Taxes are an inevitable part of life, and for Spanish-speaking individuals in the United States, TurboTax en Español offers a seamless way to handle tax filings. If you're looking for a reliable and user-friendly tool to simplify your tax process, TurboTax en Español is an excellent option. This guide will walk you through everything you need to know about TurboTax in Spanish, ensuring you're well-equipped to navigate the tax-filing process with confidence.

TurboTax has established itself as one of the leading tax preparation platforms in the United States. However, for Spanish-speaking users, navigating through tax forms and regulations in English can be daunting. That's where TurboTax en Español comes into play, offering a comprehensive solution tailored specifically for Spanish-speaking taxpayers. With its intuitive interface and robust features, TurboTax en Español ensures that language barriers do not hinder your ability to file your taxes accurately.

This article delves into the features, benefits, and practical tips for using TurboTax en Español. Whether you're a first-time user or a seasoned taxpayer, this guide will provide you with all the information you need to make the most of this powerful tool. Let's explore how TurboTax en Español can simplify your tax journey.

Read also:Mastering Basilisk Sentinel Osrs A Comprehensive Guide

Table of Contents:

- Introduction to TurboTax en Español

- Key Features of TurboTax en Español

- Benefits of Using TurboTax en Español

- TurboTax en Español vs. Other Tax Software

- Pricing and Plans

- How to Use TurboTax en Español

- Tips for Maximizing TurboTax en Español

- Common Questions About TurboTax en Español

- Recent Updates and Improvements

- Conclusion and Call to Action

Introduction to TurboTax en Español

TurboTax en Español is a specialized version of TurboTax designed specifically for Spanish-speaking taxpayers. It offers the same robust features and tools as the English version but with content translated into Spanish, making it easier for non-English speakers to file their taxes confidently. The platform is user-friendly, intuitive, and packed with features to guide you through the tax-filing process step by step.

Why Choose TurboTax en Español?

TurboTax en Español stands out due to its commitment to accessibility and inclusivity. By offering a fully translated platform, it ensures that Spanish-speaking individuals can access the same quality service as English-speaking users. Additionally, it provides access to live bilingual support, making it easier to resolve any questions or concerns during the filing process.

Target Audience

TurboTax en Español is ideal for anyone who prefers or requires Spanish language support when filing taxes. This includes immigrants, Spanish-speaking families, and businesses that need bilingual tax solutions. Its user-friendly interface makes it accessible for individuals of all tax-filing experience levels.

Key Features of TurboTax en Español

TurboTax en Español offers a wide array of features designed to simplify the tax-filing process. Below are some of the standout features that make this platform a top choice for Spanish-speaking taxpayers:

1. Fully Translated Interface

Every aspect of TurboTax en Español, from the homepage to the final review, is fully translated into Spanish. This ensures that users can navigate the platform without needing to switch between languages.

Read also:Brandon Lee Net Worth Exploring The Legacy And Wealth Of A Hollywood Icon

2. Step-by-Step Guidance

TurboTax en Español provides a step-by-step process that guides users through each stage of tax filing. It asks simple questions and fills out the necessary forms automatically, ensuring accuracy and efficiency.

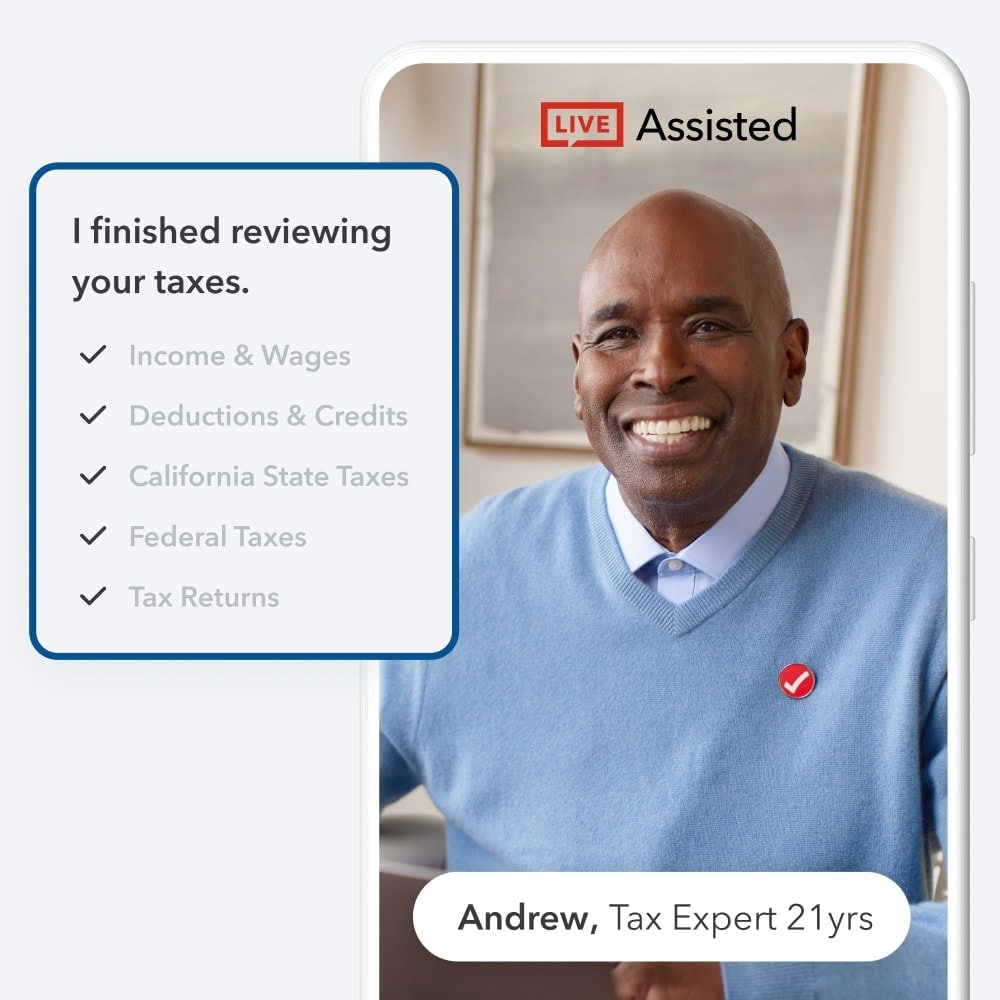

3. Live Bilingual Support

Users have access to live bilingual support, which can be invaluable when dealing with complex tax issues. Whether you need help with deductions or understanding specific tax laws, the support team is there to assist.

Benefits of Using TurboTax en Español

Using TurboTax en Español offers numerous benefits that make the tax-filing process easier and more efficient. Here are some of the key advantages:

1. Accessibility

TurboTax en Español removes language barriers, making it accessible to a broader audience. This inclusivity ensures that everyone can file their taxes accurately and confidently.

2. Time-Saving

The platform's automated processes and step-by-step guidance save users significant time compared to manually filling out tax forms. It streamlines the entire process, allowing users to focus on other important tasks.

3. Accuracy

With TurboTax en Español, users can be confident that their tax filings are accurate. The platform uses advanced algorithms to ensure that all forms are completed correctly and that users take advantage of all applicable deductions and credits.

TurboTax en Español vs. Other Tax Software

While there are several tax preparation software options available, TurboTax en Español stands out for several reasons:

1. Comprehensive Features

Unlike some competitors, TurboTax en Español offers a full suite of features, including federal and state tax filing, support for complex tax situations, and access to bilingual support.

2. User-Friendly Interface

TurboTax en Español boasts an intuitive interface that is easy to navigate, even for those with little to no experience in tax filing. Its step-by-step guidance ensures that users can complete their tax filings with minimal stress.

3. Reputation

TurboTax has a strong reputation for reliability and customer satisfaction. Its commitment to providing high-quality service extends to its Spanish-language version, ensuring that users receive the same level of support and expertise.

Pricing and Plans

TurboTax en Español offers several pricing plans to suit different needs and budgets. Below is a breakdown of the available options:

- Free Edition: Ideal for those with simple tax situations, this plan covers federal filing for free but requires payment for state filing.

- Deluxe: This plan is suitable for those with more complex tax situations, offering additional features such as itemized deductions and support for rental income.

- Premium: The Premium plan provides access to even more advanced features, including support for self-employment income and investment income.

- Premium Plus: This plan includes all the features of the Premium plan, plus access to live tax advice from certified tax professionals.

How to Use TurboTax en Español

Using TurboTax en Español is straightforward. Follow these steps to get started:

1. Create an Account

Begin by creating an account on the TurboTax website. You'll need to provide basic information such as your name, email address, and password.

2. Select Your Plan

Choose the plan that best suits your tax-filing needs. TurboTax en Español offers several options, so take the time to review each one carefully.

3. Start Your Tax Return

Once you've selected your plan, start your tax return by answering a series of questions about your income, deductions, and credits. TurboTax en Español will guide you through each step, ensuring that you provide all the necessary information.

Tips for Maximizing TurboTax en Español

To get the most out of TurboTax en Español, consider the following tips:

- Organize your documents beforehand to ensure a smooth filing process.

- Take advantage of the live support feature if you encounter any issues or have questions.

- Review your tax return carefully before submitting to ensure accuracy.

- Explore all available deductions and credits to maximize your refund.

Common Questions About TurboTax en Español

Here are some frequently asked questions about TurboTax en Español:

1. Is TurboTax en Español free?

TurboTax en Español offers a free edition for federal filing, but state filing requires payment. Additional features are available in paid plans.

2. Can I use TurboTax en Español for state taxes?

Yes, TurboTax en Español supports state tax filing for all 50 states. However, state filing requires payment, even with the free edition.

3. What if I have a complex tax situation?

TurboTax en Español offers advanced plans that can handle complex tax situations, including self-employment income, investment income, and rental property.

Recent Updates and Improvements

TurboTax en Español is continuously updated to improve functionality and user experience. Recent updates include enhanced support for bilingual users, improved navigation, and additional features to handle more complex tax situations. These updates ensure that TurboTax en Español remains a top choice for Spanish-speaking taxpayers.

Conclusion and Call to Action

TurboTax en Español is an invaluable tool for Spanish-speaking taxpayers in the United States. Its comprehensive features, user-friendly interface, and commitment to accuracy make it a top choice for simplifying the tax-filing process. Whether you're a first-time user or a seasoned taxpayer, TurboTax en Español offers the support and guidance you need to file your taxes with confidence.

We encourage you to explore the platform further and take advantage of its many features. Share this article with others who may benefit from TurboTax en Español and leave a comment below with your thoughts and experiences. For more information on tax preparation and financial planning, explore our other articles and resources.