Understanding TurboTax Espa ol is crucial for Spanish-speaking taxpayers in the United States. Whether you're a resident or a non-resident alien, filing taxes can be complex, especially if language barriers exist. TurboTax Espa ol offers an intuitive solution that simplifies the process, ensuring you comply with IRS regulations while maximizing your refund potential.

Tax season can be stressful for anyone, but for Spanish-speaking individuals, the challenges multiply. Navigating the IRS's intricate rules and forms in a second language can lead to confusion and costly mistakes. TurboTax Espa ol addresses these concerns by providing a user-friendly interface and support entirely in Spanish.

This guide aims to demystify TurboTax Espa ol, offering comprehensive insights into its features, benefits, and how it can assist you in achieving a seamless tax filing experience. By the end of this article, you'll be equipped with the knowledge to confidently manage your tax obligations using this powerful tool.

Read also:How Tall Is Rob Lowe Discover The Height And Fascinating Facts About The Iconic Actor

Table of Contents

- Introduction to TurboTax Espa ol

- Key Features of TurboTax Espa ol

- Benefits of Using TurboTax Espa ol

- How to Use TurboTax Espa ol

- Tax Forms Supported by TurboTax Espa ol

- Costs and Subscription Plans

- Customer Support Options

- Tips for Successful Tax Filing

- Common Questions About TurboTax Espa ol

- Conclusion and Next Steps

Introduction to TurboTax Espa ol

TurboTax Espa ol is a specialized version of TurboTax designed specifically for Spanish-speaking taxpayers in the United States. This platform offers a fully bilingual interface, allowing users to navigate through the tax filing process in their preferred language. The software is powered by Intuit, a leader in financial software solutions, ensuring accuracy and reliability.

With TurboTax Espa ol, users can access all the essential features of TurboTax while enjoying the added convenience of a Spanish-language interface. This makes it an ideal choice for individuals who may struggle with English or prefer to conduct their financial affairs in Spanish.

Why Choose TurboTax Espa ol?

TurboTax Espa ol stands out due to its commitment to inclusivity and accessibility. By offering a Spanish-language option, it empowers Spanish-speaking individuals to take control of their finances with confidence. The platform is regularly updated to reflect the latest IRS regulations, ensuring compliance and peace of mind.

Key Features of TurboTax Espa ol

TurboTax Espa ol boasts a range of features designed to simplify the tax filing process. Below are some of its standout capabilities:

- Step-by-Step Guidance: TurboTax Espa ol walks users through the tax filing process with clear, concise instructions in Spanish.

- Real-Time Error Alerts: The software identifies potential errors and offers suggestions to correct them, minimizing the risk of costly mistakes.

- Maximized Refunds: TurboTax Espa ol helps users identify all eligible deductions and credits, ensuring they receive the maximum possible refund.

- Secure Data Protection: All user information is encrypted and protected, ensuring privacy and security.

Additional Features

In addition to the core features, TurboTax Espa ol offers specialized tools for self-employed individuals, small business owners, and those with complex tax situations. These tools include:

- Self-Employed Deduction Finder

- Business Expense Tracker

- Investment Income Management

Benefits of Using TurboTax Espa ol

Using TurboTax Espa ol comes with numerous advantages that cater specifically to Spanish-speaking taxpayers. Here are some key benefits:

Read also:Unveiling The Basilisk Sentinel A Comprehensive Guide To This Enigmatic Creature

Firstly, TurboTax Espa ol eliminates language barriers, making the tax filing process more accessible and less intimidating. Users can focus on understanding their tax obligations without worrying about language difficulties.

Secondly, the platform's intuitive design ensures a smooth user experience. Even those with limited technical skills can navigate through the software effortlessly.

Peace of Mind

One of the most significant benefits of TurboTax Espa ol is the peace of mind it provides. By leveraging the expertise of Intuit and adhering to IRS standards, users can trust that their tax filings are accurate and compliant.

How to Use TurboTax Espa ol

Using TurboTax Espa ol is straightforward. Follow these steps to get started:

- Sign Up: Visit the TurboTax website and select the Espa ol option during the registration process.

- Gather Documents: Collect all necessary tax documents, such as W-2s, 1099s, and receipts for deductions.

- Answer Questions: TurboTax Espa ol will guide you through a series of questions to gather information about your income, deductions, and credits.

- Review and Submit: Once you've completed the questionnaire, review your tax return for accuracy before submitting it electronically.

Tips for First-Time Users

For first-time users, it's essential to allocate sufficient time to familiarize yourself with the platform. Start early to avoid last-minute stress and ensure accuracy. Additionally, consider utilizing TurboTax Espa ol's customer support resources if you encounter any difficulties.

Tax Forms Supported by TurboTax Espa ol

TurboTax Espa ol supports a wide range of tax forms, covering various income sources and deductions. Some of the most common forms include:

- Form 1040: U.S. Individual Income Tax Return

- Form W-2: Wage and Tax Statement

- Form 1099: Miscellaneous Income

- Schedule C: Profit or Loss from Business

- Schedule SE: Self-Employment Tax

These forms ensure that users can accurately report all their income sources and claim eligible deductions, regardless of their employment status or financial situation.

Specialized Forms

In addition to standard forms, TurboTax Espa ol also supports specialized forms for unique tax situations, such as:

- Form 2106: Employee Business Expenses

- Form 8829: Expenses for Business Use of Your Home

- Form 8919: Uncollected Social Security and Medicare Tax on Wages

Costs and Subscription Plans

TurboTax Espa ol offers various subscription plans to suit different needs and budgets. The pricing structure is designed to provide flexibility, allowing users to choose the plan that best fits their tax situation. Below are the main plans available:

- Free Edition: Ideal for simple tax returns with standard deductions.

- Premium Edition: Offers additional features for itemized deductions and self-employment income.

- Self-Employed Edition: Tailored for freelancers and small business owners with complex tax needs.

Pricing varies based on the plan selected and any additional services opted for, such as expert review or state tax filing.

Value for Money

While TurboTax Espa ol incurs a cost, the value it provides in terms of time saved, accuracy, and peace of mind often outweighs the expense. Users can rest assured that their tax filings are handled professionally and efficiently.

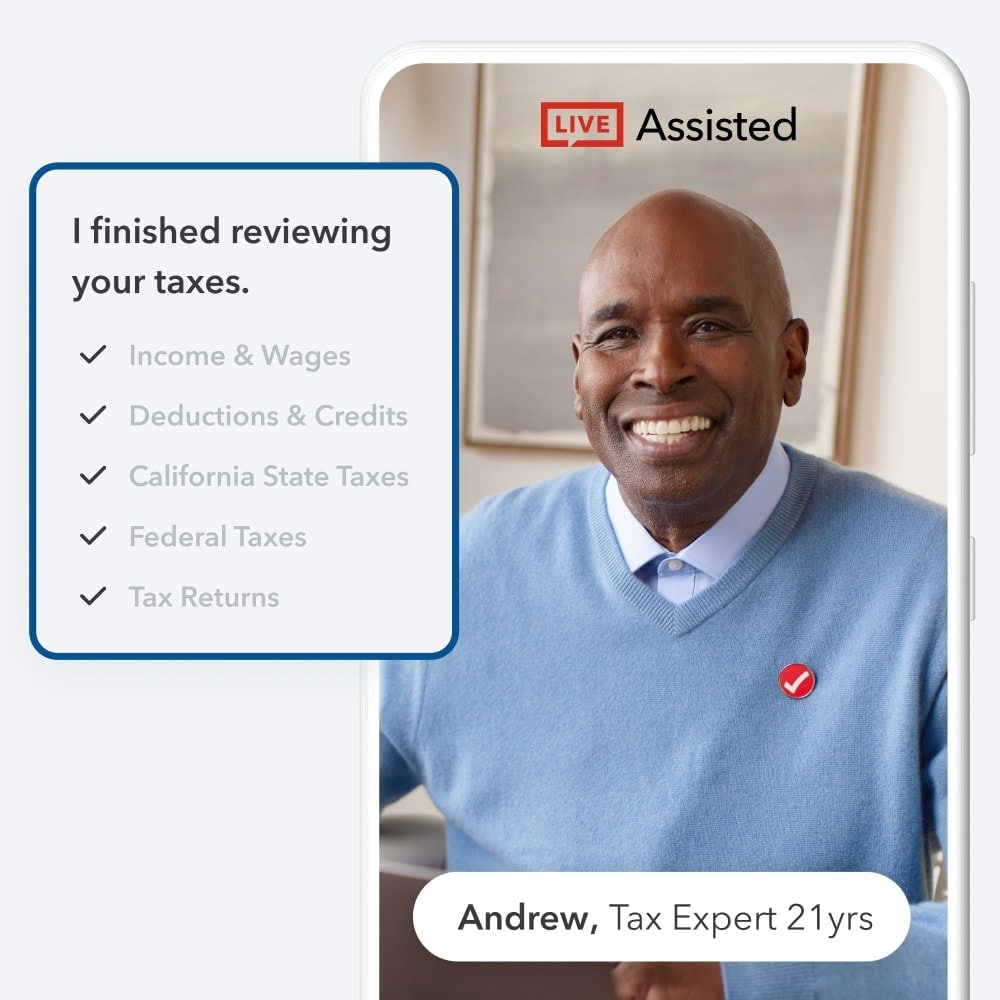

Customer Support Options

TurboTax Espa ol offers robust customer support options to assist users throughout the tax filing process. Support is available in both English and Spanish, ensuring that language is never a barrier to receiving help.

Users can access support through:

- Live Chat: Real-time assistance for immediate solutions.

- Phone Support: Dedicated phone lines for more complex issues.

- Email Support: Submit questions via email for detailed responses.

Expert Review Service

TurboTax Espa ol also offers an expert review service, where certified tax professionals review your completed tax return for accuracy and completeness. This service is particularly beneficial for those with complex tax situations or those seeking extra reassurance.

Tips for Successful Tax Filing

To ensure a successful tax filing experience with TurboTax Espa ol, consider the following tips:

- Organize Your Documents: Keep all tax-related documents in one place for easy access.

- Start Early: Begin the process well before the tax deadline to avoid last-minute stress.

- Utilize Deductions: Take advantage of all available deductions and credits to maximize your refund.

- Review Carefully: Double-check your tax return for accuracy before submission.

Avoiding Common Mistakes

Common mistakes during tax filing include incorrect Social Security numbers, mismatched income figures, and missed deductions. By using TurboTax Espa ol, you can minimize these errors and ensure a smoother process.

Common Questions About TurboTax Espa ol

Is TurboTax Espa ol Safe?

Yes, TurboTax Espa ol is safe and secure. All user data is encrypted, and the platform adheres to strict security protocols to protect sensitive information.

Can I Use TurboTax Espa ol for State Taxes?

Absolutely. TurboTax Espa ol supports state tax filings for most U.S. states, ensuring comprehensive coverage for your tax obligations.

What Happens if I Make a Mistake?

TurboTax Espa ol provides real-time error alerts to help you catch mistakes before submission. If an error is made after filing, TurboTax Espa ol offers guidance on how to amend your tax return.

Conclusion and Next Steps

TurboTax Espa ol is a powerful tool that simplifies the tax filing process for Spanish-speaking taxpayers in the United States. With its intuitive interface, robust features, and excellent customer support, it empowers users to manage their tax obligations with confidence.

To get started, visit the TurboTax website and select the Espa ol option. Gather your tax documents, follow the step-by-step guidance, and submit your tax return electronically. Remember to utilize the available resources and support options to ensure a seamless experience.

We invite you to share your thoughts and experiences in the comments section below. Additionally, explore other articles on our site for more valuable insights into personal finance and tax management. Together, let's make tax season less daunting and more manageable.