Filing taxes can be a daunting task, especially for Spanish-speaking individuals living in the United States. TurboTax Espanol offers a solution by providing a user-friendly platform to simplify the tax filing process for Spanish speakers. Whether you're a resident, citizen, or green card holder, TurboTax Espanol ensures that you can file your taxes confidently and accurately in your preferred language.

Taxes are an unavoidable responsibility for everyone earning income in the U.S., but language barriers should not hinder your ability to meet these obligations. TurboTax Espanol bridges the gap by offering intuitive tools and resources tailored specifically for Spanish-speaking taxpayers. From federal to state returns, this platform covers all aspects of tax preparation.

Understanding the importance of financial literacy and compliance, TurboTax Espanol provides a secure, reliable, and accessible service for individuals seeking to file their taxes efficiently. This guide will delve into the features, benefits, and steps involved in using TurboTax Espanol, ensuring you have all the information you need to make the most of this service.

Read also:Harvey Specter Salary In Suits The Untold Story Of One Of Tvs Most Iconic Characters

Table of Contents

- Introduction to TurboTax Espanol

- Key Features of TurboTax Espanol

- Benefits of Using TurboTax Espanol

- Step-by-Step Process to File Taxes

- Cost and Pricing Options

- Security and Privacy Measures

- Customer Support and Resources

- Frequently Asked Questions

- Comparison with Other Tax Services

- Conclusion and Call to Action

Introduction to TurboTax Espanol

Understanding TurboTax Espanol

TurboTax Espanol is a specialized version of TurboTax designed to assist Spanish-speaking taxpayers in the U.S. It offers a fully translated platform that ensures users can navigate the tax filing process without language barriers. Whether you're a newcomer to the U.S. or a long-time resident, TurboTax Espanol provides the tools and support needed to file taxes accurately and efficiently.

Why Choose TurboTax Espanol?

The primary advantage of TurboTax Espanol lies in its accessibility. The platform is equipped with features that cater specifically to the needs of Spanish speakers, including bilingual support and resources. By choosing TurboTax Espanol, users gain peace of mind knowing they have access to a service that understands their unique challenges and provides solutions tailored to their requirements.

Who Can Use TurboTax Espanol?

TurboTax Espanol is suitable for anyone who speaks Spanish and needs to file taxes in the U.S. This includes citizens, residents, and individuals with green cards. Whether you're filing federal or state taxes, TurboTax Espanol can guide you through the process step by step, ensuring compliance with all legal requirements.

Key Features of TurboTax Espanol

1. Fully Translated Interface

TurboTax Espanol boasts a fully translated interface, allowing users to interact with the platform entirely in Spanish. From the homepage to the final submission, every aspect of the platform is designed to accommodate Spanish-speaking users, ensuring clarity and ease of use.

2. Comprehensive Tax Guidance

The platform offers detailed guidance on various tax-related topics, such as deductions, credits, and exemptions. Users can access this information in Spanish, ensuring they understand the nuances of U.S. tax laws and how they apply to their situation.

3. Mobile Compatibility

TurboTax Espanol is mobile-friendly, enabling users to file their taxes on the go. With a responsive design, the platform ensures a seamless experience across devices, whether you're using a smartphone, tablet, or desktop.

Read also:Unveiling The Power Of Wwweastandardnet Your Ultimate Source For African News

Benefits of Using TurboTax Espanol

1. Simplified Tax Filing

One of the primary benefits of TurboTax Espanol is its ability to simplify the tax filing process. By breaking down complex tax concepts into easy-to-understand steps, the platform empowers users to complete their returns with confidence.

2. Increased Accuracy

With TurboTax Espanol, users can rest assured that their returns are accurate. The platform incorporates advanced algorithms to detect errors and ensure compliance with IRS regulations, minimizing the risk of mistakes.

3. Cost-Effective Solution

Compared to hiring a tax professional, TurboTax Espanol offers a cost-effective solution for Spanish-speaking taxpayers. The platform's pricing options cater to various budgets, making it accessible to a wide range of users.

Step-by-Step Process to File Taxes

1. Account Setup

Begin by creating an account on TurboTax Espanol. This process involves providing basic information, such as your name, email address, and preferred language settings.

2. Data Entry

Once your account is set up, you can start entering your tax information. TurboTax Espanol guides you through this process, asking relevant questions and collecting necessary data to complete your return.

3. Review and Submission

Before submitting your return, TurboTax Espanol allows you to review all entered information. This step ensures accuracy and gives you the opportunity to make any necessary corrections before final submission.

Cost and Pricing Options

1. Free Edition

TurboTax Espanol offers a free edition for users who qualify for the IRS Free File program. This option is ideal for individuals with lower incomes who need to file simple returns.

2. Deluxe Edition

The Deluxe edition includes federal and state filing, as well as access to additional features such as deductions and credits. This option is suitable for users with more complex tax situations.

3. Premier Edition

For those with significant investments or business income, the Premier edition provides advanced tools and support to handle complex tax scenarios.

Security and Privacy Measures

1. Data Encryption

TurboTax Espanol employs robust data encryption to protect user information. All data transmitted through the platform is securely encrypted, ensuring privacy and preventing unauthorized access.

2. Secure Storage

User data is stored in secure servers that adhere to industry standards for data protection. TurboTax Espanol ensures that your personal and financial information remains confidential at all times.

3. Identity Theft Protection

In addition to data security, TurboTax Espanol offers identity theft protection services to safeguard users against potential threats. This feature provides an extra layer of security, giving users peace of mind.

Customer Support and Resources

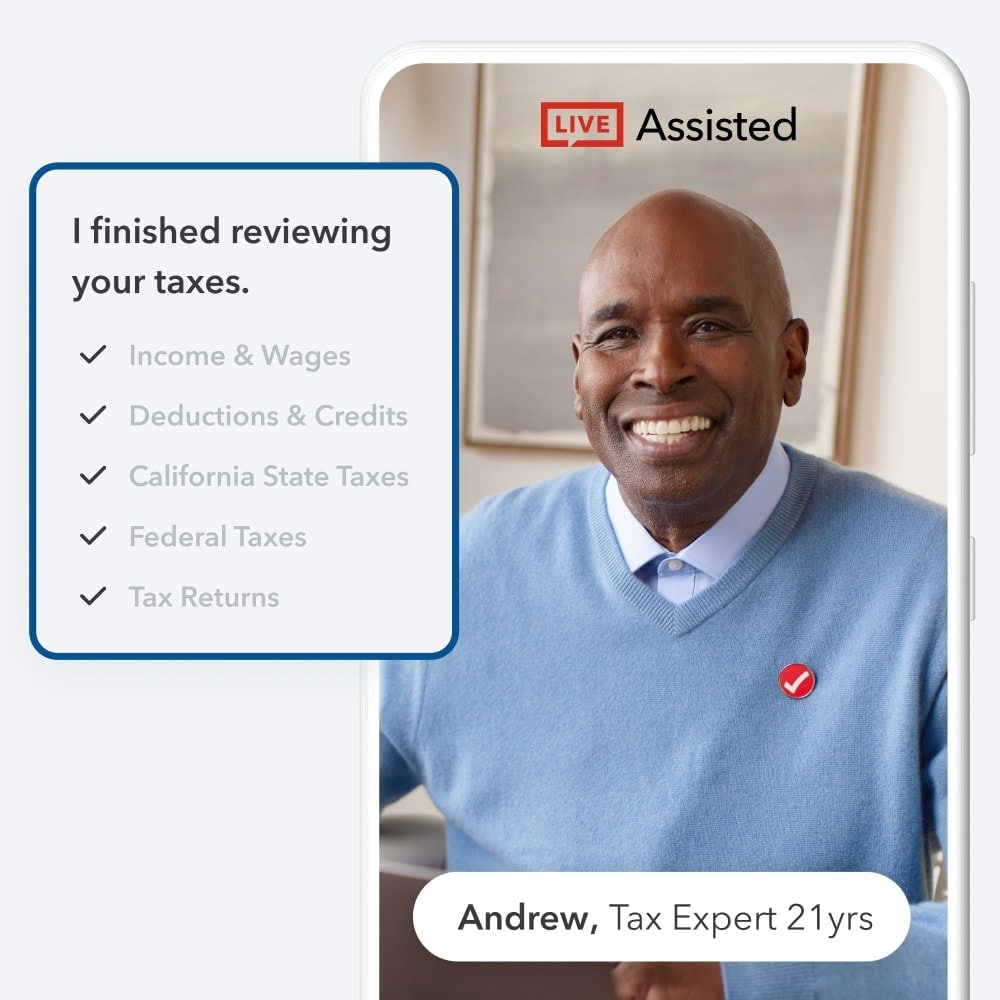

1. Live Chat Support

TurboTax Espanol offers live chat support to assist users with any questions or issues they may encounter during the filing process. This service is available in Spanish, ensuring effective communication.

2. Educational Resources

The platform provides a wealth of educational resources, including articles, videos, and FAQs, all available in Spanish. These resources help users better understand tax concepts and improve their financial literacy.

3. Community Forums

Users can engage with a community of fellow taxpayers through TurboTax Espanol's forums. These forums serve as a platform for sharing experiences, tips, and advice, fostering a supportive environment for Spanish-speaking taxpayers.

Frequently Asked Questions

1. Can I File Both Federal and State Taxes with TurboTax Espanol?

Yes, TurboTax Espanol supports both federal and state tax filing, ensuring comprehensive coverage for all your tax needs.

2. Is TurboTax Espanol Compatible with All Devices?

Yes, TurboTax Espanol is fully compatible with all devices, including smartphones, tablets, and desktops, offering a seamless experience across platforms.

3. What Happens if I Make a Mistake During the Filing Process?

TurboTax Espanol includes error detection tools to identify and correct mistakes before submission. However, if an error is discovered after filing, the platform provides guidance on how to amend your return.

Comparison with Other Tax Services

1. TurboTax Espanol vs. Competitors

Compared to other tax services, TurboTax Espanol stands out for its specialized focus on Spanish-speaking users. While other platforms may offer limited Spanish support, TurboTax Espanol provides a fully translated and tailored experience.

2. Unique Selling Points

The platform's unique selling points include its intuitive design, comprehensive features, and dedication to serving the Spanish-speaking community. These factors make TurboTax Espanol a preferred choice for many taxpayers.

Conclusion and Call to Action

TurboTax Espanol offers a reliable and accessible solution for Spanish-speaking taxpayers in the U.S. By providing a fully translated platform, comprehensive guidance, and robust security measures, TurboTax Espanol ensures that users can file their taxes accurately and confidently. Whether you're a newcomer or a seasoned taxpayer, TurboTax Espanol has the tools and resources to meet your needs.

We encourage you to take advantage of this service by signing up today and experiencing the benefits firsthand. Don't forget to leave a comment or share this article with others who may find it helpful. For more information on TurboTax Espanol and other tax-related topics, explore our website and stay informed.

Data Source: TurboTax Official Website, IRS Guidelines, and Industry Reports.