time and consistently.

Who Can Use Experian Boost?

Experian Boost is available to anyone with an Experian account and a bank account that supports the service. It is particularly beneficial for individuals with limited credit history or those looking to improve their credit scores.

Benefits of Using Experian Boost

Using Experian Boost offers numerous advantages, including:

- Improved Credit Scores: By including non-traditional payments, users can potentially see an increase in their credit scores.

- Comprehensive Credit Profile: Experian Boost provides a more complete picture of your financial habits, showcasing responsible behavior beyond traditional credit metrics.

- Free Service: Experian Boost is free to use, making it an accessible option for anyone looking to build or improve their credit.

Long-Term Financial Benefits

Over time, using Experian Boost can lead to better credit opportunities, such as lower interest rates on loans and credit cards. It can also improve your chances of being approved for rental agreements or new credit accounts.

Limitations of Experian Boost

While Experian Boost offers many benefits, it is not without limitations. Below are some key considerations:

- Experian Boost only affects your Experian credit report, not those from other credit bureaus like Equifax or TransUnion.

- Not all lenders use Experian data, so the impact on loan approvals may vary.

- The service relies on accurate transaction history, so any discrepancies in your bank account could affect eligibility.

Understanding Its Scope

It's important to recognize that Experian Boost is not a substitute for traditional credit-building methods. It should be used in conjunction with responsible financial practices to achieve the best results.

Step-by-Step Guide to Using Experian Boost

Here’s a step-by-step guide to getting started with Experian Boost:

- Create or log in to your Experian account.

- Link your bank account to the Experian Boost platform.

- Allow the system to scan your transaction history for eligible payments.

- Review and select the payments you want to include in your credit file.

- Finalize the process and monitor your credit score improvements.

Tips for Maximizing Results

To maximize the benefits of Experian Boost, ensure that your transaction history is accurate and up-to-date. Pay your bills on time and consistently to demonstrate financial responsibility. Regularly review your credit report to track progress and identify areas for improvement.

Common Questions About Experian Boost

Below are answers to some frequently asked questions about Experian Boost:

Does Experian Boost Affect My Credit Report?

Yes, Experian Boost affects your Experian credit report by adding non-traditional payment data. This can lead to an improved credit score if your payments are consistent and on time.

Is Experian Boost Free?

Yes, Experian Boost is free to use. There are no fees associated with connecting your bank account or including eligible payments in your credit file.

Can I Remove Payments from My Credit File?

Yes, you can remove payments from your credit file at any time. Experian Boost gives you full control over which payments are included in your credit profile.

Alternatives to Experian Boost

If Experian Boost does not meet your needs, there are alternative credit-building tools available:

- UltraFICO Score: Allows users to leverage their bank account data to improve their credit score.

- Experian CreditWorks: Offers personalized credit-building strategies and tools.

- Secured Credit Cards: Provide a traditional method for building credit by requiring a security deposit.

Comparing Options

When choosing a credit-building tool, consider factors such as ease of use, cost, and impact on your credit score. Each option has its own benefits and limitations, so it's important to select the one that best aligns with your financial goals.

Conclusion and Call to Action

In conclusion, Experian Boost offers a valuable opportunity to improve your credit score by including everyday bill payments. By understanding which bills qualify and how the service works, you can take control of your financial future. Remember to use Experian Boost in conjunction with responsible financial practices to achieve the best results.

We encourage you to take action today by signing up for Experian Boost and exploring its benefits. Leave a comment below to share your experiences or ask questions. Don't forget to explore other articles on our site for more tips on improving your financial health.