Experian Boost has become a popular tool for individuals seeking to improve their credit scores. This innovative service allows users to add positive payment history from utility and streaming service bills, potentially increasing their credit score. If you're wondering how many points Experian Boost can add to your credit score, this article will provide all the answers you need.

In an era where credit scores significantly impact financial opportunities, understanding tools like Experian Boost is essential. Whether you're applying for a mortgage, car loan, or credit card, a higher credit score can lead to better interest rates and loan terms. Experian Boost offers a unique approach to enhancing credit scores by incorporating overlooked payment data.

By the end of this guide, you'll have a clear understanding of how Experian Boost works, the factors that influence the number of points it can add, and whether it's the right choice for you. Let's dive in and explore the world of Experian Boost and its potential benefits.

Read also:Lucy Devito A Rising Star In The Entertainment Industry

Table of Contents

- Introduction to Experian Boost

- How Experian Boost Works

- How Many Points Does Experian Boost Give You?

- Who Is Eligible for Experian Boost?

- The Impact of Data on Your Credit Score

- Experian Boost vs. Other Credit Builders

- Steps to Use Experian Boost

- Benefits of Using Experian Boost

- Limitations and Drawbacks

- Conclusion and Call to Action

Introduction to Experian Boost

Experian Boost is a groundbreaking tool designed to help individuals enhance their credit profiles by leveraging untapped data. Traditionally, credit scores are calculated based on credit card payments, loans, and other financial obligations. However, Experian Boost expands this scope by factoring in utility and subscription payments.

Launched in 2019, Experian Boost has quickly gained traction among consumers looking to improve their financial standing. The service is free to use and offers a user-friendly interface, making it accessible to a wide audience. By connecting your bank account, Experian Boost identifies eligible payments and adds them to your credit file.

Why Experian Boost Matters

For many people, traditional credit scoring methods don't fully capture their financial responsibility. Experian Boost addresses this gap by incorporating non-traditional payment data. This can be particularly beneficial for individuals with limited credit histories or those seeking to rebuild their credit.

How Experian Boost Works

Using Experian Boost is straightforward and involves a few simple steps. First, you need to create an account on the Experian website. Once registered, you'll be prompted to connect your bank account. Experian Boost will then scan your transaction history to identify eligible payments.

Eligible payments typically include utility bills (electricity, water, gas), mobile phone bills, and subscription services like streaming platforms. You have the option to select which payments you want to include in your credit file. After confirming your selections, Experian recalculates your FICO Score based on the updated information.

Security and Privacy

Experian prioritizes the security and privacy of its users. All data is encrypted and securely stored, ensuring that your financial information remains protected. Additionally, Experian does not share your data with third parties without your explicit consent.

Read also:Symeon Mooney The Rising Star In The Entertainment Industry

How Many Points Does Experian Boost Give You?

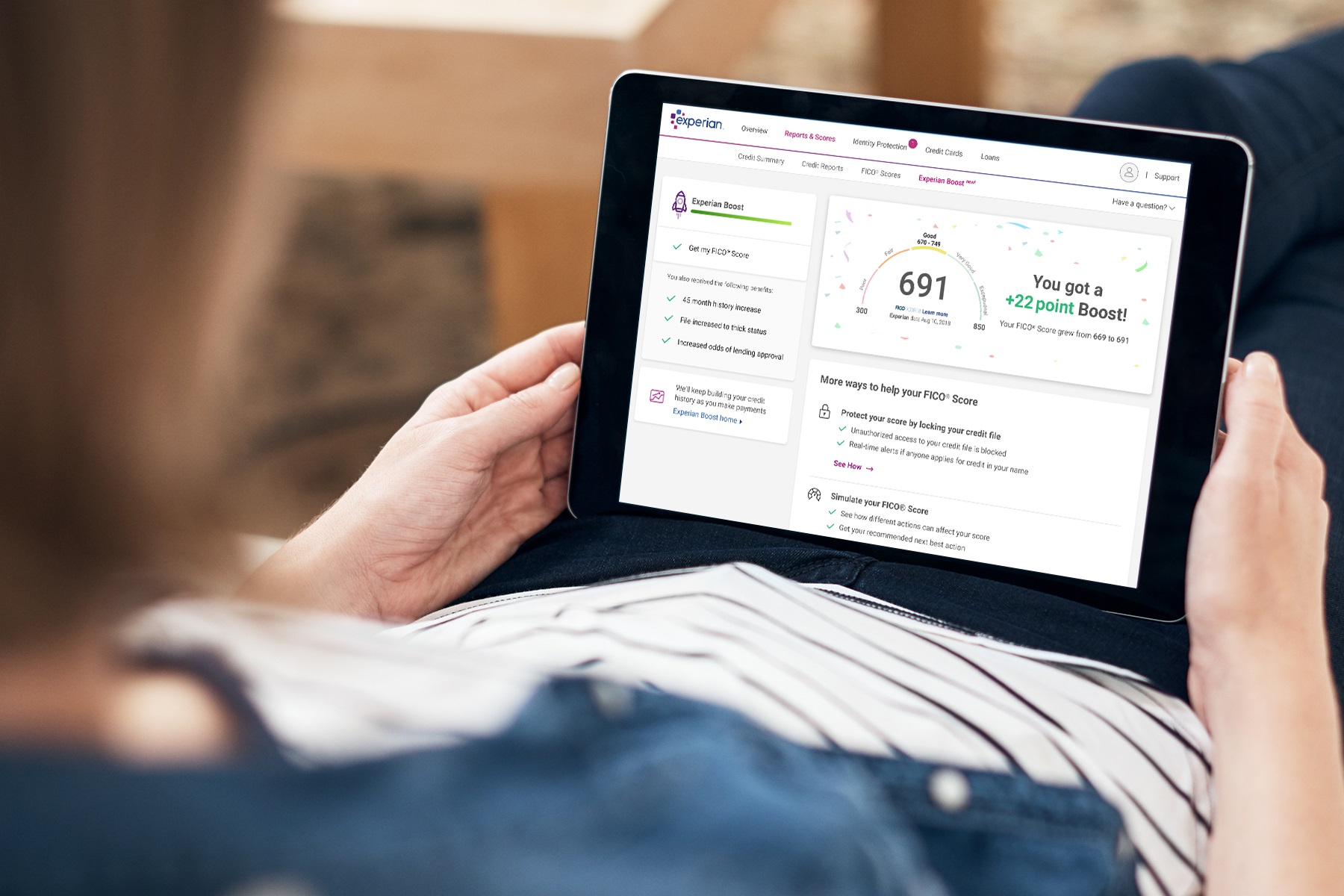

One of the most common questions about Experian Boost is how many points it can add to your credit score. While the exact number varies depending on individual circumstances, studies have shown that users can see an average increase of 10-20 points.

Factors Influencing Point Increases:

- Current credit score

- Payment history

- Types of eligible payments

- Frequency of payments

Individuals with lower credit scores or limited credit histories often experience more significant improvements. Conversely, those with already high credit scores may see minimal changes. It's important to note that Experian Boost does not guarantee a specific point increase.

Who Is Eligible for Experian Boost?

Experian Boost is available to anyone with a U.S. bank account and a social security number. However, the service is most beneficial for individuals who consistently pay their utility and subscription bills on time. If you have a history of missed or late payments, Experian Boost may not significantly impact your credit score.

Key Eligibility Criteria

- U.S. residents

- Active bank account

- Eligible payment history

It's worth noting that Experian Boost does not affect credit reports from other bureaus like Equifax or TransUnion. The improvements are specific to your Experian credit file.

The Impact of Data on Your Credit Score

The data added through Experian Boost can significantly influence your credit score. Payment history accounts for approximately 35% of your FICO Score, making it one of the most critical factors. By incorporating positive payment data, Experian Boost helps create a more comprehensive picture of your financial responsibility.

However, it's important to remember that Experian Boost only adds positive payment history. Late or missed payments are not included, ensuring that the service enhances your credit profile without negatively impacting it.

Types of Data Considered

- Utility payments

- Mobile phone bills

- Streaming service subscriptions

- Other recurring payments

Experian Boost continuously updates its algorithms to identify new types of eligible payments, further expanding its potential impact.

Experian Boost vs. Other Credit Builders

While Experian Boost is a powerful tool, it's not the only option available for building credit. Other methods, such as secured credit cards and credit-builder loans, offer alternative ways to improve your credit score. Each option has its own advantages and disadvantages.

Experian Boost stands out due to its simplicity and lack of financial commitment. Unlike secured credit cards or loans, which require upfront payments or interest charges, Experian Boost is free to use and does not involve debt.

Comparison Table

| Method | Pros | Cons |

|---|---|---|

| Experian Boost | Free, easy to use, no debt required | Limited to Experian credit file |

| Secured Credit Card | Reports to all three credit bureaus | Requires deposit, may have fees |

| Credit-Builder Loan | Reports to all three credit bureaus | Involves interest charges |

Steps to Use Experian Boost

Getting started with Experian Boost is simple and can be done in just a few minutes. Follow these steps to maximize the benefits:

- Create an account on the Experian website

- Connect your bank account

- Review eligible payments

- Select payments to include

- Confirm and wait for score recalibration

Experian provides detailed instructions and support to guide you through the process, ensuring a smooth experience.

Benefits of Using Experian Boost

Experian Boost offers several advantages for users looking to improve their credit scores:

- Free to Use: No cost or financial commitment required

- Quick Results: Credit score updates are typically available within minutes

- Comprehensive Data: Incorporates a wide range of payment types

- Privacy Protection: Ensures secure handling of personal information

These benefits make Experian Boost an attractive option for individuals seeking to enhance their financial standing.

Limitations and Drawbacks

While Experian Boost offers many advantages, it's important to be aware of its limitations:

- Only affects Experian credit file

- Does not include negative payment history

- May not significantly impact high credit scores

Additionally, Experian Boost requires users to maintain consistent payment habits to sustain improvements. Falling behind on payments can negate the positive effects of the service.

Conclusion and Call to Action

In conclusion, Experian Boost is a valuable tool for individuals seeking to improve their credit scores. By incorporating positive payment history from utility and subscription bills, users can potentially see an increase of 10-20 points. While the service has its limitations, its simplicity, cost-effectiveness, and quick results make it an attractive option for many.

We encourage you to take action and explore Experian Boost for yourself. If you have questions or feedback, feel free to leave a comment below. Additionally, consider sharing this article with others who may benefit from the information. For more insights on credit building and financial wellness, explore our other articles on the site.

Remember, your credit score is a powerful tool that can open doors to better financial opportunities. Take control of your credit today with Experian Boost!

References:

- Experian Official Website

- FICO Score Calculation Methodology

- Consumer Financial Protection Bureau Reports